Region:Europe

Author(s):Rebecca

Product Code:KRAA1451

Pages:84

Published On:August 2025

By Mode of Payment:The mode of payment segmentation includes various methods through which transactions are conducted. The subsegments are Card Payments (Debit, Credit, Prepaid), Digital Wallets (including Mobile Wallets, Apple Pay, Google Pay, Samsung Pay), Bank Transfers (including Online Banking, SEPA, Instant Payments), Cash, Buy Now Pay Later (BNPL), and Other POS (Gift Cards, QR, Wearables). Among these, Digital Wallets and Card Payments are gaining significant traction due to their convenience, security features, and widespread acceptance among both consumers and merchants. The adoption of contactless and mobile payments is particularly strong in urban areas, supported by high smartphone penetration and digital infrastructure.

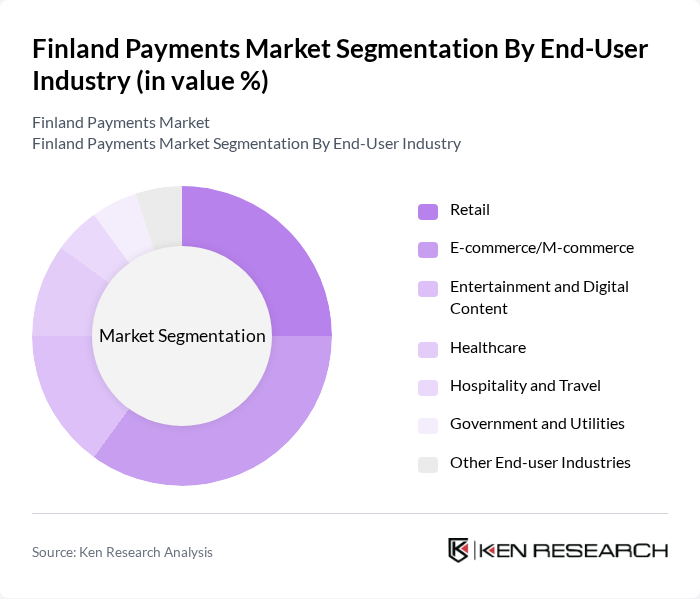

By End-User Industry:This segmentation focuses on the various industries utilizing payment services. The subsegments include Retail, E-commerce/M-commerce, Entertainment and Digital Content, Healthcare, Hospitality and Travel, Government and Utilities, and Other End-user Industries. The E-commerce and Retail sectors are particularly dominant, driven by the increasing trend of online shopping, digital transformation in retail, and the convenience of digital payments. Entertainment and digital content, as well as healthcare, are also seeing increased adoption of digital payment methods as consumer habits shift and service providers expand digital offerings.

The Finland Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nordea Bank Abp, OP Financial Group, Danske Bank A/S, S-Pankki Oyj, Aktia Bank Plc, Paytrail Oyj, Klarna AB, Revolut Ltd., Mastercard Inc., Visa Inc., Stripe Inc., Adyen N.V., PayPal Holdings Inc., Wise Plc, Zimpler AB, MobilePay Finland Oy, Siirto (Automatia Pankkiautomaatit Oy), Apple Pay, Google Pay, Braintree (a PayPal Service) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the payments market in Finland appears promising, driven by technological advancements and changing consumer preferences. As digital payment adoption continues to rise, innovations such as artificial intelligence and blockchain technology are expected to enhance transaction efficiency and security. Furthermore, the increasing focus on sustainable payment solutions will likely shape the market landscape, encouraging providers to develop eco-friendly practices that resonate with environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Mode of Payment | Card Payments (Debit, Credit, Prepaid) Digital Wallets (incl. Mobile Wallets, Apple Pay, Google Pay, Samsung Pay) Bank Transfers (incl. Online Banking, SEPA, Instant Payments) Cash Buy Now Pay Later (BNPL) Other POS (Gift Cards, QR, Wearables) |

| By End-User Industry | Retail E-commerce/M-commerce Entertainment and Digital Content Healthcare Hospitality and Travel Government and Utilities Other End-user Industries |

| By Interaction Channel | Point-of-Sale (POS) Online (Card-Not-Present, Digital Wallet, Account-to-Account) Mobile Payments Peer-to-Peer (P2P) Others |

| By Transaction Type | Consumer-to-Business (C2B) Business-to-Business (B2B) Person-to-Person (P2P) Remittances and Cross-border Others |

| By Transaction Size | Small Transactions (<€50) Medium Transactions (€50–€500) Large Transactions (>€500) Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Non-profits Others |

| By Geographic Distribution | Urban Areas Rural Areas Suburban Areas Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Payment Preferences | 120 | General Consumers, Age 18-65 |

| SME Payment Processing Insights | 90 | Business Owners, Financial Managers |

| Fintech Adoption Trends | 60 | Fintech Executives, Product Managers |

| Regulatory Impact Assessment | 40 | Policy Makers, Compliance Officers |

| Merchant Payment Solutions | 70 | Retail Managers, E-commerce Directors |

The Finland Payments Market is valued at approximately USD 76 billion, driven by the increasing adoption of digital payment solutions, e-commerce growth, and a shift towards contactless transactions. This reflects a significant trend towards cashless economies in Finland.