Region:Europe

Author(s):Shubham

Product Code:KRAC0571

Pages:97

Published On:August 2025

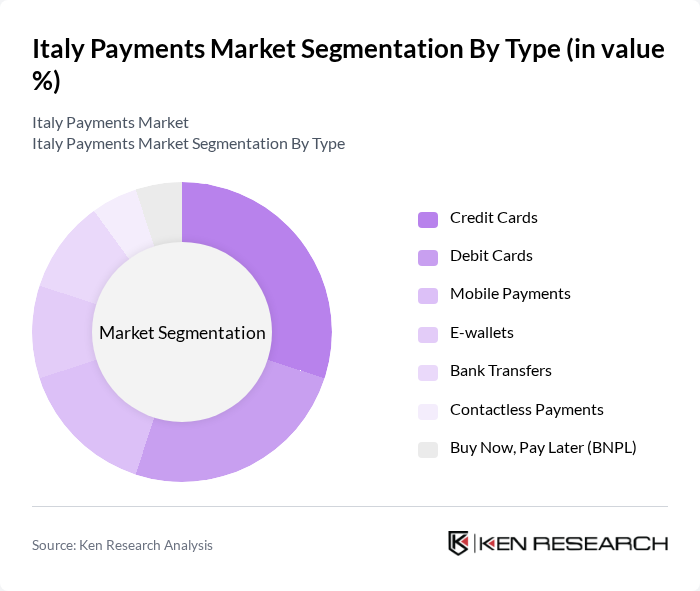

By Type:The Italy Payments Market is segmented into various types, including Credit Cards, Debit Cards, Mobile Payments, E-wallets, Bank Transfers, Contactless Payments, and Buy Now, Pay Later (BNPL). Each of these segments plays a crucial role in shaping consumer payment preferences and behaviors. Credit and debit cards remain popular due to their convenience and entrenched acceptance, while mobile payments and e-wallets (including PayPal, PostePay, Apple Pay, Google Pay, Satispay) are gaining traction in e-commerce and at POS. Contactless payments have surged, supported by widespread issuance of contactless cards and rising consumer familiarity post-pandemic; account-to-account options (e.g., SEPA transfers, MyBank) also play a notable role online.

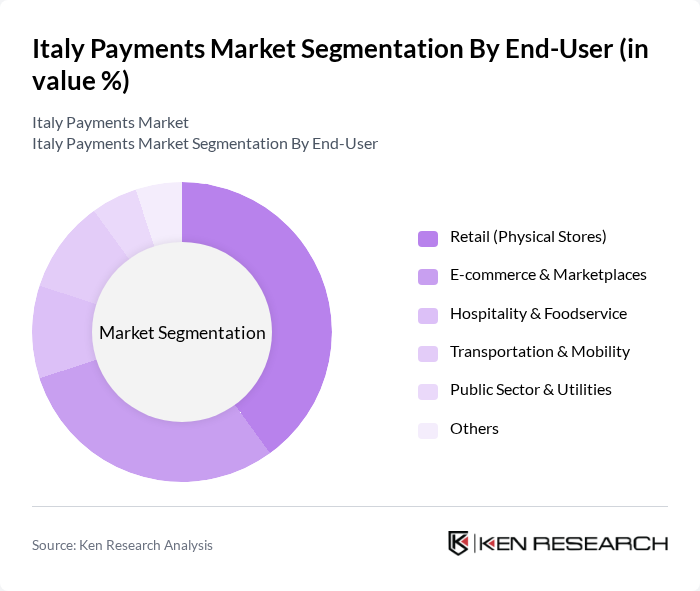

By End-User:The market is also segmented by end-user categories, including Retail (Physical Stores), E-commerce & Marketplaces, Hospitality & Foodservice, Transportation & Mobility, Public Sector & Utilities, and Others. The retail sector, particularly physical stores, continues to dominate due to high transaction volumes and extensive card acceptance networks, while e-commerce is rapidly growing on the back of shifting consumer habits and strong online payment method adoption (cards, wallets, account-to-account).

The Italy Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nexi S.p.A., Worldline S.A. (including equensWorldline), UniCredit S.p.A., Intesa Sanpaolo S.p.A., PayPal Holdings, Inc., Stripe, Inc., Mastercard Incorporated, Visa Inc., Adyen N.V., BANCOMAT S.p.A. (Bancomat Pay), Poste Italiane S.p.A. (PostePay S.p.A.), Banca Sella S.p.A. (Axerve), Amazon Pay, MyBank (PRETA S.A.S.), Klarna Bank AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy payments market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As digital payment adoption accelerates, innovations such as AI-driven fraud detection and blockchain technology are expected to enhance transaction security and efficiency. Additionally, the increasing integration of payment solutions with e-commerce platforms will further streamline the consumer experience, making digital transactions more accessible and user-friendly, thereby solidifying the shift towards a cashless economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Credit Cards Debit Cards Mobile Payments E-wallets Bank Transfers Contactless Payments Buy Now, Pay Later (BNPL) |

| By End-User | Retail (Physical Stores) E-commerce & Marketplaces Hospitality & Foodservice Transportation & Mobility Public Sector & Utilities Others |

| By Payment Method | Online (E-commerce, In-app) In-store (POS, Contactless) Recurring (Subscriptions, Bills) Account-to-Account (A2A: SEPA, MyBank) Peer-to-Peer (P2P: Bancomat Pay, bank apps) Cash on Delivery |

| By Transaction Size | Micro (? €10) Small (€10–€50) Medium (€50–€500) Large (? €500) |

| By Customer Segment | Consumers (B2C) Micro & Small Businesses (MSMEs) Mid-market & Large Enterprises Public Administration Non-profits |

| By Geographic Distribution | Northern Italy Central Italy Southern Italy Islands Cross?border (tourism, EU transactions) |

| By Industry Vertical | Financial Services Retail & Grocery Telecommunications & Media Healthcare & Pharma Travel & Leisure Utilities & Public Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Payment Solutions | 150 | Retail Managers, Payment System Analysts |

| Consumer Payment Preferences | 150 | General Consumers, Tech-Savvy Users |

| Fintech Adoption Trends | 100 | Fintech Executives, Product Managers |

| Banking Sector Innovations | 80 | Banking Executives, Compliance Officers |

| Digital Wallet Usage | 120 | Digital Wallet Users, E-commerce Managers |

The Italy Payments Market is valued at approximately USD 420 billion, reflecting significant growth driven by card-based payment value and the adoption of electronic payments, supported by government initiatives and the expansion of digital banking.