Region:Europe

Author(s):Shubham

Product Code:KRAA2479

Pages:83

Published On:August 2025

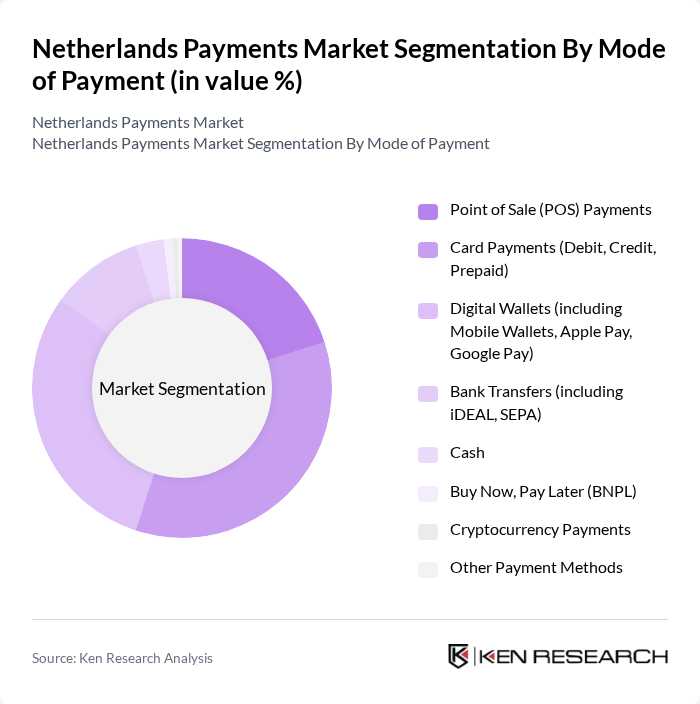

By Mode of Payment:The Netherlands Payments Market is segmented by various modes of payment, including Point of Sale (POS) Payments, Card Payments (Debit, Credit, Prepaid), Digital Wallets, Bank Transfers, Cash, Buy Now, Pay Later (BNPL), Cryptocurrency Payments, and Other Payment Methods. Among these, Digital Wallets and card-based payments have gained significant traction due to their convenience, the increasing use of smartphones for transactions, and the popularity of platforms like iDEAL, Apple Pay, and Google Pay .

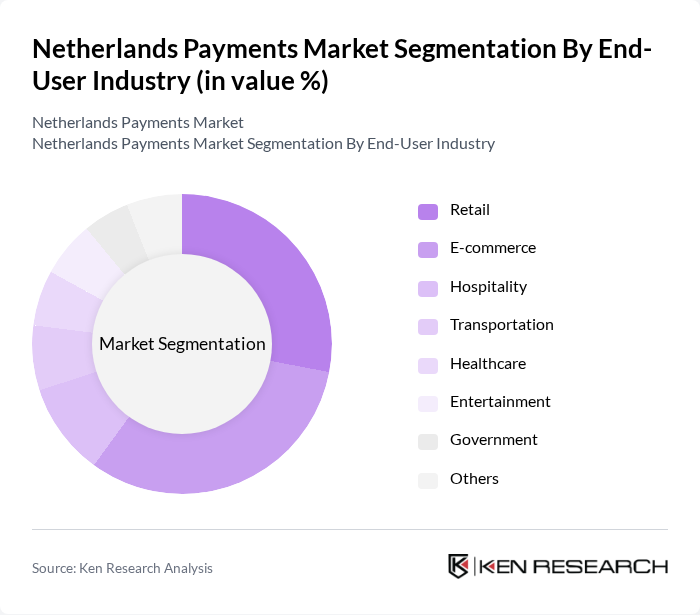

By End-User Industry:The payments market is also segmented by end-user industries, including Retail, E-commerce, Hospitality, Transportation, Healthcare, Entertainment, Government, and Others. The E-commerce sector is particularly dominant, driven by the rapid growth of online shopping and the increasing preference for digital transactions among consumers. Retail and e-commerce together account for the majority of payment transaction volumes in the Netherlands .

The Netherlands Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adyen N.V., ING Groep N.V., Rabobank, ABN AMRO Bank N.V., Mollie B.V., Currence iDEAL B.V., PayPal Holdings, Inc., Mastercard Inc., Visa Inc., American Express Company, Klarna AB, Riverty (formerly AfterPay), Bunq B.V., Worldline S.A., Stripe, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The Netherlands payments market is poised for continued evolution, driven by technological advancements and changing consumer preferences. The shift towards contactless payments is expected to accelerate, with projections indicating that contactless transactions could account for over 65% of all payments in future. Additionally, the integration of artificial intelligence in payment processing will enhance security and efficiency, further shaping the landscape of digital transactions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Mode of Payment | Point of Sale (POS) Payments Card Payments (Debit, Credit, Prepaid) Digital Wallets (including Mobile Wallets, Apple Pay, Google Pay) Bank Transfers (including iDEAL, SEPA) Cash Buy Now, Pay Later (BNPL) Cryptocurrency Payments Other Payment Methods |

| By End-User Industry | Retail E-commerce Hospitality Transportation Healthcare Entertainment Government Others |

| By Payment Channel | Online Payments Point of Sale (POS) Payments Mobile Payments Peer-to-Peer (P2P) Payments Recurring Payments Others |

| By Transaction Size | Micro Transactions (< €10) Small Transactions (€10–€100) Medium Transactions (€100–€1,000) Large Transactions (> €1,000) |

| By Industry Vertical | Financial Services Retail and Wholesale Healthcare Education Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Profit Organizations |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Payment Preferences | 100 | Retail Managers, Payment System Analysts |

| Consumer Attitudes Towards Digital Payments | 150 | General Consumers, Tech-Savvy Users |

| Merchant Adoption of Payment Technologies | 80 | Business Owners, Financial Officers |

| Impact of Regulation on Payment Systems | 60 | Compliance Officers, Legal Advisors |

| Trends in Mobile Payment Usage | 90 | Mobile App Developers, Marketing Managers |

The Netherlands Payments Market is valued at approximately EUR 1.5 trillion, driven by the increasing adoption of digital payment methods, e-commerce growth, and consumer preference for contactless transactions. This reflects a significant shift towards online and mobile payments in recent years.