Region:Global

Author(s):Dev

Product Code:KRAC0554

Pages:90

Published On:August 2025

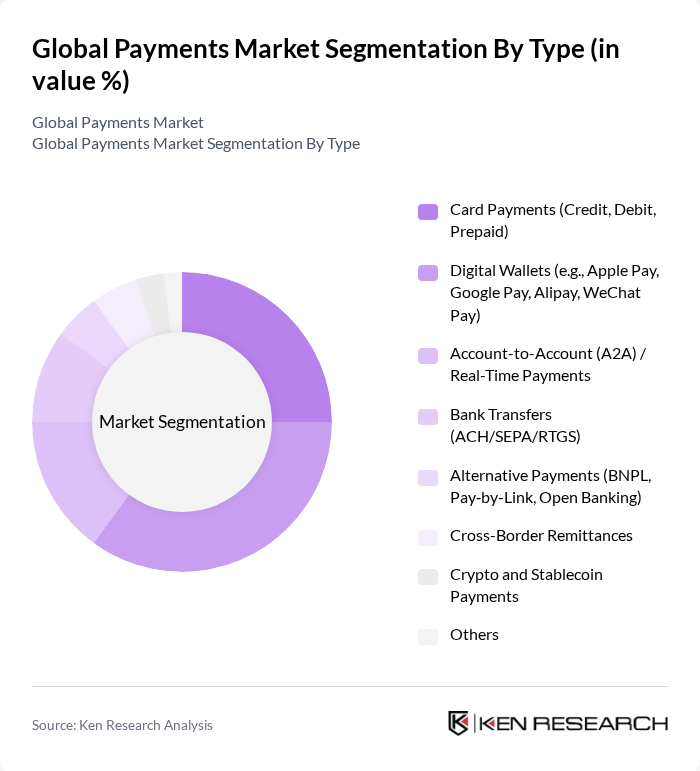

By Type:The segmentation by type includes various payment methods that cater to different consumer needs and preferences. The subsegments are Card Payments (Credit, Debit, Prepaid), Digital Wallets (e.g., Apple Pay, Google Pay, Alipay, WeChat Pay), Account-to-Account (A2A) / Real-Time Payments, Bank Transfers (ACH/SEPA/RTGS), Alternative Payments (BNPL, Pay?by?Link, Open Banking), Cross-Border Remittances, Crypto and Stablecoin Payments, and Others. Among these, Digital Wallets are currently dominating the market due to their convenience, security, and the growing trend of mobile commerce.

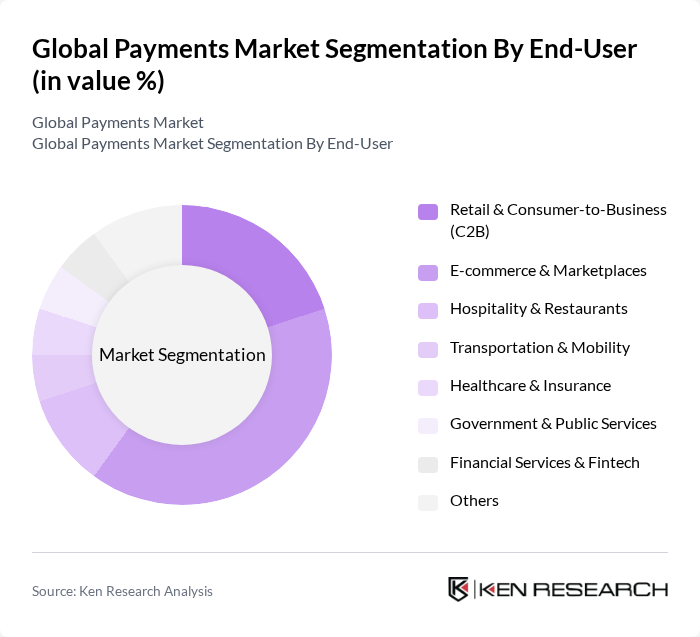

By End-User:The end-user segmentation encompasses various sectors utilizing payment solutions, including Retail & Consumer-to-Business (C2B), E-commerce & Marketplaces, Hospitality & Restaurants, Transportation & Mobility, Healthcare & Insurance, Government & Public Services, Financial Services & Fintech, and Others. The E-commerce & Marketplaces segment is leading the market, driven by the rapid growth of online shopping and the increasing preference for digital transactions among consumers.

The Global Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Block, Inc. (Square), Stripe, Inc., Adyen N.V., Worldpay (FIS), Visa Inc., Mastercard Incorporated, American Express Company, Fiserv, Inc. (Clover), PayU, Alipay (Ant Group), WeChat Pay (Tencent), Revolut Ltd., Wise plc, Zelle (Early Warning Services), Global Payments Inc., Payoneer Global Inc., Checkout.com, Rapyd, Nuvei Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the global payments market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As digital payment adoption accelerates, the integration of artificial intelligence and machine learning will enhance transaction security and customer experience. Additionally, the rise of blockchain technology is expected to streamline cross-border payments, making them faster and more cost-effective. These trends indicate a dynamic landscape where innovation will play a crucial role in shaping the future of payments.

| Segment | Sub-Segments |

|---|---|

| By Type | Card Payments (Credit, Debit, Prepaid) Digital Wallets (e.g., Apple Pay, Google Pay, Alipay, WeChat Pay) Account-to-Account (A2A) / Real-Time Payments Bank Transfers (ACH/SEPA/RTGS) Alternative Payments (BNPL, Pay?by?Link, Open Banking) Cross-Border Remittances Crypto and Stablecoin Payments Others |

| By End-User | Retail & Consumer-to-Business (C2B) E-commerce & Marketplaces Hospitality & Restaurants Transportation & Mobility Healthcare & Insurance Government & Public Services Financial Services & Fintech Others |

| By Payment Method | Online/Remote (Card-not-present) In-Store/Point-of-Sale (Contact, Contactless, QR) Recurring/Subscription Billing Peer-to-Peer (P2P) & Wallet-to-Wallet B2B Payments & Virtual Cards Buy Now, Pay Later (BNPL) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Industry Vertical | Financial Services Retail and E-commerce Telecommunications & Utilities Travel, Airlines & Tourism Gaming & Digital Content Education & Nonprofit Others |

| By Transaction Size | Micro & Small Tickets (? USD 25) Medium Tickets (USD 25–500) Large & High-Value (? USD 500) Others |

| By Payment Frequency | One-Time Payments Recurring Payments Subscription Payments Installment Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Payment Solutions | 150 | Payment Managers, Retail Operations Directors |

| Fintech Innovations | 100 | Product Development Leads, Technology Officers |

| Consumer Payment Preferences | 140 | End-users, Market Research Analysts |

| Cross-border Payment Systems | 80 | International Payments Managers, Compliance Officers |

| Digital Wallet Adoption | 120 | Marketing Managers, User Experience Designers |

The Global Payments Market is valued at approximately USD 2.6 trillion, driven by the increasing adoption of digital payment solutions, the rise of e-commerce, and the growing demand for contactless payment methods, particularly accelerated by the COVID-19 pandemic.