Region:Europe

Author(s):Geetanshi

Product Code:KRAB3944

Pages:99

Published On:October 2025

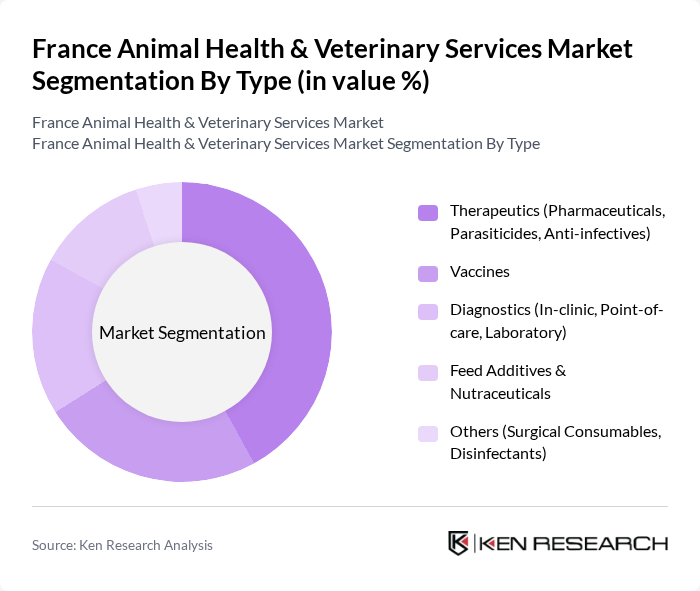

By Type:The market is segmented into therapeutics, vaccines, diagnostics, feed additives, and others. Among these, therapeutics—which include pharmaceuticals, parasiticides, and anti-infectives—hold the largest share, driven by the rising prevalence of infectious and chronic diseases in both companion and production animals. The demand for vaccines is also significant, underpinned by preventive care initiatives in livestock and pets. Diagnostics, especially in-clinic and point-of-care testing, are gaining traction due to their role in enabling timely interventions and improving animal health outcomes .

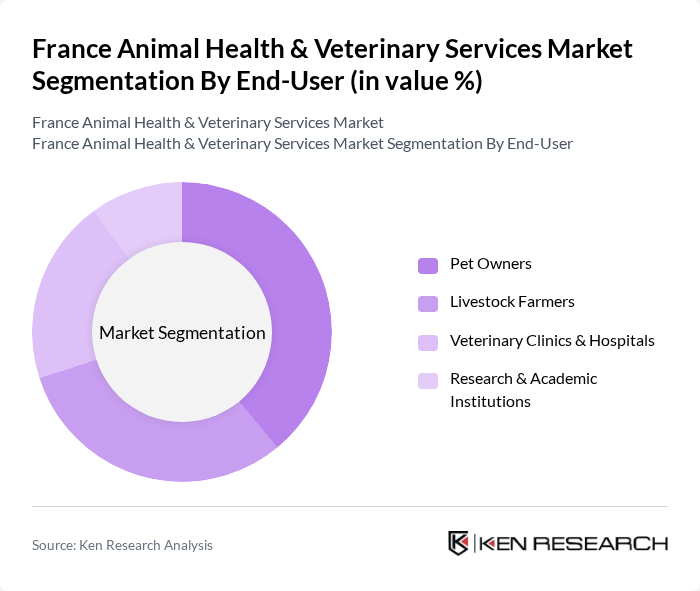

By End-User:The end-user segmentation includes pet owners, livestock farmers, veterinary clinics and hospitals, and research and academic institutions. Pet owners represent a significant portion of the market, propelled by the increasing trend of pet humanization and willingness to invest in premium veterinary services. Livestock farmers are also critical, aiming to maintain herd health and productivity through veterinary care. Veterinary clinics and hospitals are the primary service providers, while research and academic institutions contribute to ongoing advancements in veterinary medicine and diagnostics .

The France Animal Health & Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boehringer Ingelheim, Zoetis Inc., Merck Animal Health, Elanco Animal Health, Ceva Santé Animale, Virbac, Vetoquinol, IDEXX Laboratories, Neogen Corporation, Dechra Pharmaceuticals, IVC Evidensia, VetOne, CVS Group PLC, National Veterinary Associates (NVA), Mars Petcare (including AniCura and VCA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France Animal Health & Veterinary Services market appears promising, driven by ongoing trends in pet ownership and technological integration. As pet humanization continues to rise, owners are expected to prioritize preventive care and advanced veterinary services. Additionally, the expansion of telemedicine is likely to enhance accessibility, allowing veterinarians to cater to a broader audience. These trends indicate a robust growth trajectory for the market, fostering innovation and improved animal health outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Therapeutics (Pharmaceuticals, Parasiticides, Anti-infectives) Vaccines Diagnostics (In-clinic, Point-of-care, Laboratory) Feed Additives & Nutraceuticals Others (Surgical Consumables, Disinfectants) |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics & Hospitals Research & Academic Institutions |

| By Service Type | Preventive Care (Vaccination, Wellness Exams) Surgical Services Emergency & Critical Care Consultation & Telemedicine |

| By Distribution Channel | Online Retail Veterinary Clinics & Hospitals Pharmacies Direct Sales |

| By Region | Northern France Southern France Eastern France Western France |

| By Animal Type | Companion Animals (Dogs, Cats, Others) Production Animals (Cattle, Poultry, Swine, Sheep/Goats) Equine |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 80 | Veterinarians, Clinic Managers |

| Animal Health Product Manufacturers | 50 | Product Managers, Sales Directors |

| Livestock Farmers | 40 | Farm Owners, Animal Husbandry Managers |

| Pet Owners | 60 | Pet Care Consumers, Animal Welfare Advocates |

| Veterinary Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The France Animal Health & Veterinary Services Market is valued at approximately USD 2.1 billion, reflecting a significant growth driven by increasing pet ownership, awareness of animal health, and advancements in veterinary technology.