Region:Middle East

Author(s):Shubham

Product Code:KRAB4481

Pages:94

Published On:October 2025

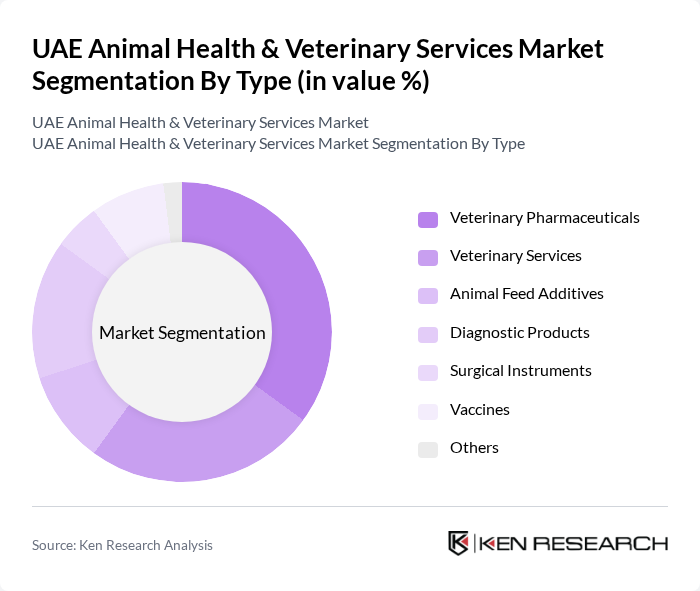

By Type:The market is segmented into various types, including Veterinary Pharmaceuticals, Veterinary Services, Animal Feed Additives, Diagnostic Products, Surgical Instruments, Vaccines, and Others. Among these, Veterinary Pharmaceuticals and Diagnostic Products are the leading segments due to the increasing demand for effective treatment options and advanced diagnostic tools. The growing trend of preventive healthcare for pets and livestock further drives the need for these products.

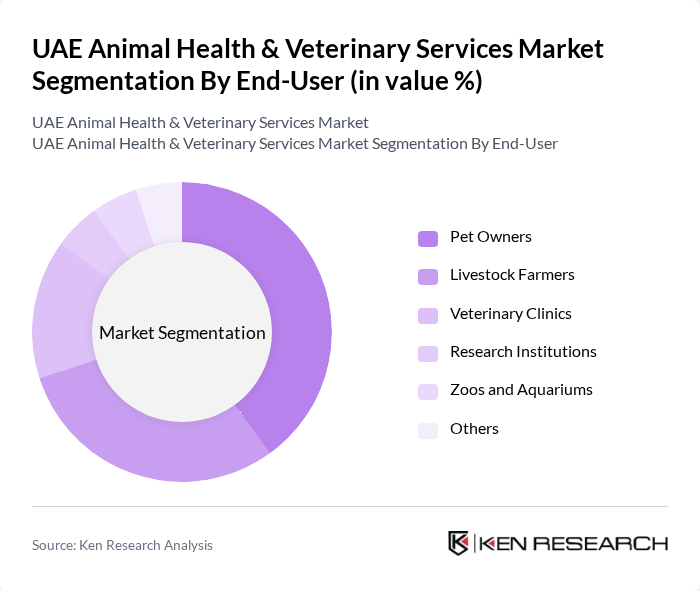

By End-User:The end-user segmentation includes Pet Owners, Livestock Farmers, Veterinary Clinics, Research Institutions, Zoos and Aquariums, and Others. Pet Owners and Livestock Farmers are the dominant segments, driven by the increasing number of pets and the growing livestock industry in the UAE. The rising awareness of animal health and welfare among pet owners significantly contributes to the demand for veterinary services and products.

The UAE Animal Health & Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Bayer Animal Health, Boehringer Ingelheim, IDEXX Laboratories, Virbac, Cegelec, Vetoquinol, Neogen Corporation, PetIQ, Alltech, Phibro Animal Health, Vetmedin, Animal Health International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE animal health and veterinary services market appears promising, driven by increasing pet ownership and advancements in veterinary technology. As the population grows, the demand for high-quality animal protein will necessitate enhanced veterinary services. Additionally, the integration of telemedicine and AI in veterinary practices is expected to streamline operations and improve care delivery. These trends will likely foster a more robust market environment, encouraging investment and innovation in animal health services.

| Segment | Sub-Segments |

|---|---|

| By Type | Veterinary Pharmaceuticals Veterinary Services Animal Feed Additives Diagnostic Products Surgical Instruments Vaccines Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Research Institutions Zoos and Aquariums Others |

| By Service Type | Preventive Care Emergency Care Surgical Services Diagnostic Services Rehabilitation Services Others |

| By Distribution Channel | Direct Sales Online Retail Veterinary Clinics Pharmacies Distributors Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Animal Type | Companion Animals Livestock Exotic Animals Aquatic Animals Others |

| By Price Range | Low-End Products Mid-Range Products Premium Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 150 | Pet Owners, Animal Caretakers |

| Livestock Farmers | 80 | Farm Owners, Animal Husbandry Managers |

| Animal Health Product Distributors | 60 | Sales Managers, Product Managers |

| Veterinary Technicians | 70 | Veterinary Technicians, Support Staff |

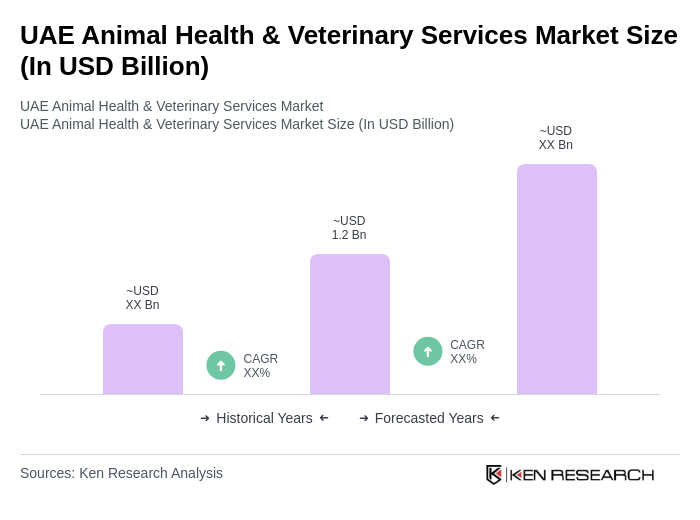

The UAE Animal Health & Veterinary Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing pet ownership, heightened awareness of animal health, and advancements in veterinary technology.