Saudi Arabia Pet Food Market Overview

- The Saudi Arabia Pet Food Market is valued at USD 290 million, based on a five-year historical analysis. This growth is primarily driven by increasing pet ownership, rising disposable incomes, and a growing awareness of pet nutrition among consumers. The market has seen a shift towards premium and organic pet food products, reflecting changing consumer preferences and a focus on health and wellness for pets. The rise of pet humanization and the influence of social media have further accelerated this trend, with pet owners increasingly seeking products that offer functional and natural ingredients, such as omega fatty acids, probiotics, and antioxidants, to support pet health and wellness .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their large populations and higher income levels. These urban centers have a significant number of pet owners who are willing to spend on quality pet food, contributing to the overall growth of the market. Additionally, the presence of major retail chains, pet specialty stores, and expanding e-commerce platforms in these cities enhances accessibility to a variety of pet food products .

- In 2023, the Saudi Food and Drug Authority (SFDA) issued the “Regulations for the Registration, Importation, and Circulation of Animal Feed and Pet Food, 2023.” This binding instrument mandates that all pet food products must comply with safety and quality standards, including mandatory labeling requirements for ingredients, nutritional information, and country of origin. The regulation requires importers and manufacturers to register products with the SFDA, conduct regular safety assessments, and adhere to traceability protocols. These measures are designed to protect consumer interests and promote the health of pets, thereby fostering trust in the pet food industry .

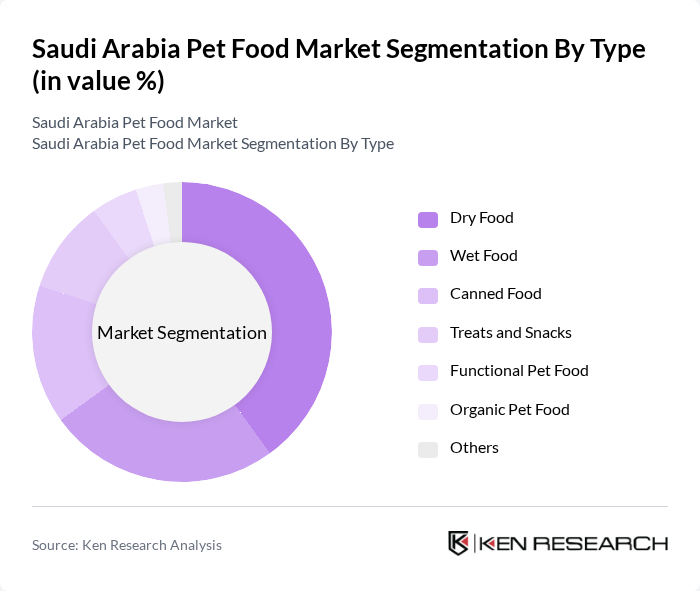

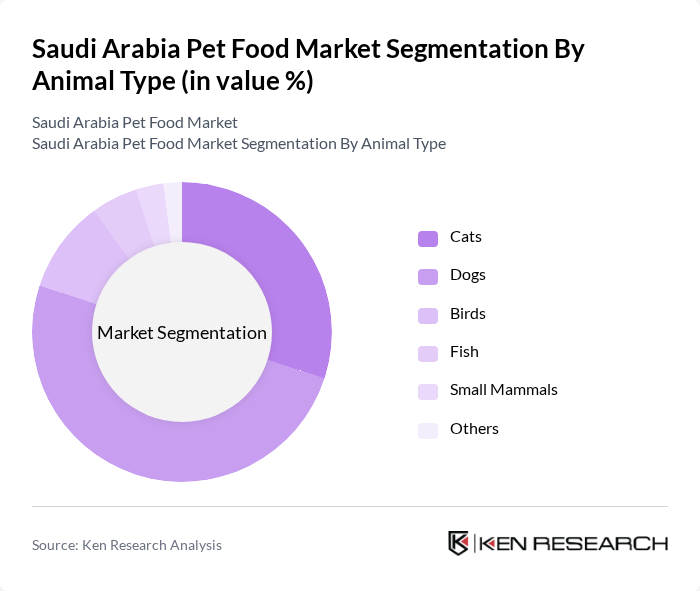

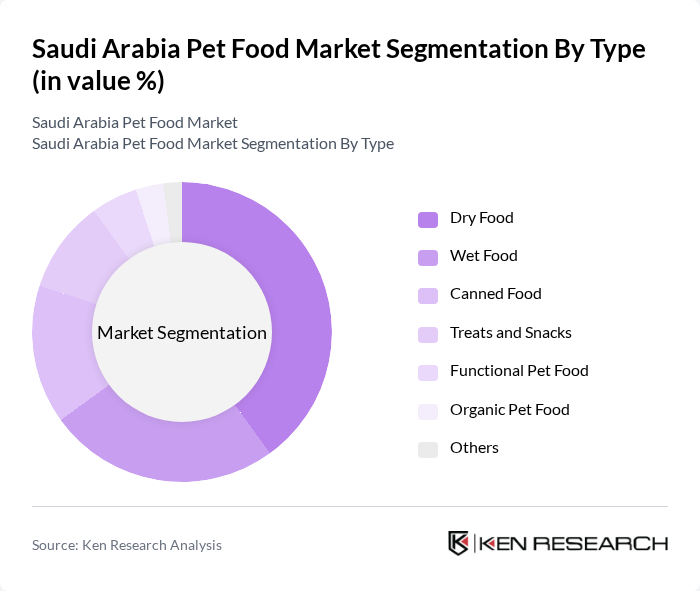

Saudi Arabia Pet Food Market Segmentation

By Type:The market is segmented into various types of pet food, including Dry Food, Wet Food, Canned Food, Treats and Snacks, Functional Pet Food, Organic Pet Food, and Others. Among these,Dry Foodis the most popular choice due to its convenience, affordability, and longer shelf life.Wet Foodis gaining traction for its palatability and higher moisture content, which appeals to pet owners concerned about hydration and taste. The demand forOrganic and Functional Pet Foodis also on the rise as consumers become more health-conscious and seek products with natural ingredients, added vitamins, and health benefits such as improved digestion and coat health .

By Animal Type:The segmentation by animal type includes Cats, Dogs, Birds, Fish, Small Mammals, and Others.Dogs and Catsdominate the market, with a significant preference for dog food due to the higher number of dog owners in the region. The trend towards premium and specialized diets for pets is also influencing purchasing decisions, particularly among dog owners who seek high-quality nutrition for their pets. The market for pet food for birds, fish, and small mammals remains niche but is gradually expanding as pet ownership diversifies .

Saudi Arabia Pet Food Market Competitive Landscape

The Saudi Arabia Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Royal Canin, Spectrum Brands (United Pet Group), Almarai, Jazan Poultry, Pet Arabia, Pet World Saudi, Petzone, Pet Kingdom, Petco Animal Supplies, Feline Natural, Pet Lovers Centre, Paws & Claws contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Pet Food Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The pet ownership rate in Saudi Arabia has surged, with approximately 70% of households owning at least one pet as of recent periods. This translates to around 7 million pet owners in the country. The growing trend of pet adoption, particularly among younger demographics, is driving demand for pet food products. As pet ownership continues to rise, the market for pet food is expected to expand significantly, reflecting a cultural shift towards viewing pets as family members.

- Rising Disposable Income:Saudi Arabia's GDP per capita is projected to reach $27,000 in future, indicating a steady increase in disposable income. This economic growth allows pet owners to spend more on premium pet food products. As consumers become more affluent, they are increasingly willing to invest in high-quality nutrition for their pets, which is expected to boost the overall pet food market. The trend towards higher spending on pet care is a significant driver of market growth.

- Growing Awareness of Pet Nutrition:There is a notable increase in consumer awareness regarding pet nutrition, with 80% of pet owners in Saudi Arabia actively seeking information about pet food ingredients and health benefits. This trend is supported by educational campaigns and the rise of social media influencers advocating for better pet diets. As pet owners prioritize health and wellness for their pets, the demand for specialized and nutritious pet food products is expected to grow, further propelling market expansion.

Market Challenges

- High Import Tariffs:Saudi Arabia imposes significant import tariffs on pet food, averaging around 5% in recent periods. These tariffs increase the cost of imported products, making it challenging for international brands to compete with local manufacturers. The high tariffs can lead to increased retail prices, potentially limiting consumer access to a variety of pet food options. This regulatory environment poses a barrier to market entry for new players and can stifle competition.

- Limited Local Production:The local production capacity for pet food in Saudi Arabia is currently insufficient to meet the growing demand, with only 40% of the market being supplied by domestic manufacturers. This reliance on imports creates vulnerabilities in the supply chain, especially during global disruptions. The lack of local production facilities also limits innovation and the ability to respond quickly to changing consumer preferences, presenting a significant challenge for market growth.

Saudi Arabia Pet Food Market Future Outlook

The Saudi Arabian pet food market is poised for significant growth, driven by increasing pet ownership and rising disposable incomes. As consumers become more health-conscious, the demand for premium and organic pet food products is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. Innovations in pet food formulations and packaging will also play a crucial role in attracting consumers, ensuring that the market remains dynamic and responsive to evolving trends.

Market Opportunities

- Growth of E-commerce Platforms:The e-commerce sector in Saudi Arabia is projected to reach $11 billion in future, providing a significant opportunity for pet food brands to expand their online presence. With increasing internet penetration and consumer preference for online shopping, brands can leverage digital platforms to reach a broader audience, enhancing sales and brand visibility in the competitive market.

- Demand for Organic Pet Food:The organic pet food segment is experiencing rapid growth, with sales expected to increase by 15% annually. As consumers become more health-conscious, the demand for organic and natural pet food options is rising. This trend presents an opportunity for manufacturers to innovate and develop products that cater to this growing consumer preference, potentially capturing a larger market share.