Region:Europe

Author(s):Rebecca

Product Code:KRAC0238

Pages:99

Published On:August 2025

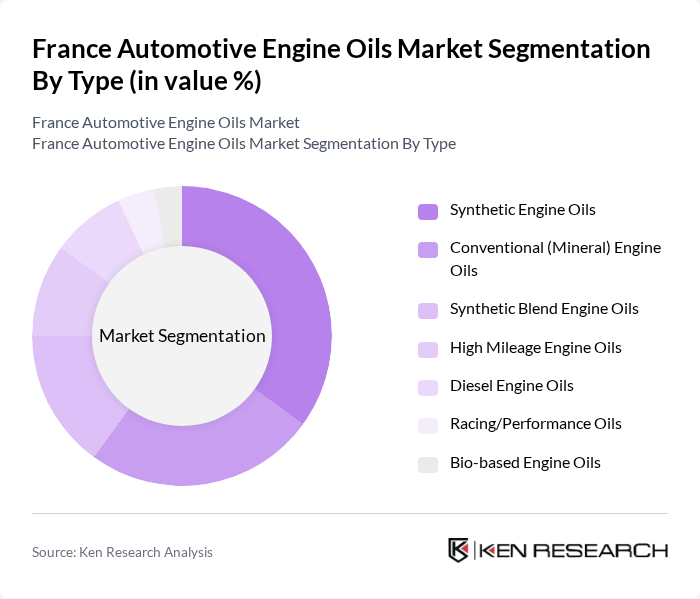

By Type:The market is segmented into various types of engine oils, including Synthetic Engine Oils, Conventional (Mineral) Engine Oils, Synthetic Blend Engine Oils, High Mileage Engine Oils, Diesel Engine Oils, Racing/Performance Oils, and Bio-based Engine Oils. Each type caters to different consumer needs and preferences, with synthetic oils gaining popularity due to their superior performance, better thermal stability, and longer drain intervals. The trend toward synthetic and semi-synthetic oils is further supported by stricter emission norms and the need for improved engine protection in modern vehicles .

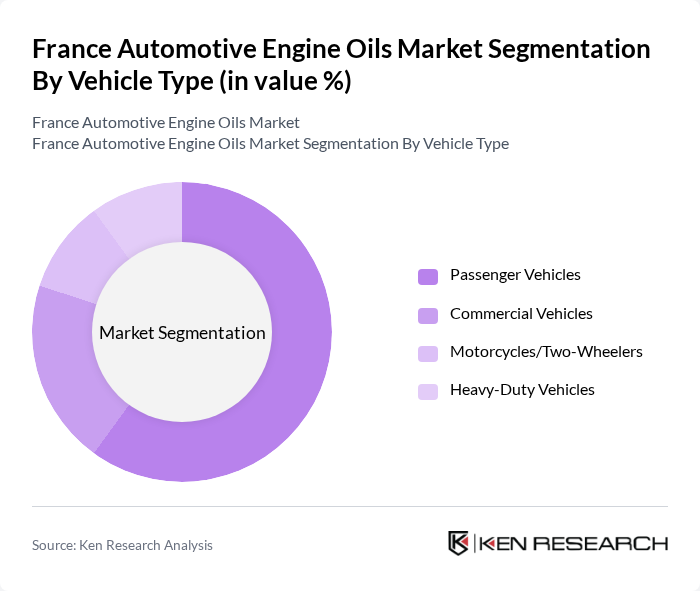

By Vehicle Type:The segmentation by vehicle type includes Passenger Vehicles, Commercial Vehicles, Motorcycles/Two-Wheelers, and Heavy-Duty Vehicles. Each segment has distinct requirements for engine oils. Passenger vehicles represent the largest share, driven by the high number of personal vehicles and the increasing adoption of advanced lubricants for modern engines. Commercial and heavy-duty vehicles require oils with enhanced durability and protection, while motorcycles and two-wheelers benefit from specialized formulations for high-revving engines .

The France Automotive Engine Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as TotalEnergies SE, ExxonMobil Corporation, Royal Dutch Shell plc, BP plc (Castrol), Motul S.A., Fuchs Petrolub SE, Eni S.p.A., Valvoline Inc., Liqui Moly GmbH, Repsol S.A., Chevron Corporation, Gulf Oil International Ltd., Amsoil Inc., Petronas Lubricants International, Elf Aquitaine S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the automotive engine oils market in France appears promising, driven by technological advancements and evolving consumer preferences. The shift towards electric vehicles is expected to reshape the market landscape, prompting manufacturers to innovate and develop specialized oils. Additionally, the increasing focus on sustainability will likely lead to a rise in demand for bio-based and eco-friendly engine oils, aligning with consumer values and regulatory requirements. Overall, the market is poised for transformation as it adapts to these emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Engine Oils Conventional (Mineral) Engine Oils Synthetic Blend Engine Oils High Mileage Engine Oils Diesel Engine Oils Racing/Performance Oils Bio-based Engine Oils |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Motorcycles/Two-Wheelers Heavy-Duty Vehicles |

| By Product Grade (Viscosity) | SAE 0W-20 SAE 5W-30 SAE 10W-40 Other Grades |

| By Distribution Channel | Online Retail Offline Retail (Workshops, Service Stations, Auto Parts Stores) Direct Sales (B2B, Fleets) |

| By Packaging Type | Bulk Packaging Retail Packaging (Bottles, Cans) |

| By Price Range | Economy Mid-Range Premium |

| By End-User | Individual Consumers Commercial Fleets Government/Municipal Fleets Workshops & Service Centers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Oil Retailers | 100 | Store Managers, Sales Representatives |

| Automotive Service Centers | 80 | Service Managers, Technicians |

| Oil Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Automotive Industry Experts | 40 | Consultants, Industry Analysts |

| End Consumers (Car Owners) | 120 | Car Owners, Fleet Managers |

The France Automotive Engine Oils Market is valued at approximately USD 1.1 billion, reflecting a five-year historical analysis. This growth is driven by an increasing number of vehicles, consumer awareness regarding engine maintenance, and advancements in oil technology.