Region:North America

Author(s):Geetanshi

Product Code:KRAC0109

Pages:88

Published On:August 2025

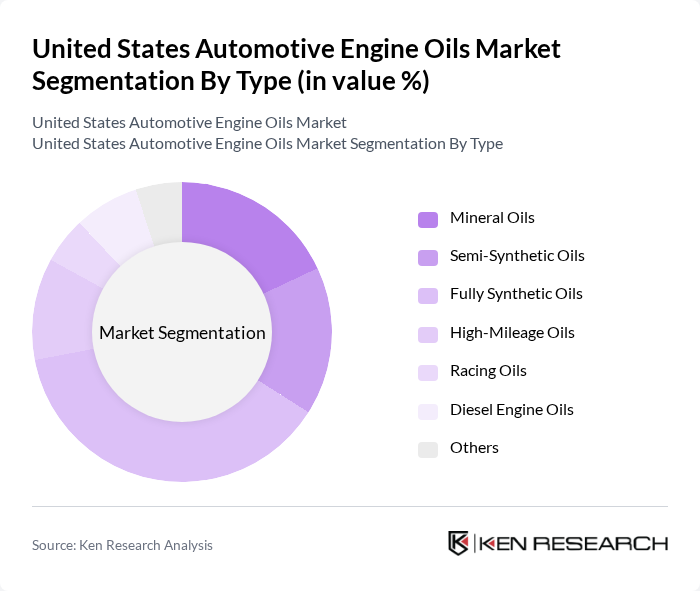

By Type:The market is segmented into Mineral Oils, Semi-Synthetic Oils, Fully Synthetic Oils, High-Mileage Oils, Racing Oils, Diesel Engine Oils, and Others. Fully synthetic oils are increasingly preferred due to their superior thermal stability, extended drain intervals, and enhanced engine protection, especially as modern engines require higher-performance lubricants. Mineral and semi-synthetic oils remain relevant for older vehicles and cost-sensitive consumers, while high-mileage and racing oils serve specialized segments .

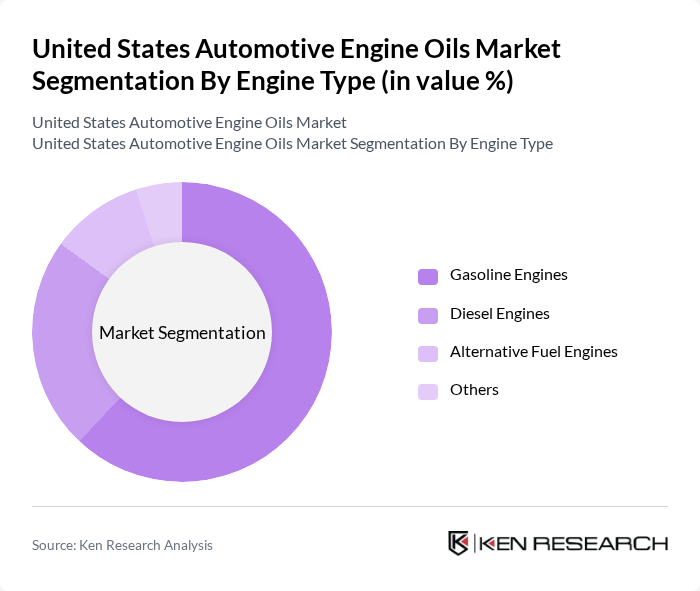

By Engine Type:Segmentation by engine type includes Gasoline Engines, Diesel Engines, Alternative Fuel Engines, and Others. Gasoline engines account for the largest share, reflecting their dominance in the U.S. passenger vehicle market. Diesel engines are significant in commercial fleets and heavy-duty vehicles, while alternative fuel engines—including hybrids—are emerging as a small but growing segment due to the shift toward electrification and sustainability .

The United States Automotive Engine Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Chevron Corporation, Shell plc, BP plc (Castrol), TotalEnergies SE, Valvoline Inc., Phillips 66 Lubricants, Pennzoil (a Shell brand), Royal Purple (Calumet Specialty Products Partners, L.P.), Amsoil Inc., Mobil 1 (ExxonMobil brand), LIQUI MOLY GmbH, Red Line Synthetic Oil (Phillips 66 subsidiary), FUCHS Group, and Motul S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the United States automotive engine oils market appears promising, driven by ongoing technological advancements and a shift towards sustainability. As electric vehicles gain traction, traditional engine oil manufacturers are exploring innovative formulations to cater to evolving consumer preferences. Additionally, the rise of subscription services for oil changes is expected to reshape the market landscape, providing convenience and fostering customer loyalty. These trends indicate a dynamic market environment poised for growth and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral Oils Semi-Synthetic Oils Fully Synthetic Oils High-Mileage Oils Racing Oils Diesel Engine Oils Others |

| By Engine Type | Gasoline Engines Diesel Engines Alternative Fuel Engines Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy-Duty Vehicles Motorcycles Others |

| By Region | New England Mideast Great Lakes Plains Southeast Southwest Rocky Mountain Far West |

| By Sales Channel | Online Retail Auto Parts Stores Supermarkets/Hypermarkets Service Stations Others |

| By End-User | Individual Consumers Automotive Workshops Fleet Operators OEMs Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Owners | 120 | Car Owners, Fleet Managers |

| Commercial Vehicle Operators | 90 | Logistics Managers, Fleet Supervisors |

| Automotive Service Providers | 60 | Service Station Owners, Mechanics |

| Oil Retailers and Distributors | 50 | Retail Managers, Supply Chain Coordinators |

| Automotive Industry Experts | 40 | Engineers, Product Development Managers |

The United States Automotive Engine Oils Market is valued at approximately USD 9.3 billion, reflecting a steady growth driven by factors such as an expanding vehicle fleet and advancements in synthetic oil formulations.