Region:Europe

Author(s):Shubham

Product Code:KRAB5594

Pages:83

Published On:October 2025

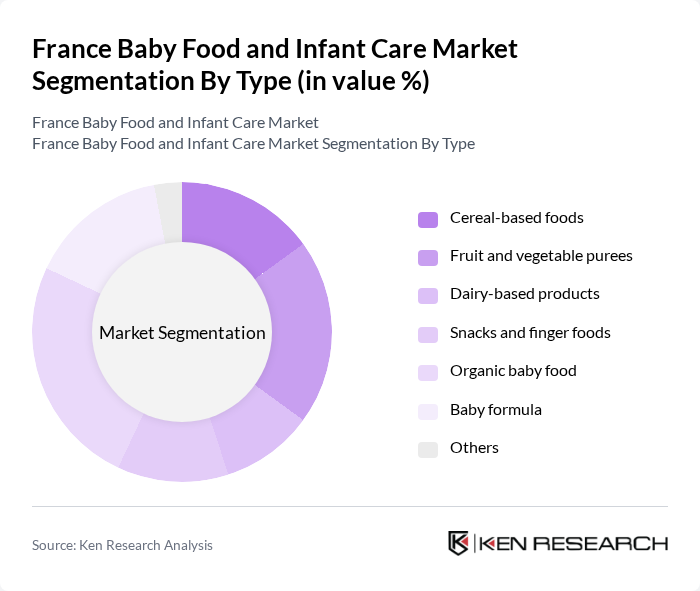

By Type:The market is segmented into various types of baby food products, including cereal-based foods, fruit and vegetable purees, dairy-based products, snacks and finger foods, organic baby food, baby formula, and others. Among these, organic baby food has gained significant traction due to rising health consciousness among parents, while baby formula remains a staple for many families.

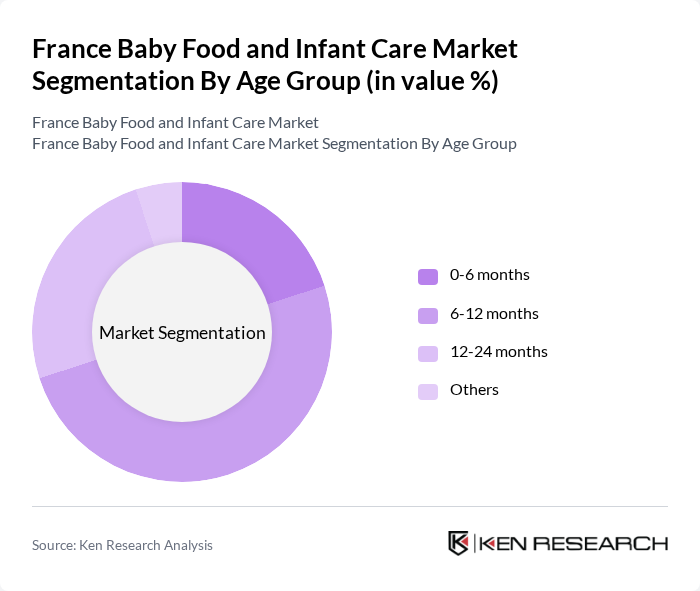

By Age Group:The market is also segmented by age group, including 0-6 months, 6-12 months, 12-24 months, and others. The 6-12 months age group is particularly significant, as this is when infants begin to transition to solid foods, leading to increased demand for a variety of baby food products.

The France Baby Food and Infant Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone S.A., Nestlé S.A., Hero Group, Mead Johnson Nutrition Company, Hain Celestial Group, Inc., Plum Organics, Organix Brands Ltd., Baby Gourmet Foods Inc., Ella's Kitchen, Beech-Nut Nutrition Company, Earth's Best Organic, Happy Family Organics, Sprout Organic Foods, Little Spoon, Yumi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France baby food and infant care market appears promising, driven by evolving consumer preferences and increasing health awareness. As parents continue to seek nutritious and convenient options, the demand for organic and plant-based products is expected to rise. Additionally, the growth of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. Companies that adapt to these trends and invest in innovation will likely thrive in this competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereal-based foods Fruit and vegetable purees Dairy-based products Snacks and finger foods Organic baby food Baby formula Others |

| By Age Group | 6 months 12 months 24 months Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Pharmacies Others |

| By Packaging Type | Jars Pouches Tetra Packs Cans Others |

| By Brand Type | National brands Private labels Premium brands Others |

| By Nutritional Content | High protein Low sugar Fortified Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Baby Food Retail Purchases | 150 | Parents of infants aged 0-12 months |

| Infant Care Product Usage | 100 | Caregivers and guardians of children aged 0-3 years |

| Organic Baby Food Preferences | 80 | Health-conscious parents and nutrition-focused caregivers |

| Market Trends in Baby Snacks | 70 | Parents with children aged 1-3 years |

| Purchasing Channels for Infant Care | 90 | Parents who shop online and in-store for baby products |

The France Baby Food and Infant Care Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by increasing health awareness among parents and the rising demand for organic and natural baby food products.