Region:Middle East

Author(s):Rebecca

Product Code:KRAB7763

Pages:91

Published On:October 2025

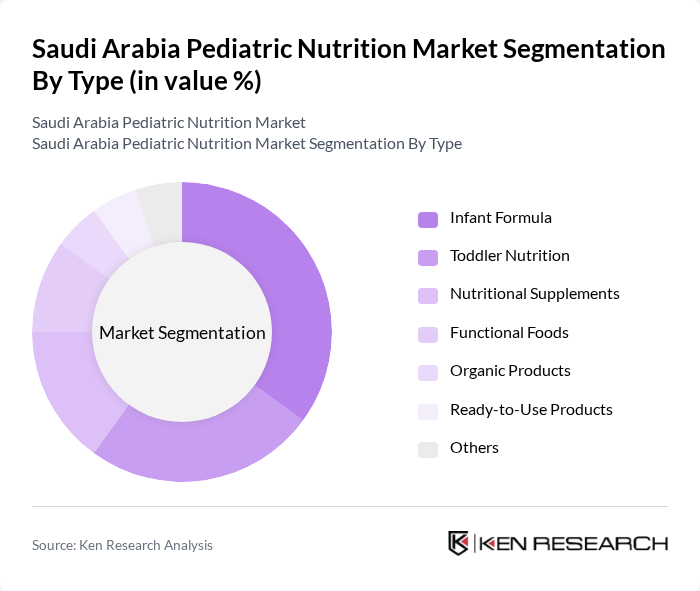

By Type:The market is segmented into various types of pediatric nutrition products, including Infant Formula, Toddler Nutrition, Nutritional Supplements, Functional Foods, Organic Products, Ready-to-Use Products, and Others. Each of these segments caters to specific dietary needs and preferences of children, reflecting the growing trend towards specialized nutrition.

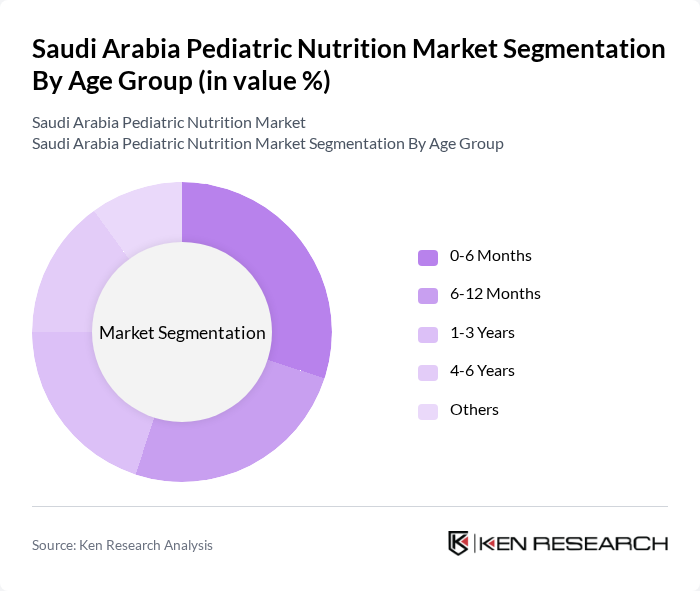

By Age Group:The pediatric nutrition market is also segmented by age group, including 0-6 Months, 6-12 Months, 1-3 Years, 4-6 Years, and Others. This segmentation allows manufacturers to tailor their products to meet the specific nutritional requirements of children at different developmental stages.

The Saudi Arabia Pediatric Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company, FrieslandCampina, Hero Group, Perrigo Company plc, Hain Celestial Group, Inc., Bledina (part of Danone), Holle Baby Food AG, Nutricia (part of Danone), Abbott Nutrition, Enfamil (part of Reckitt Benckiser), Baby Gourmet Foods Inc., Yummy Spoonfuls contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pediatric nutrition market in Saudi Arabia appears promising, driven by evolving consumer preferences and increasing health consciousness. As parents become more informed about nutrition, the demand for specialized products, such as organic and fortified options, is expected to rise. Additionally, the growth of e-commerce platforms will facilitate easier access to a wider range of products, enhancing market penetration. Collaborations with healthcare professionals will further strengthen brand credibility and consumer trust, paving the way for innovative product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Infant Formula Toddler Nutrition Nutritional Supplements Functional Foods Organic Products Ready-to-Use Products Others |

| By Age Group | 6 Months 12 Months 3 Years 6 Years Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies Online Retail Specialty Stores Others |

| By Packaging Type | Tetra Packs Cans Pouches Bottles Others |

| By Brand Type | Established Brands Private Labels New Entrants Others |

| By Nutritional Content | High Protein Low Sugar Fortified with Vitamins Probiotics Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pediatric Nutrition Product Purchases | 150 | Parents of children aged 0-12 years |

| Healthcare Professional Insights | 100 | Pediatricians, Nutritionists, Dietitians |

| Market Trends in Infant Formula | 80 | Retail Managers, Product Category Managers |

| Consumer Preferences for Nutritional Supplements | 70 | Parents, Caregivers, Health Advocates |

| Awareness of Pediatric Nutrition Guidelines | 60 | School Health Coordinators, Community Health Workers |

The Saudi Arabia Pediatric Nutrition Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased awareness of child health and nutrition, as well as rising disposable incomes among families.