Region:Europe

Author(s):Geetanshi

Product Code:KRAA0220

Pages:84

Published On:August 2025

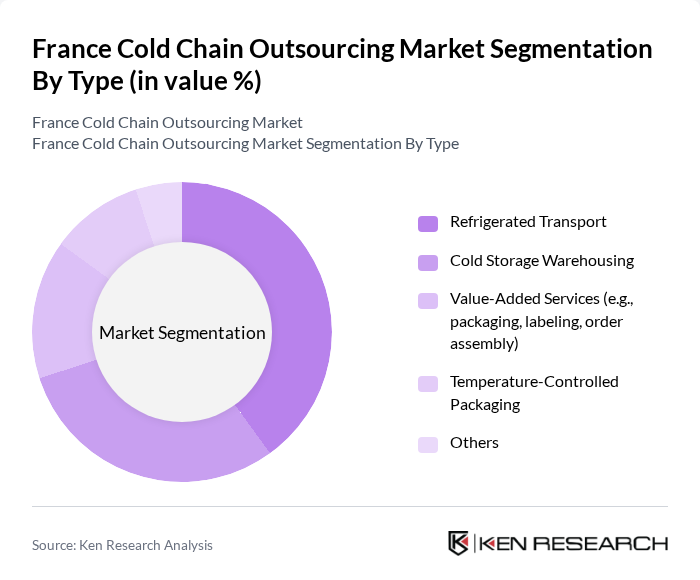

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Warehousing, Value-Added Services, Temperature-Controlled Packaging, and Others. Each of these segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain. Refrigerated transport and cold storage warehousing are the dominant segments, reflecting the need for reliable logistics and storage solutions for perishable goods. Value-added services such as packaging, labeling, and order assembly are increasingly important as supply chains become more complex and customer requirements more specific .

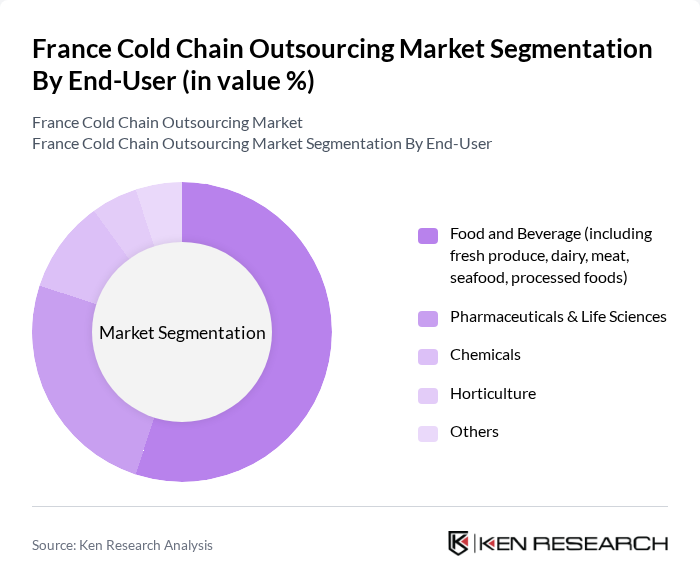

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals & Life Sciences, Chemicals, Horticulture, and Others. The food and beverage sector is particularly significant, driven by the increasing demand for fresh and frozen products, while the pharmaceuticals and life sciences segment is expanding due to the growing need for temperature-controlled logistics for vaccines, biopharmaceuticals, and clinical trial materials .

The France Cold Chain Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sofrilog, STEF, XPO Logistics, Kuehne + Nagel, DB Schenker, DHL Supply Chain, Geodis, Seafrigo, Lineage Logistics, Norbert Dentressangle (now part of XPO Logistics), STEF-TFE, Rhenus Logistics, Chronopost (DPDgroup), FM Logistic, Stef Logistique contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain outsourcing market in France appears promising, driven by technological advancements and increasing consumer demand for quality and safety. The integration of IoT technologies for real-time monitoring is expected to enhance operational efficiency, while the shift towards sustainable practices will likely attract investments. Additionally, the expansion of e-commerce and the pharmaceutical sector will further stimulate growth, creating a dynamic environment for cold chain service providers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Warehousing Value-Added Services (e.g., packaging, labeling, order assembly) Temperature-Controlled Packaging Others |

| By End-User | Food and Beverage (including fresh produce, dairy, meat, seafood, processed foods) Pharmaceuticals & Life Sciences Chemicals Horticulture Others |

| By Product Type | Fresh Produce (fruits & vegetables) Frozen Foods Dairy Products Meat, Fish & Seafood Pharmaceuticals & Vaccines Others |

| By Service Type | Transportation Services Warehousing Services Packaging & Value-Added Services Others |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Ambient (above 5°C) Others |

| By Distribution Channel | Direct Sales Online Sales Third-Party Logistics (3PL) Others |

| By Region | Northern France Southern France Eastern France Western France |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Chain Logistics | 80 | Logistics Coordinators, Regulatory Affairs Managers |

| Biotechnology Temperature Control | 50 | Operations Managers, Research and Development Heads |

| Retail Cold Chain Management | 40 | Inventory Managers, Distribution Center Supervisors |

| Third-Party Cold Chain Providers | 60 | Business Development Managers, Operations Directors |

The France Cold Chain Outsourcing Market is valued at approximately USD 11.5 billion, reflecting a significant growth driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals.