Region:Central and South America

Author(s):Shubham

Product Code:KRAA0774

Pages:90

Published On:August 2025

By Service:The service segmentation includes various sub-segments such as Storage (Chilled, Frozen, Ambient), Transportation (Road, Rail, Air, Sea), Value-Added Services (Packaging, Labeling, Inventory Management), Temperature-Controlled Packaging, Monitoring and Control Systems, and Logistics Management Services. Among these, Storage services are currently leading the market due to the rising demand for efficient storage solutions for perishable goods. The increasing focus on food safety, traceability, and quality assurance has further propelled the growth of temperature-controlled storage facilities, with storage representing the largest share of cold chain investments .

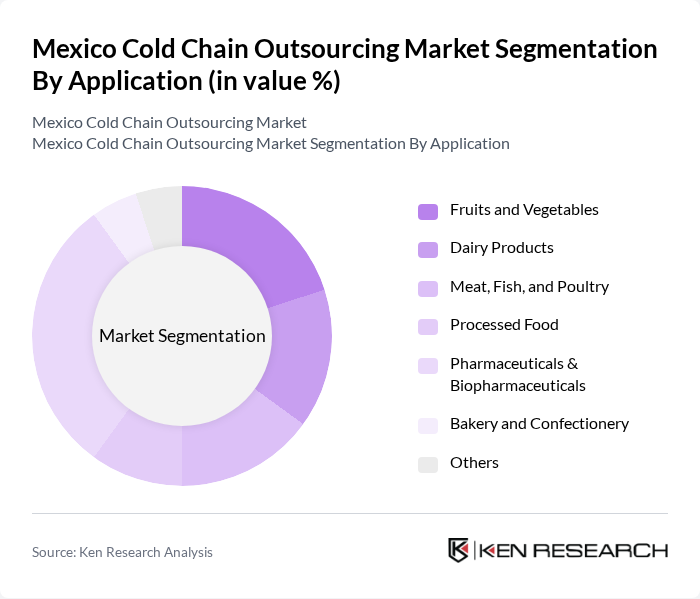

By Application:The application segmentation encompasses Fruits and Vegetables, Dairy Products, Meat, Fish, and Poultry, Processed Food, Pharmaceuticals & Biopharmaceuticals, Bakery and Confectionery, and Others. The Pharmaceuticals & Biopharmaceuticals segment is currently the dominant application area, driven by the increasing need for temperature-sensitive medications and vaccines. The rise in healthcare demands, especially post-pandemic, and the growth in pharmaceutical exports have significantly boosted the requirement for reliable cold chain solutions in this sector .

The Mexico Cold Chain Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Frialsa Frigoríficos, Friopuerto Veracruz, Emergent Cold LatAm, Americold Logistics, DHL Supply Chain Mexico, Kuehne + Nagel, Grupo Serbom, Lineage Logistics, CEVA Logistics, Grupo TMM, C.H. Robinson, Maersk, XPO Logistics, Transplace, Agility Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain outsourcing market in Mexico appears promising, driven by technological advancements and increasing consumer expectations for food quality. As companies adopt IoT solutions for real-time monitoring, operational efficiencies are expected to improve significantly. Furthermore, the focus on sustainability will likely lead to the adoption of eco-friendly practices, enhancing the market's appeal. Overall, the combination of these trends is set to reshape the landscape of cold chain logistics in Mexico, fostering growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Service | Storage (Chilled, Frozen, Ambient) Transportation (Road, Rail, Air, Sea) Value-Added Services (Packaging, Labeling, Inventory Management) Temperature-Controlled Packaging Monitoring and Control Systems Logistics Management Services |

| By Application | Fruits and Vegetables Dairy Products Meat, Fish, and Poultry Processed Food Pharmaceuticals & Biopharmaceuticals Bakery and Confectionery Others |

| By End-User | Food and Beverage Pharmaceuticals Agriculture Retail Others |

| By Temperature Range | Chilled Frozen Ambient |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Customer Segment | Large Enterprises SMEs Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Chain Management | 60 | Logistics Coordinators, Regulatory Affairs Managers |

| Retail Cold Storage Solutions | 50 | Operations Managers, Inventory Control Specialists |

| Technology in Cold Chain Logistics | 40 | IT Managers, Technology Implementation Leads |

| Cold Chain Sustainability Practices | 40 | Sustainability Officers, Environmental Compliance Managers |

The Mexico Cold Chain Outsourcing Market is valued at approximately USD 4 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and retail logistics.