Region:Europe

Author(s):Dev

Product Code:KRAA0394

Pages:89

Published On:August 2025

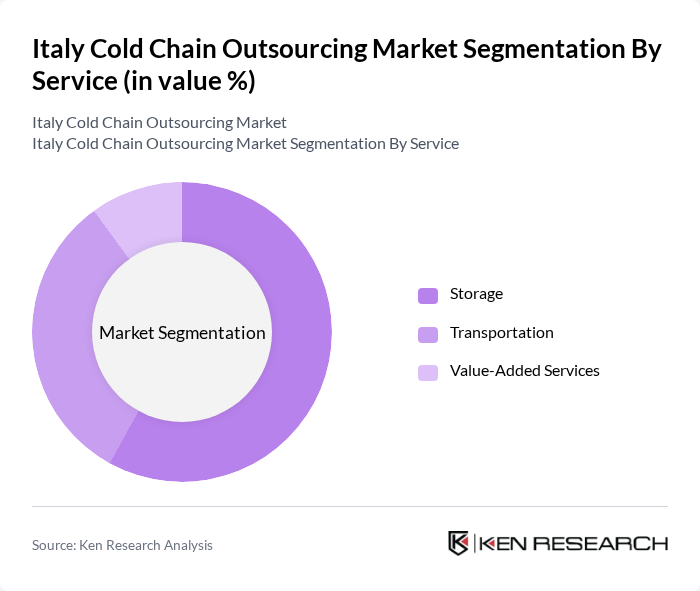

By Service:The service segment includes various offerings that cater to the needs of cold chain logistics. The primary subsegments are Storage, Transportation, and Value-Added Services. Storage involves maintaining temperature-controlled environments for products, while Transportation focuses on the movement of goods under specific temperature conditions. Value-Added Services encompass additional offerings such as packaging, labeling, and inventory management, which enhance the overall efficiency and compliance of cold chain operations .

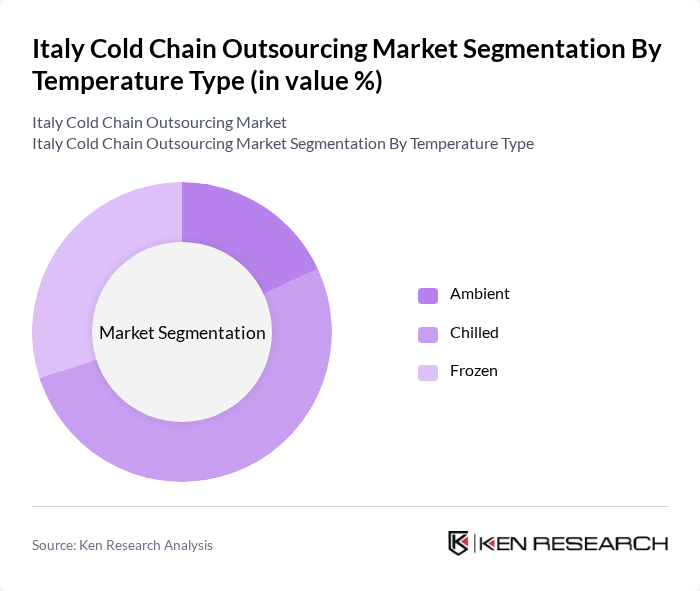

By Temperature Type:The temperature type segment categorizes services based on the required temperature conditions for storage and transportation. The subsegments include Ambient, Chilled, and Frozen. Ambient services are used for products that do not require temperature control, while Chilled services are essential for perishable items that need to be kept at specific cool temperatures. Frozen services are critical for products that must remain at sub-zero temperatures to maintain quality and safety. The segment is witnessing increased demand for chilled and frozen logistics due to the growth of food and pharmaceutical sectors .

The Italy Cold Chain Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Safim Logistics, Frigocaserta SRL, Eurofrigo Vernate SRL, Frigoscandia SPA, DRS Depositi Regionali Surgelati SRL, DHL Supply Chain, Kuehne + Nagel, Geodis, CEVA Logistics, DB Schenker, Lineage Logistics, Stef Italia, Italtrans, Number1 Logistics Group, Rhenus Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain outsourcing market in Italy appears promising, driven by technological innovations and evolving consumer preferences. As the demand for perishable goods continues to rise, companies are likely to invest in automation and IoT solutions for enhanced efficiency. Additionally, the increasing focus on sustainability will push businesses to adopt eco-friendly practices, ensuring compliance with stringent regulations while meeting consumer expectations for transparency and quality in food supply chains.

| Segment | Sub-Segments |

|---|---|

| By Service | Storage Transportation Value-Added Services |

| By Temperature Type | Ambient Chilled Frozen |

| By Application | Horticulture (Fresh Fruits and Vegetables) Dairy Products (Milk, Ice-cream, Butter, etc.) Meats and Fish Processed Food Products Pharma, Life Sciences, and Chemicals Other Applications |

| By Geographic Coverage | Northern Italy Central Italy Southern Italy Islands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 100 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Storage | 60 | Quality Assurance Managers, Operations Directors |

| Retail Cold Chain Management | 50 | Store Managers, Inventory Control Specialists |

| Temperature-Sensitive Product Logistics | 40 | Procurement Managers, Distribution Supervisors |

| Cold Chain Technology Providers | 40 | Product Development Managers, Technical Sales Representatives |

The Italy Cold Chain Outsourcing Market is valued at approximately USD 9.5 billion, reflecting a significant growth driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals.