Region:Europe

Author(s):Dev

Product Code:KRAB6034

Pages:89

Published On:October 2025

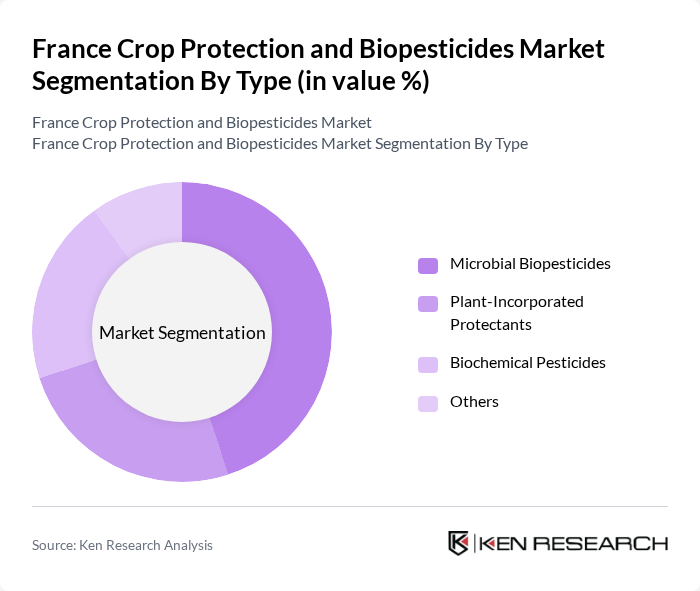

By Type:The market is segmented into various types, including Microbial Biopesticides, Plant-Incorporated Protectants, Biochemical Pesticides, and Others. Among these, Microbial Biopesticides are gaining traction due to their effectiveness and lower environmental impact. The increasing consumer preference for organic farming and the need for sustainable agricultural practices are driving the demand for these products.

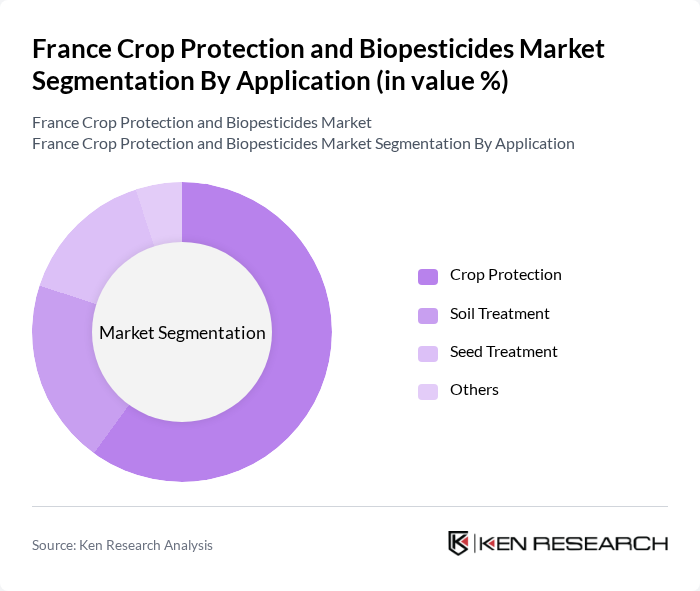

By Application:The applications of crop protection and biopesticides include Crop Protection, Soil Treatment, Seed Treatment, and Others. Crop Protection is the leading application segment, driven by the need to safeguard crops from pests and diseases. The increasing adoption of integrated pest management practices is further propelling the demand for biopesticides in this segment.

The France Crop Protection and Biopesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, FMC Corporation, UPL Limited, ADAMA Agricultural Solutions Ltd., Biobest Group NV, Marrone Bio Innovations, Inc., Certis Europe, Koppert Biological Systems, AgraQuest, Inc., BioWorks, Inc., Greenhouse Biosecurity, T. Stanes & Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France Crop Protection and Biopesticides Market appears promising, driven by ongoing trends in sustainable agriculture and technological advancements. As the demand for organic produce continues to rise, the market for biopesticides is expected to expand significantly. Innovations in biopesticide formulations and increased collaboration between research institutions and industry players will likely enhance product efficacy and availability, positioning biopesticides as a viable alternative to synthetic chemicals in pest management strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Microbial Biopesticides Plant-Incorporated Protectants Biochemical Pesticides Others |

| By Application | Crop Protection Soil Treatment Seed Treatment Others |

| By End-User | Agriculture Horticulture Forestry Others |

| By Distribution Channel | Direct Sales Retail Online Sales Others |

| By Region | Northern France Southern France Eastern France Western France |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Protection | 100 | Farmers, Agronomists |

| Fruit and Vegetable Biopesticide Usage | 80 | Horticulturists, Agricultural Advisors |

| Biopesticide Distribution Channels | 60 | Distributors, Retail Managers |

| Regulatory Compliance in Crop Protection | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trends in Sustainable Agriculture | 70 | Research Analysts, Policy Makers |

The France Crop Protection and Biopesticides Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by the increasing demand for sustainable agricultural practices and organic produce, alongside stringent regulations on chemical pesticides.