Region:Asia

Author(s):Dev

Product Code:KRAA3555

Pages:91

Published On:September 2025

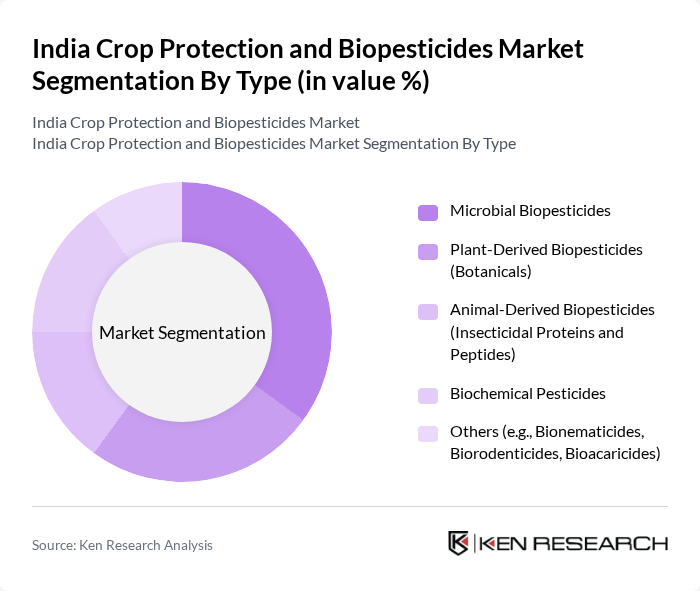

By Type:The market is segmented into various types of biopesticides, including microbial biopesticides, plant-derived biopesticides, animal-derived biopesticides, biochemical pesticides, and others. Among these, microbial biopesticides are gaining significant traction due to their effectiveness and lower environmental impact. The increasing preference for organic farming and the need for sustainable pest management solutions are driving the demand for these products.

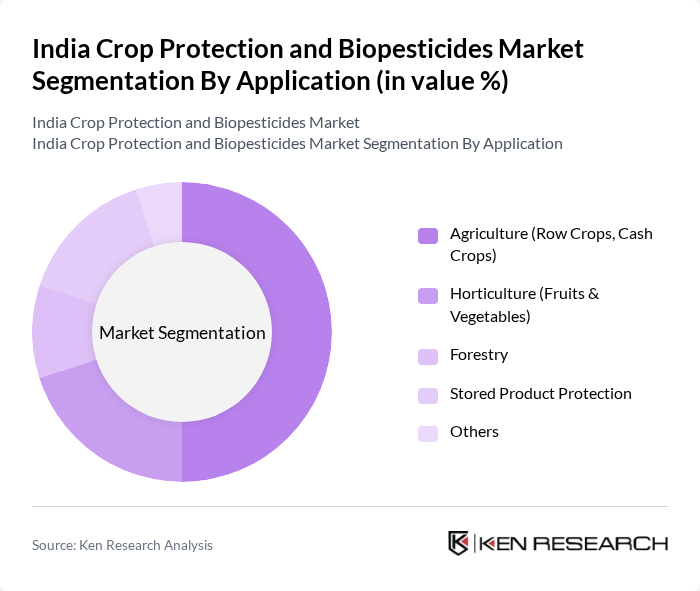

By Application:The applications of biopesticides are diverse, including agriculture (row crops and cash crops), horticulture (fruits and vegetables), forestry, stored product protection, and others. The agriculture segment, particularly row crops, dominates the market due to the high volume of pesticide usage in traditional farming practices. The increasing shift towards sustainable agriculture is further propelling the adoption of biopesticides in this segment.

The India Crop Protection and Biopesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience Limited, Syngenta India Limited, UPL Limited, BASF India Limited, FMC India Private Limited, Rallis India Limited, Dhanuka Agritech Limited, Insecticides (India) Limited, Coromandel International Limited, T. Stanes and Company Limited, GrowTech Agri Science Private Limited, Gujarat State Fertilizers & Chemicals Limited, Mahindra Agri Solutions Limited, Adama Agricultural Solutions, Sumitomo Chemical India Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Crop Protection and Biopesticides Market appears promising, driven by increasing consumer demand for organic products and supportive government policies. As awareness of health and environmental issues continues to rise, the market is likely to see a shift towards biopesticides. Innovations in product formulations and the expansion of research collaborations will further enhance the market landscape, positioning biopesticides as a viable alternative to synthetic chemicals in agriculture.

| Segment | Sub-Segments |

|---|---|

| By Type | Microbial Biopesticides Plant-Derived Biopesticides (Botanicals) Animal-Derived Biopesticides (Insecticidal Proteins and Peptides) Biochemical Pesticides Others (e.g., Bionematicides, Biorodenticides, Bioacaricides) |

| By Application | Agriculture (Row Crops, Cash Crops) Horticulture (Fruits & Vegetables) Forestry Stored Product Protection Others |

| By End-User | Farmers Commercial Growers Government Agencies Agricultural Cooperatives Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms Others |

| By Region | North India South India East India West India |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Protection | 120 | Farmers, Agronomists, Crop Advisors |

| Horticultural Biopesticides | 90 | Horticulturists, Agricultural Extension Officers |

| Organic Farming Practices | 60 | Organic Farmers, Certification Bodies |

| Distribution Channels for Biopesticides | 50 | Distributors, Retailers, Supply Chain Managers |

| Regulatory Compliance Insights | 40 | Regulatory Affairs Specialists, Compliance Officers |

The India Crop Protection and Biopesticides Market is valued at approximately USD 6.4 billion, reflecting a significant growth trend driven by the demand for sustainable agricultural practices and effective pest management solutions.