Region:Europe

Author(s):Shubham

Product Code:KRAA6189

Pages:96

Published On:September 2025

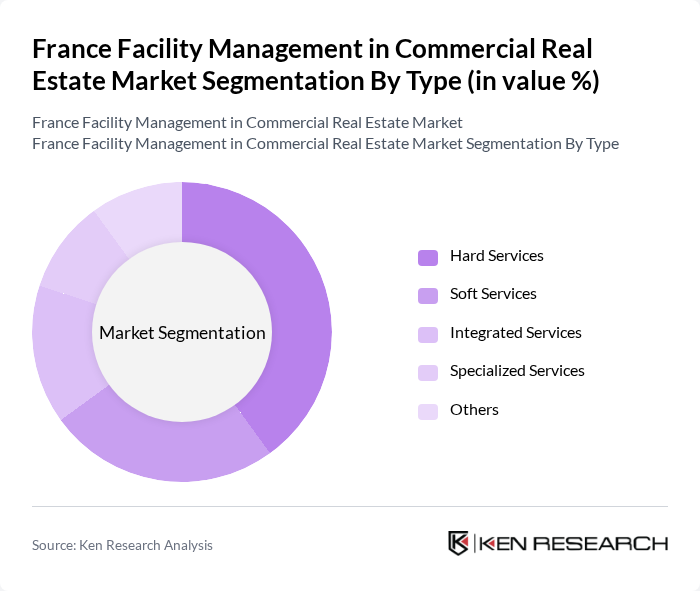

By Type:The facility management market can be segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Among these, Hard Services, which encompass maintenance and repair activities, are currently leading the market due to the essential nature of these services in ensuring operational efficiency and safety in commercial properties. The increasing complexity of building systems and the need for compliance with safety regulations further drive the demand for Hard Services.

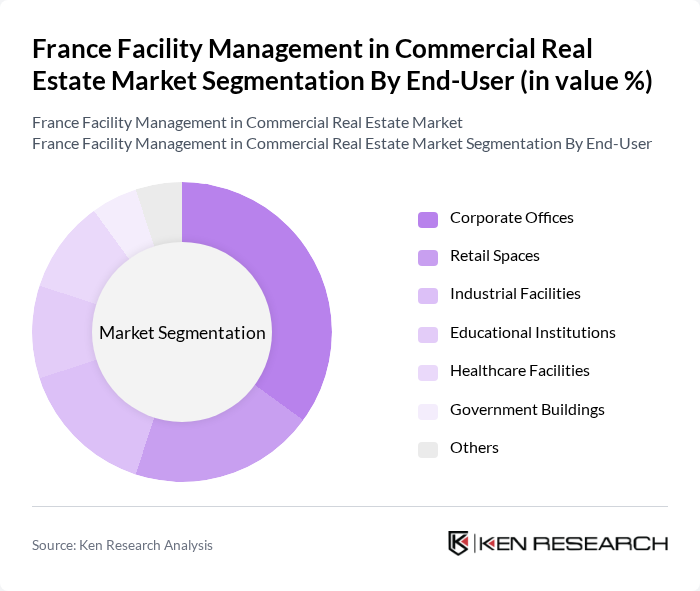

By End-User:The end-user segmentation includes Corporate Offices, Retail Spaces, Industrial Facilities, Educational Institutions, Healthcare Facilities, Government Buildings, and Others. Corporate Offices are the dominant segment, driven by the increasing number of businesses seeking professional facility management services to enhance operational efficiency and employee satisfaction. The trend towards flexible workspaces and the need for compliance with health and safety regulations further bolster the demand in this segment.

The France Facility Management in Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sodexo, ISS Facility Services, CBRE Group, Inc., JLL (Jones Lang LaSalle), Cushman & Wakefield, GDI Integrated Facility Services, Aramark, Compass Group, Mitie Group plc, Serco Group plc, Bilfinger SE, Engie, Veolia Environnement, ISS A/S, SUEZ contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in France's commercial real estate market appears promising, driven by technological innovations and a heightened focus on sustainability. As companies increasingly adopt integrated facility management solutions, the demand for skilled professionals in this sector will rise. Additionally, the ongoing shift towards flexible workspaces will necessitate adaptive facility management strategies, ensuring that service providers remain agile and responsive to changing client needs and market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Corporate Offices Retail Spaces Industrial Facilities Educational Institutions Healthcare Facilities Government Buildings Others |

| By Service Model | Outsourced Services In-House Services Hybrid Services |

| By Contract Type | Fixed-Price Contracts Time and Material Contracts Performance-Based Contracts |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Investment Source | Private Investments Public Funding Joint Ventures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Facility Management | 150 | Facility Managers, Real Estate Directors |

| Retail Space Management | 100 | Property Managers, Operations Heads |

| Industrial Facility Services | 80 | Logistics Managers, Site Supervisors |

| Healthcare Facility Management | 70 | Facility Directors, Compliance Officers |

| Educational Institution Facility Services | 60 | Campus Facility Managers, Administrative Heads |

The France Facility Management in Commercial Real Estate Market is valued at approximately USD 30 billion, reflecting a significant growth driven by the demand for efficient building management solutions and the rise of smart buildings focused on sustainability and energy efficiency.