Region:Europe

Author(s):Shubham

Product Code:KRAB1109

Pages:88

Published On:October 2025

By Type:The facility management market can be segmented into various types, including Hard Services, Soft Services, Integrated Facility Management (IFM), Specialized Services, and Other Services. Each of these segments plays a crucial role in the overall market dynamics, catering to different operational needs and client preferences.

The Hard Services segment is currently dominating the market due to the essential nature of these services in maintaining the operational integrity of commercial properties. This includes critical systems such as HVAC, electrical, and plumbing, which are vital for the functionality of any commercial space. The increasing focus on building safety and compliance with regulations has further propelled the demand for these services. Additionally, advancements in technology have led to more efficient maintenance practices, making Hard Services a key area of investment for facility management companies. The shift towards integrated contracts and the adoption of smart building technologies are also influencing service delivery models across all segments.

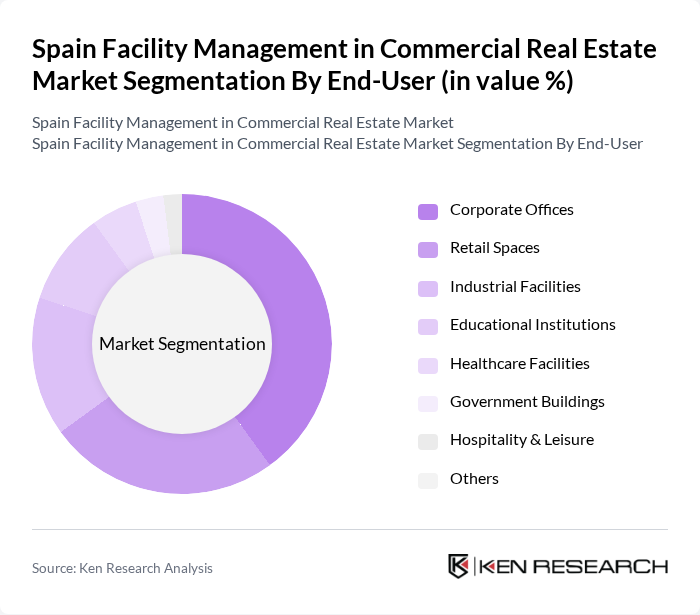

By End-User:The end-user segmentation includes Corporate Offices, Retail Spaces, Industrial Facilities, Educational Institutions, Healthcare Facilities, Government Buildings, Hospitality & Leisure, and Others. Each end-user category has unique requirements and expectations from facility management services, influencing the overall market landscape.

Corporate Offices represent the largest end-user segment in the facility management market, driven by the increasing number of businesses establishing operations in Spain. The demand for efficient workspace management, coupled with the need for compliance with health and safety regulations, has led to a surge in facility management services tailored for corporate environments. Additionally, the trend towards flexible workspaces and the integration of technology in office management further enhance the appeal of facility management solutions in this sector. The commercial sector, including offices and retail, is also benefiting from the rebound in hospitality and tourism, as well as the expansion of e-commerce logistics and data centers, which require specialized facility management support.

The Spain Facility Management in Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo S.A., CBRE Group, Inc., JLL (Jones Lang LaSalle), G4S plc, Cushman & Wakefield, Aramark Corporation, Serco Group plc, Compass Group PLC, Mitie Group plc, Apleona GmbH, Bilfinger SE, Engie Services, SODEXO España, Ecolab Inc., Clece S.A., Ferrovial Servicios, Acciona Facility Services S.A., ILUNION Facility Services, Sacyr Facilities, Licuas S.A., The Mail Company, Grupo Eulen, OHL Servicios-Ingesan, Dominion (Global Dominion Access S.A.), FAMAEX contribute to innovation, geographic expansion, and service delivery in this space.

Note: The establishment years and headquarters for ISS Facility Services, Sodexo S.A., JLL (Jones Lang LaSalle), and G4S plc are accurate. CBRE Group, Inc. is headquartered in Dallas, USA, not Los Angeles.

The future of facility management in Spain's commercial real estate market appears promising, driven by the increasing adoption of smart technologies and a heightened focus on sustainability. As businesses prioritize operational efficiency and cost reduction, the demand for integrated facility management solutions is expected to rise. Additionally, the ongoing trend towards outsourcing facility management services will likely create new opportunities for specialized providers, enabling them to offer tailored solutions that meet evolving client needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., HVAC, MEP, Fire Safety, Building Fabric Maintenance) Soft Services (e.g., Cleaning, Security, Landscaping, Waste Management) Integrated Facility Management (IFM) Specialized Services (e.g., Energy Management, Pest Control, Technical Audits) Other Services (e.g., Reception, Mailroom, Document Management) |

| By End-User | Corporate Offices Retail Spaces Industrial Facilities Educational Institutions Healthcare Facilities Government Buildings Hospitality & Leisure Others |

| By Service Model | Outsourced Services In-House Services Hybrid Services |

| By Region | Madrid Catalonia (Barcelona) Andalusia Valencia Basque Country Other Regions |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Performance-Based Contracts |

| By Industry Vertical | Commercial Real Estate Hospitality Transportation Manufacturing Public Sector |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment Joint Ventures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Space Facility Management | 100 | Facility Managers, Real Estate Directors |

| Retail Property Management | 80 | Property Managers, Operations Heads |

| Industrial Facility Services | 60 | Logistics Managers, Site Supervisors |

| Commercial Real Estate Sustainability Practices | 50 | Sustainability Officers, Compliance Managers |

| Tenant Experience Management | 40 | Tenant Relations Managers, Customer Experience Leads |

The Spain Facility Management in Commercial Real Estate Market is valued at approximately EUR 15 billion, driven by the demand for efficient building management solutions, urbanization, and sustainable practices in property management.