Region:Europe

Author(s):Geetanshi

Product Code:KRAA0258

Pages:81

Published On:August 2025

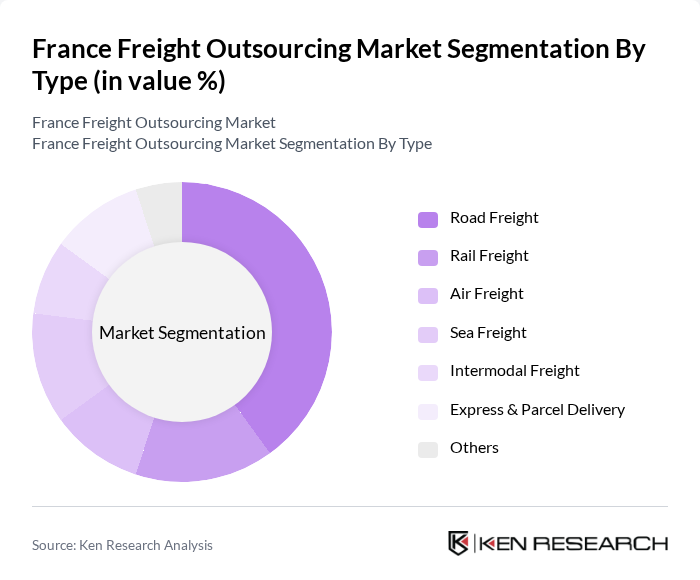

By Type:The freight outsourcing market in France is segmented into Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express & Parcel Delivery, and Others. Road Freight is the most dominant segment due to its flexibility, extensive network coverage, and ability to support both full-truck-load (FTL) and less-than-truck-load (LTL) services. The segment benefits from the growing e-commerce sector and last-mile delivery requirements, as well as investments in sustainable transportation solutions such as electric and biofuel-powered trucks .

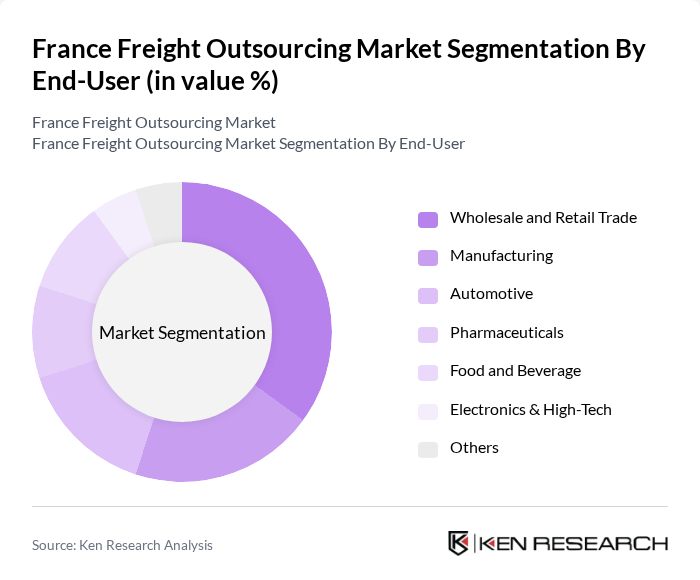

By End-User:The end-user segmentation of the freight outsourcing market includes Wholesale and Retail Trade, Manufacturing, Automotive, Pharmaceuticals, Food and Beverage, Electronics & High-Tech, and Others. The Wholesale and Retail Trade segment leads the market, driven by the rapid growth of e-commerce and the need for efficient supply chain solutions. Demand for timely deliveries, inventory management, and value-added services such as packaging and tracking has made this segment a key driver in the freight outsourcing landscape .

The France Freight Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geodis, XPO Logistics, DB Schenker, Kuehne + Nagel, DPDgroup (La Poste Group), DHL Supply Chain, Bolloré Logistics, SNCF Logistics, CEVA Logistics, Rhenus Logistics, Norbert Dentressangle (XPO Logistics France), TSE Express, Transports Dufour, STG Group, Groupe Charles André (GCA), Mondial Relay, and General Logistics Systems (GLS France) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France freight outsourcing market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt digital freight platforms, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainability will likely lead to the adoption of green logistics solutions, aligning with regulatory pressures and consumer preferences. This dynamic environment presents opportunities for innovative service providers to capture market share and enhance customer satisfaction through tailored logistics solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express & Parcel Delivery Others |

| By End-User | Wholesale and Retail Trade Manufacturing Automotive Pharmaceuticals Food and Beverage Electronics & High-Tech Others |

| By Service Type | Freight Forwarding Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Warehousing & Distribution Customs Clearance Others |

| By Mode of Transport | Full Truck Load (FTL) Less Than Truck Load (LTL) Dedicated Freight Express Delivery Others |

| By Geographic Coverage | Domestic Freight International Freight Cross-Border Freight Intra-European Freight Others |

| By Customer Type | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Others |

| By Technology Utilization | Traditional Logistics Digital Logistics Solutions Automated Logistics Systems IoT-Enabled Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Freight Outsourcing | 100 | Logistics Directors, Supply Chain Managers |

| Automotive Supply Chain Management | 80 | Procurement Managers, Operations Directors |

| Pharmaceutical Logistics Solutions | 60 | Compliance Officers, Distribution Managers |

| Food and Beverage Distribution | 50 | Warehouse Managers, Quality Assurance Heads |

| E-commerce Logistics Strategies | 60 | eCommerce Operations Managers, Fulfillment Specialists |

The France Freight Outsourcing Market is valued at approximately USD 33 billion, driven by the increasing demand for efficient logistics solutions, the rapid expansion of e-commerce, and the need for cost-effective transportation options.