Region:Europe

Author(s):Geetanshi

Product Code:KRAB2846

Pages:86

Published On:October 2025

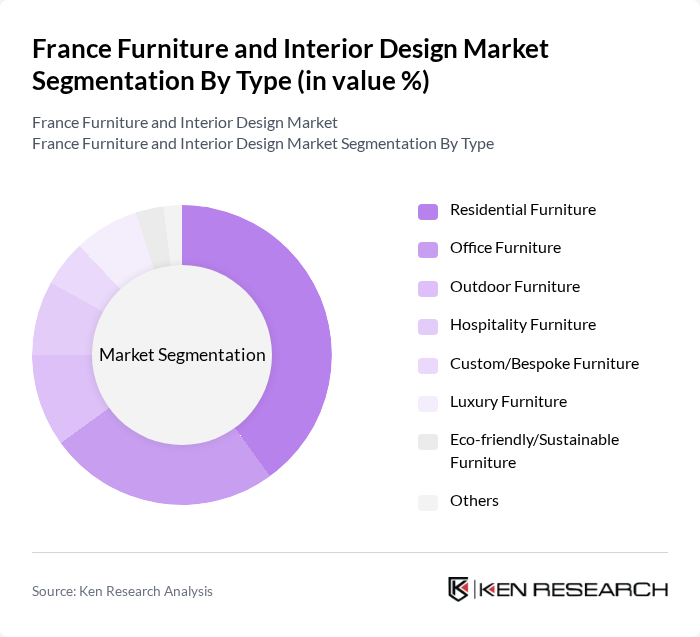

By Type:The market is segmented into various types of furniture, including Residential Furniture, Office Furniture, Outdoor Furniture, Hospitality Furniture, Custom/Bespoke Furniture, Luxury Furniture, Eco-friendly/Sustainable Furniture, and Others. Among these, Residential Furniture is the most dominant segment, driven by the increasing trend of home renovations, the growing interest in interior design among consumers, and the shift toward multifunctional and space-saving solutions. Office Furniture follows closely, fueled by the rise of remote work and the need for ergonomic solutions in home offices .

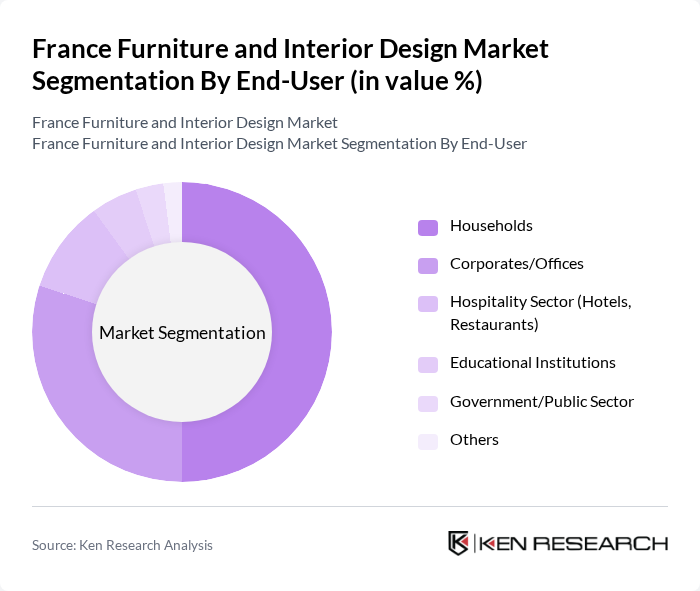

By End-User:The end-user segmentation includes Households, Corporates/Offices, Hospitality Sector (Hotels, Restaurants), Educational Institutions, Government/Public Sector, and Others. Households represent the largest segment, driven by the increasing trend of home improvement, personalization, and a preference for high-quality, durable furnishings. Corporates/Offices are also significant, as businesses invest in ergonomic and stylish office furniture to enhance employee productivity and comfort, with demand further supported by flexible work arrangements .

The France Furniture and Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Maisons du Monde, Roche Bobois, Conforama, La Redoute, Alinéa, Habitat, Fly, AM.PM, Cdiscount, Leroy Merlin, Gautier, Ligne Roset, Tectona, BoConcept contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France furniture and interior design market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture is expected to rise. Additionally, the integration of smart technology into furniture design will likely enhance user experience and convenience. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share and meet the needs of environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Hospitality Furniture Custom/Bespoke Furniture Luxury Furniture Eco-friendly/Sustainable Furniture Others |

| By End-User | Households Corporates/Offices Hospitality Sector (Hotels, Restaurants) Educational Institutions Government/Public Sector Others |

| By Distribution Channel | Specialty Stores Online Retail/E-commerce Home Centers Wholesale Distributors Department Stores/Hypermarkets Direct Sales Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Material | Wood Metal Plastic Fabric/Upholstery Glass Others |

| By Style | Modern Traditional Contemporary Rustic Industrial Others |

| By Functionality | Multi-functional Space-saving Ergonomic Modular Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Design Enthusiasts |

| Commercial Interior Design Projects | 80 | Business Owners, Facility Managers |

| Custom Furniture Orders | 60 | Interior Designers, Architects |

| Furniture Retail Trends | 100 | Retail Managers, Sales Executives |

| Consumer Preferences in Design | 120 | General Consumers, Design Students |

The France Furniture and Interior Design Market is valued at approximately USD 18 billion, reflecting a significant growth driven by increased consumer spending on home improvement and a shift towards sustainable furniture options.