Region:Asia

Author(s):Rebecca

Product Code:KRAB2855

Pages:83

Published On:October 2025

By Type:The furniture market in Indonesia is diverse, encompassing various types that cater to different consumer needs. The primary segments include Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Eco-Friendly Furniture, Luxury Furniture, and Others. Among these,Residential Furnitureis the most dominant segment, driven by the increasing demand for home furnishings as urban living spaces expand. Consumers are increasingly seeking stylish and functional pieces that enhance their living environments, resulting in a surge in the residential segment. Notably, home furniture accounted for over 60% of total market revenue in the most recent period .

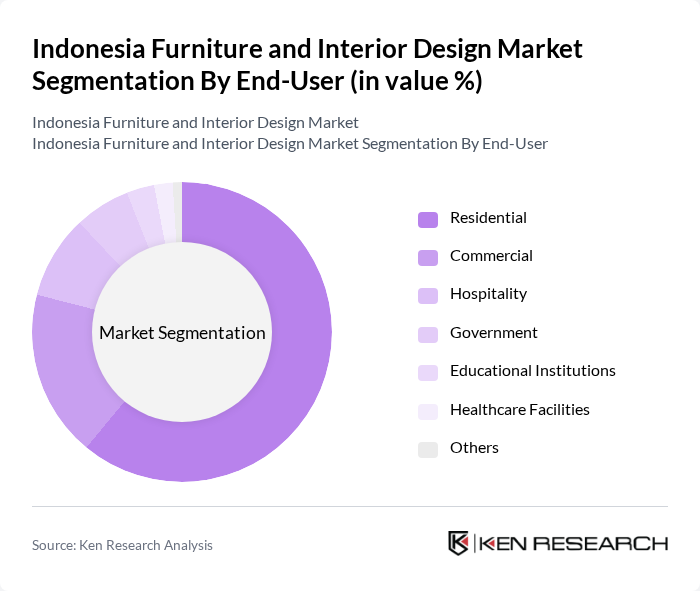

By End-User:The end-user segmentation of the furniture market includes Residential, Commercial, Hospitality, Government, Educational Institutions, Healthcare Facilities, and Others. TheResidentialsegment leads the market, driven by the growing trend of home improvement and interior design among Indonesian households. As more people invest in their living spaces, the demand for various types of furniture tailored to residential needs continues to rise, making it the most significant contributor to market growth .

The Indonesia Furniture and Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Indonesia, Fabelio, Informa, Ace Hardware Indonesia, Kawan Lama Group, Lotte Mart Indonesia, Toko Furniture, Duta Cemerlang, Djarum Group, Sinar Mas Land, Duta Furniture, Citra Cendana, Karya Cipta, Mitra10, and Rattan House contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Indonesian furniture and interior design market appears promising, driven by ongoing urbanization and rising disposable incomes. As consumers increasingly prioritize home aesthetics, the demand for innovative and sustainable furniture solutions is expected to grow. Additionally, the integration of technology in furniture design, such as smart furniture, will likely attract tech-savvy consumers. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capitalize on emerging opportunities in this dynamic market.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Eco-Friendly Furniture Luxury Furniture Others |

| By End-User | Residential Commercial Hospitality Government Educational Institutions Healthcare Facilities Others |

| By Distribution Channel | Online Retail Home Centers Specialty Stores Direct Sales Wholesale Showrooms Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Wood Metal Plastic Glass Rattan Fabric Others |

| By Style | Modern Traditional Contemporary Rustic Industrial Others |

| By Functionality | Multi-functional Space-saving Modular Fixed Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 100 | Homeowners, Interior Designers |

| Commercial Interior Design Projects | 80 | Office Managers, Facility Managers |

| Custom Furniture Manufacturing | 60 | Manufacturing Managers, Product Designers |

| Online Furniture Retail | 90 | E-commerce Managers, Marketing Managers |

| Furniture Export Market | 50 | Export Managers, Trade Analysts |

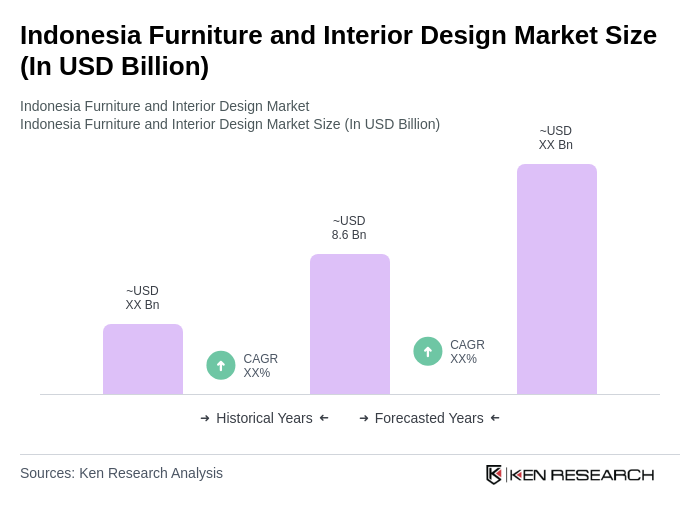

The Indonesia Furniture and Interior Design Market is valued at approximately USD 8.6 billion, driven by urban development, increased consumer spending, and a growing middle class seeking stylish and functional furniture for residential and commercial spaces.