India Furniture and Interior Design Market Overview

- The India Furniture and Interior Design Market is valued at USD 30 billion, based on a five-year historical analysis. This growth is primarily driven by rapid urbanization, rising disposable incomes, a burgeoning middle class, and an expanding real estate sector. The demand for both residential and commercial furniture continues to surge, reflecting a shift in consumer preferences towards stylish, functional, and space-saving designs. The proliferation of online retail platforms and modular furniture solutions further accelerates market expansion, especially in metropolitan and tier 2/3 cities .

- Key cities such as Mumbai, Delhi, Bangalore, and Hyderabad dominate the market due to their rapid urbanization, high population density, and significant economic activities. These metropolitan areas are witnessing robust real estate development, which in turn fuels the demand for furniture and interior design services, making them pivotal to market growth .

- The Furniture and Furnishing (Quality Control) Order, 2023 issued by the Ministry of Commerce and Industry mandates compliance with specified standards for furniture products. This regulation covers operational requirements for eco-friendly materials, quality benchmarks, and manufacturing processes, and provides incentives for companies adopting sustainable practices, thereby enhancing the overall quality and environmental responsibility of the sector .

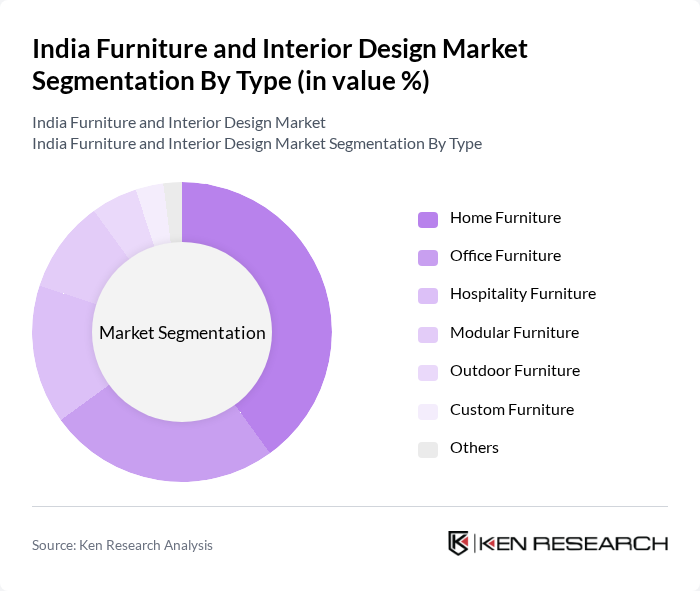

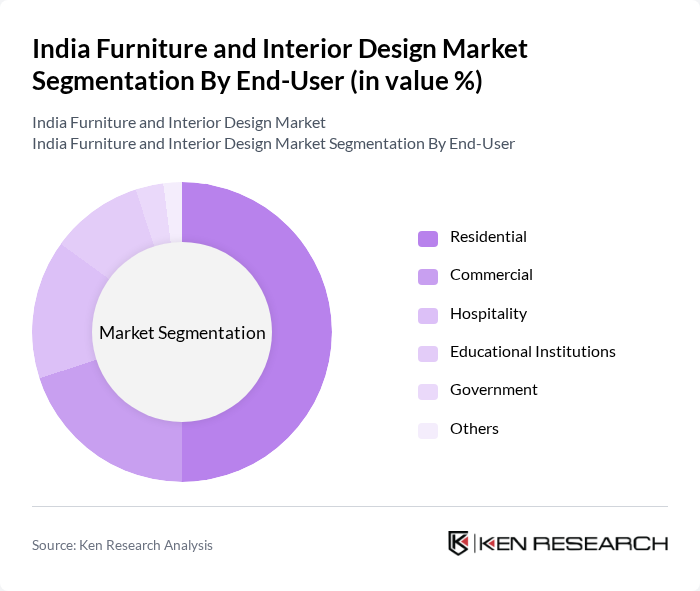

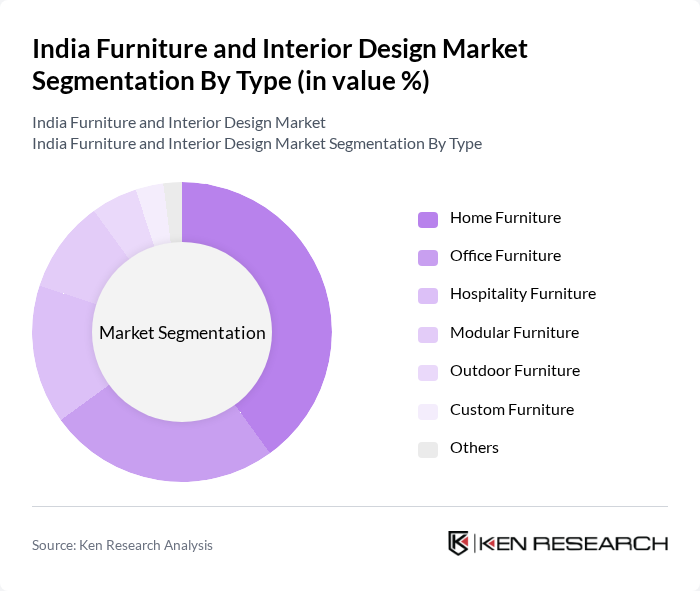

India Furniture and Interior Design Market Segmentation

By Type:The market is segmented into various types of furniture, including Home Furniture, Office Furniture, Hospitality Furniture, Modular Furniture, Outdoor Furniture, Custom Furniture, and Others. Home Furniture remains the leading segment, propelled by the growing trend of home decor, renovation, and increased consumer investment in stylish and functional furnishings. Modular and space-saving furniture are witnessing accelerated adoption, especially among urban households and younger demographics seeking flexibility and efficient use of space .

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, Educational Institutions, Government, and Others. The Residential segment is the most significant contributor, as consumers increasingly focus on home aesthetics, comfort, and personalized design. Rising disposable income, changing lifestyles, and a surge in homeownership have led to robust demand for residential furniture, with commercial and hospitality segments also growing due to expansion in office spaces, hotels, and institutional infrastructure .

India Furniture and Interior Design Market Competitive Landscape

The India Furniture and Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as Godrej Interio, IKEA India, Durian Industries, Nilkamal Limited, Featherlite Furniture, Urban Ladder, Pepperfry, Hometown, Wipro Furniture, Spacewood Furnishers, RoyalOak, Evok, Furniturewalla, Zuari Furniture, Livspace contribute to innovation, geographic expansion, and service delivery in this space.

India Furniture and Interior Design Market Industry Analysis

Growth Drivers

- Rising Urbanization:Urbanization in India is projected to reach 600 million people in future, significantly increasing the demand for furniture and interior design. As urban areas expand, the need for residential and commercial spaces grows, leading to a surge in furniture consumption. The urban population's growth rate is approximately 2.3% annually, driving the demand for modern and stylish furniture solutions that cater to urban lifestyles and preferences.

- Increasing Disposable Income:India's per capita income is expected to rise to approximately ?1,72,000 (around $2,100) in future, enhancing consumer purchasing power. This increase in disposable income allows households to invest more in home furnishings and interior design services. As consumers prioritize aesthetics and comfort, the demand for premium and designer furniture is anticipated to grow, reflecting changing lifestyle aspirations among the middle and upper classes.

- Growing E-commerce Platforms:The e-commerce furniture market in India is projected to reach ?35,000 crores (approximately $4.2 billion) in future, driven by the increasing penetration of the internet and smartphone usage. Online platforms provide consumers with a wider range of choices and competitive pricing, facilitating easier access to furniture products. This shift towards online shopping is reshaping consumer behavior, making it a significant growth driver in the furniture and interior design sector.

Market Challenges

- High Competition:The Indian furniture market is characterized by intense competition, with over 10,000 organized and unorganized players. This saturation leads to price wars and reduced profit margins for manufacturers and retailers. Established brands face challenges in differentiating their offerings, while new entrants struggle to gain market share. The competitive landscape necessitates innovation and effective marketing strategies to attract and retain customers in this crowded market.

- Fluctuating Raw Material Prices:The furniture industry is heavily reliant on raw materials such as wood, metal, and upholstery, which have seen price volatility due to global supply chain disruptions. For instance, the price of plywood has increased by 15% in recent periods due to rising demand and supply constraints. This fluctuation impacts production costs and profitability, forcing manufacturers to adapt their pricing strategies and potentially pass costs onto consumers.

India Furniture and Interior Design Market Future Outlook

The future of the India furniture and interior design market appears promising, driven by technological advancements and evolving consumer preferences. The integration of smart technology into furniture design is expected to enhance functionality and appeal, catering to tech-savvy consumers. Additionally, the growing emphasis on sustainable and eco-friendly materials will likely shape product offerings, aligning with global trends towards environmental responsibility. As urbanization continues, the demand for innovative and space-efficient furniture solutions will further propel market growth.

Market Opportunities

- Expansion of Online Retail:The rapid growth of online retail presents a significant opportunity for furniture brands to reach a broader audience. With an estimated 881 million internet users in India in recent periods, companies can leverage digital platforms to enhance visibility and sales. This shift allows for innovative marketing strategies and personalized shopping experiences, catering to diverse consumer needs and preferences.

- Customization Trends:Increasing consumer demand for personalized products offers a lucrative opportunity for furniture manufacturers. Customization allows consumers to select materials, colors, and designs that reflect their individual tastes. This trend is supported by advancements in manufacturing technologies, enabling companies to efficiently produce bespoke furniture solutions that cater to specific customer requirements, enhancing customer satisfaction and loyalty.