Region:Europe

Author(s):Shubham

Product Code:KRAB2663

Pages:93

Published On:October 2025

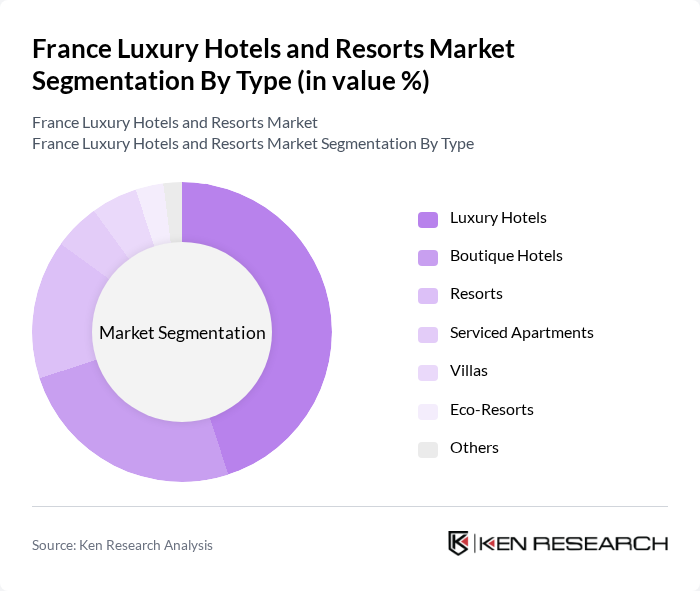

By Type:The luxury hotels and resorts market is segmented into various types, including luxury hotels, boutique hotels, resorts, serviced apartments, villas, eco-resorts, and others. Among these, luxury hotels are the most dominant segment, driven by their ability to offer unparalleled services, exclusive amenities, and prime locations. Boutique hotels are gaining traction due to their unique designs and personalized experiences, appealing to travelers seeking authenticity. The demand for eco-resorts is also on the rise as sustainability becomes a priority for many travelers. The segment’s growth is further supported by the expansion of branded luxury hotel portfolios and the integration of wellness and experiential offerings .

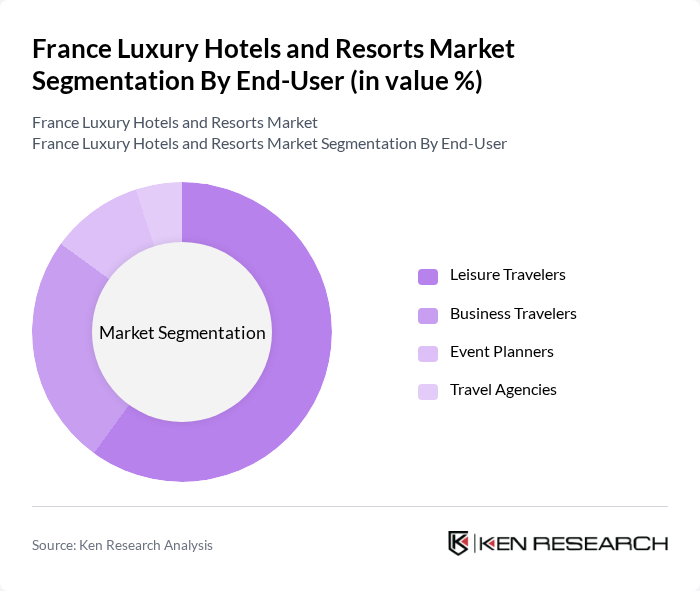

By End-User:The market is also segmented by end-user categories, including leisure travelers, business travelers, event planners, and travel agencies. Leisure travelers represent the largest segment, as they seek luxury accommodations for vacations and special occasions. Business travelers follow closely, driven by the need for high-quality services and amenities during corporate trips. Event planners and travel agencies play a crucial role in promoting luxury hotels, particularly for conferences and group bookings. The rise of remote work and extended-stay demand has also contributed to the growing importance of serviced apartments and flexible luxury accommodations .

The France Luxury Hotels and Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as AccorHotels, Marriott International, Hilton Worldwide, Four Seasons Hotels and Resorts, InterContinental Hotels Group (IHG), The Ritz-Carlton Hotel Company, Mandarin Oriental Hotel Group, Hyatt Hotels Corporation, Relais & Châteaux, The Leading Hotels of the World, Belmond Ltd., Rosewood Hotels & Resorts, Shangri-La Hotels and Resorts, Kempinski Hotels, Small Luxury Hotels of the World, Barrière Group, Louvre Hotels Group, Groupe Lucien Barrière, Evok Hotels Collection, Airelles Collection contribute to innovation, geographic expansion, and service delivery in this space .

The future of the luxury hotel market in France appears promising, driven by increasing disposable incomes and a growing preference for personalized travel experiences. As the economy stabilizes, luxury hotels are likely to invest in enhancing their service offerings and sustainability practices. Additionally, the integration of technology in hospitality services will cater to evolving consumer expectations, ensuring that the sector remains competitive and appealing to both domestic and international travelers.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Hotels Boutique Hotels Resorts Serviced Apartments Villas Eco-Resorts Others |

| By End-User | Leisure Travelers Business Travelers Event Planners Travel Agencies |

| By Price Range | Premium Ultra-Premium Budget Luxury Others |

| By Location | Urban Centers Coastal Areas Countryside Ski Resorts |

| By Service Type | Full-Service Hotels Limited-Service Hotels All-Inclusive Resorts |

| By Distribution Channel | Direct Booking Online Travel Agencies Travel Agents Others |

| By Customer Demographics | Families Couples Solo Travelers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Managers | 60 | General Managers, Operations Directors |

| High-Net-Worth Individuals | 100 | Affluent Travelers, Luxury Lifestyle Influencers |

| Travel Agents Specializing in Luxury | 50 | Luxury Travel Advisors, Agency Owners |

| Hospitality Industry Experts | 40 | Consultants, Market Analysts |

| Luxury Service Providers | 40 | Concierge Managers, Spa Directors |

The France Luxury Hotels and Resorts Market is valued at approximately USD 12.2 billion, reflecting a significant rebound post-pandemic, driven by increased international tourism and demand for high-end accommodations.