Region:Middle East

Author(s):Shubham

Product Code:KRAB1055

Pages:88

Published On:October 2025

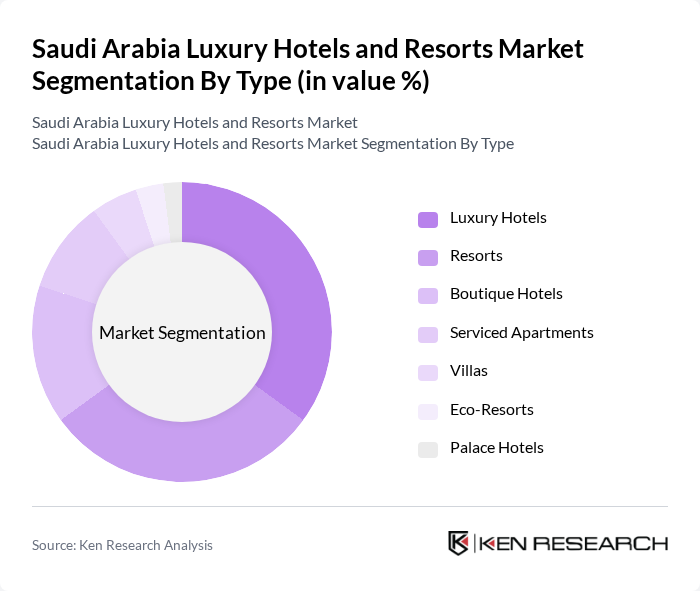

By Type:The luxury hotels and resorts market can be segmented into various types, including Luxury Hotels, Resorts, Boutique Hotels, Serviced Apartments, Villas, Eco-Resorts, and Palace Hotels. Among these, Luxury Hotels and Resorts remain the most prominent, driven by demand for high-end accommodations from both leisure and business travelers. The trend towards unique and personalized experiences has also led to a rise in Boutique Hotels, while Eco-Resorts are gaining traction due to the growing emphasis on sustainability and eco-friendly tourism. International brands such as Four Seasons, Mandarin Oriental, and Jumeirah are expanding their presence, reflecting the market's shift towards iconic luxury offerings.

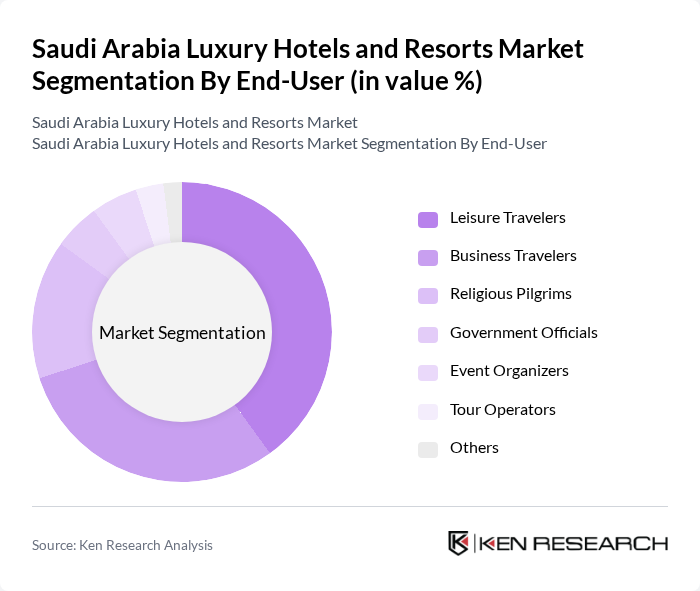

By End-User:The market can also be segmented based on end-users, including Leisure Travelers, Business Travelers, Religious Pilgrims, Government Officials, Event Organizers, Tour Operators, and Others. Leisure Travelers represent the largest segment, driven by the increasing popularity of Saudi Arabia as a tourist destination, supported by mega-events and entertainment festivals. Business Travelers follow closely, supported by the growing corporate sector and international business events hosted in the country. Religious Pilgrims remain a significant segment, especially in holy cities during peak seasons.

The Saudi Arabia Luxury Hotels and Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Four Seasons Hotels and Resorts, The Ritz-Carlton, Jumeirah Group, Hilton Worldwide, Marriott International, Accor Hotels, InterContinental Hotels Group (IHG), Rosewood Hotels & Resorts, Shangri-La Hotels and Resorts, Kempinski Hotels, Mandarin Oriental Hotel Group, Hyatt Hotels Corporation, Anantara Hotels, Resorts & Spas, Banyan Tree Hotels & Resorts, Mövenpick Hotels & Resorts, The Red Sea Global (Developer/Operator), NEOM Hotel Development Company, Dur Hospitality, Shaza Hotels, Al Khozama Management Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury hotel market in Saudi Arabia appears promising, driven by ongoing government initiatives and a growing tourism sector. As the country continues to diversify its economy, investments in infrastructure and mega-projects will enhance the appeal of luxury accommodations. Additionally, the increasing focus on personalized guest experiences and wellness tourism is expected to shape the market, attracting a broader range of affluent travelers seeking unique and enriching experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Hotels Resorts Boutique Hotels Serviced Apartments Villas Eco-Resorts Palace Hotels |

| By End-User | Leisure Travelers Business Travelers Religious Pilgrims Government Officials Event Organizers Tour Operators Others |

| By Price Range | Premium Ultra-Premium Mid-Range Luxury Budget Luxury Others |

| By Location | Urban Areas (Riyadh, Jeddah, Dammam) Coastal Areas (Red Sea, Arabian Gulf) Desert Resorts (AlUla, NEOM) Historical Sites (Makkah, Madinah, Diriyah) Others |

| By Service Type | Full-Service Hotels Limited-Service Hotels All-Inclusive Resorts Specialty Lodging Others |

| By Amenities Offered | Spa and Wellness Facilities Fine Dining Restaurants Conference and Meeting Rooms Recreational Activities Private Beaches and Pools Others |

| By Booking Channel | Direct Booking Online Travel Agencies (OTAs) Travel Agents Corporate Bookings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Management | 50 | General Managers, Operations Directors |

| Travel Agency Insights | 60 | Luxury Travel Advisors, Agency Owners |

| Guest Experience Feedback | 100 | Frequent Luxury Travelers, VIP Guests |

| Market Trends Analysis | 50 | Market Analysts, Tourism Board Officials |

| Service Offerings Evaluation | 40 | Hotel Service Managers, Spa Directors |

The Saudi Arabia Luxury Hotels and Resorts Market is valued at approximately USD 1.1 billion, driven by increased international tourism, government initiatives, and rising disposable income among locals, particularly under the Vision 2030 initiative aimed at diversifying the economy.