Region:Asia

Author(s):Geetanshi

Product Code:KRAA8148

Pages:81

Published On:September 2025

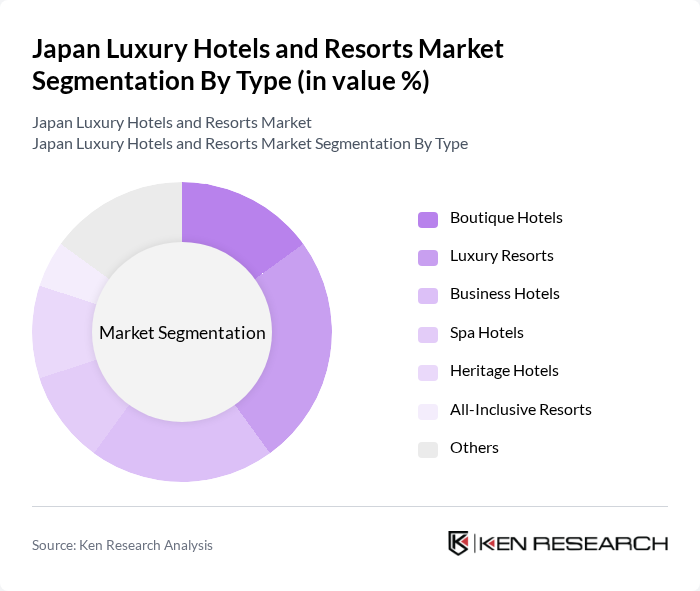

By Type:The luxury hotels and resorts market can be segmented into various types, including Boutique Hotels, Luxury Resorts, Business Hotels, Spa Hotels, Heritage Hotels, All-Inclusive Resorts, and Others. Each of these sub-segments caters to different consumer preferences and travel motivations. Boutique hotels are gaining popularity for their unique designs and personalized services, while luxury resorts attract travelers seeking comprehensive amenities and experiences.

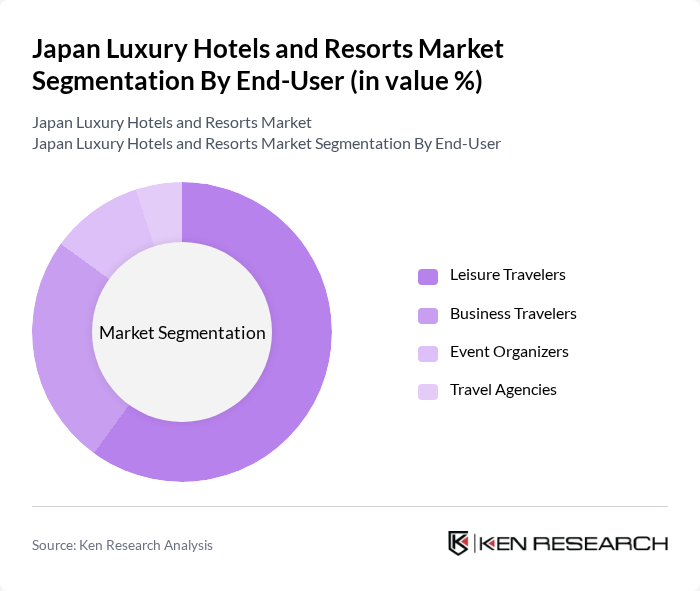

By End-User:The market can also be segmented based on end-users, which include Leisure Travelers, Business Travelers, Event Organizers, and Travel Agencies. Leisure travelers dominate the market, driven by a growing interest in experiential travel and luxury vacations. Business travelers contribute significantly as well, particularly in urban areas where corporate events and conferences are prevalent.

The Japan Luxury Hotels and Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Ritz-Carlton, Tokyo, Aman Tokyo, Park Hyatt Tokyo, Mandarin Oriental Tokyo, Four Seasons Hotel Tokyo at Marunouchi, Grand Hyatt Tokyo, Conrad Tokyo, The Peninsula Tokyo, Shangri-La Hotel, Tokyo, Hyatt Regency Kyoto, The St. Regis Osaka, Hilton Tokyo, InterContinental Tokyo Bay, The Westin Tokyo, Hotel Granvia Kyoto contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan luxury hotels and resorts market appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek personalized experiences, hotels are expected to invest in tailored services and amenities. Additionally, the integration of smart technologies will enhance operational efficiency and guest satisfaction. With a focus on sustainability, luxury resorts are likely to adopt eco-friendly practices, aligning with global trends and consumer expectations, thereby positioning themselves favorably in the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Boutique Hotels Luxury Resorts Business Hotels Spa Hotels Heritage Hotels All-Inclusive Resorts Others |

| By End-User | Leisure Travelers Business Travelers Event Organizers Travel Agencies |

| By Price Range | Premium Luxury Ultra-Luxury |

| By Location | Urban Areas Coastal Regions Mountain Resorts Cultural Heritage Sites |

| By Service Type | Full-Service Hotels Limited-Service Hotels Extended Stay Hotels |

| By Amenities Offered | Spa and Wellness Facilities Fine Dining Restaurants Conference and Meeting Rooms |

| By Distribution Channel | Direct Booking Online Travel Agencies Travel Agents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Guests | 150 | Frequent travelers, affluent individuals |

| Hotel Management Professionals | 100 | General Managers, Operations Directors |

| Travel Agents Specializing in Luxury Travel | 80 | Luxury Travel Advisors, Agency Owners |

| Tourism Industry Experts | 60 | Market Analysts, Economic Advisors |

| Luxury Brand Managers | 70 | Marketing Directors, Brand Strategists |

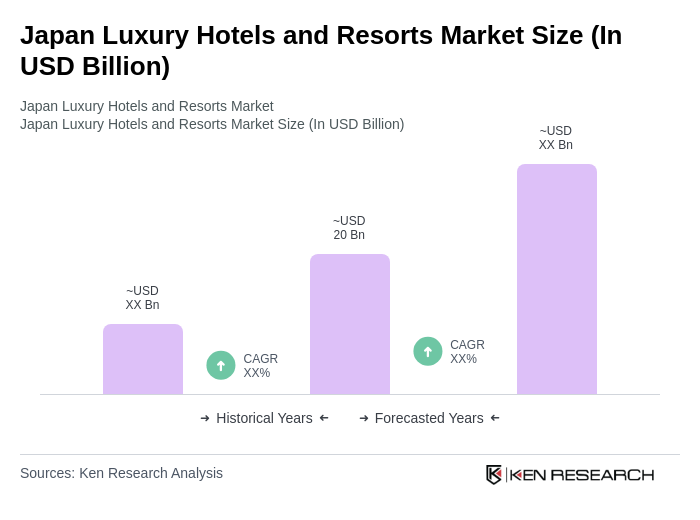

The Japan Luxury Hotels and Resorts Market is valued at approximately USD 20 billion, reflecting a significant growth driven by increased international tourism, rising disposable incomes, and a preference for unique travel experiences among affluent travelers.