Region:Europe

Author(s):Geetanshi

Product Code:KRAB5829

Pages:97

Published On:October 2025

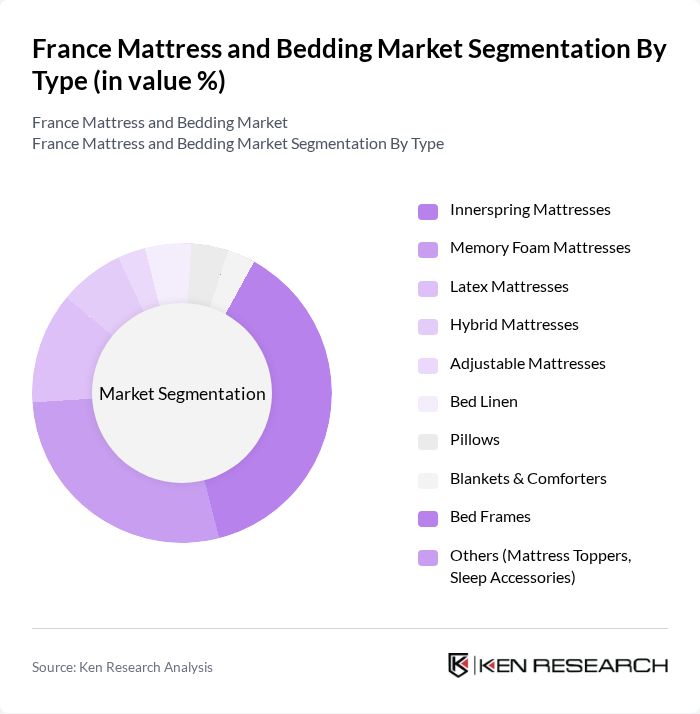

By Type:The mattress and bedding market is segmented into innerspring mattresses, memory foam mattresses, latex mattresses, hybrid mattresses, adjustable mattresses, bed linen, pillows, blankets & comforters, bed frames, and others such as mattress toppers and sleep accessories. Memory foam and foam mattresses have gained significant popularity due to their comfort, ergonomic support, and alignment with consumer demand for personalized sleep solutions. Innerspring mattresses remain a substantial segment, particularly among traditional buyers, while hybrid and latex mattresses are increasingly favored for their durability and breathability .

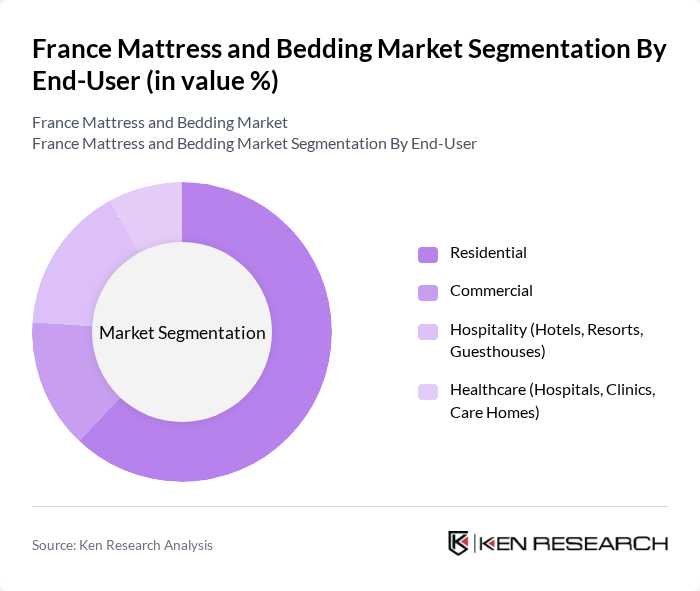

By End-User:The market is also segmented by end-users: residential, commercial, hospitality (hotels, resorts, guesthouses), and healthcare (hospitals, clinics, care homes). The residential segment is the largest, driven by a growing focus on home comfort and the trend of home improvement. Increasing consumer investment in quality sleep products has led to rising demand for diverse bedding solutions. The hospitality sector is also expanding, supported by growth in tourism and hotel construction, which further fuels demand for mattresses and bedding .

The France Mattress and Bedding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., IKEA, Emma – The Sleep Company (Emma Sleep GmbH), Hypnos Beds, Dodo, Bultex, Simmons, Dunlopillo, Matelas No Stress, La Compagnie du Lit, Treca Interiors Paris, Merinos, Matelas Direct, Conforama, Epeda, André Renault, Grand Litier, Maliterie, Simmons Bedding Company, Swissflex contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France mattress and bedding market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on health and wellness is likely to sustain demand for high-quality sleep products. Additionally, the integration of smart technology into mattresses is expected to attract tech-savvy consumers. As sustainability becomes a priority, manufacturers will need to innovate eco-friendly products to meet consumer expectations, ensuring a competitive edge in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Mattresses Bed Linen Pillows Blankets & Comforters Bed Frames Others (Mattress Toppers, Sleep Accessories) |

| By End-User | Residential Commercial Hospitality (Hotels, Resorts, Guesthouses) Healthcare (Hospitals, Clinics, Care Homes) |

| By Sales Channel | Online Retail Offline Retail (Specialty Stores, Hypermarkets, Furniture Stores) Direct-to-Consumer (DTC) Brands |

| By Price Range | Budget Mid-Range Premium |

| By Material | Foam Fabric/Textile Wood Metal Natural/Organic Materials |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| By Brand Positioning | Luxury Brands Value Brands Niche/Eco-Friendly Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 120 | Homeowners, Renters aged 25-55 |

| Bedding Retail Insights | 60 | Store Managers, Sales Representatives |

| Online Bedding Sales Trends | 50 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Feedback | 40 | Product Designers, R&D Managers |

| Consumer Preferences in Bedding | 80 | Interior Designers, Home Decor Influencers |

The France Mattress and Bedding Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increased consumer awareness of sleep quality and rising disposable incomes.