Region:Africa

Author(s):Rebecca

Product Code:KRAB4068

Pages:98

Published On:October 2025

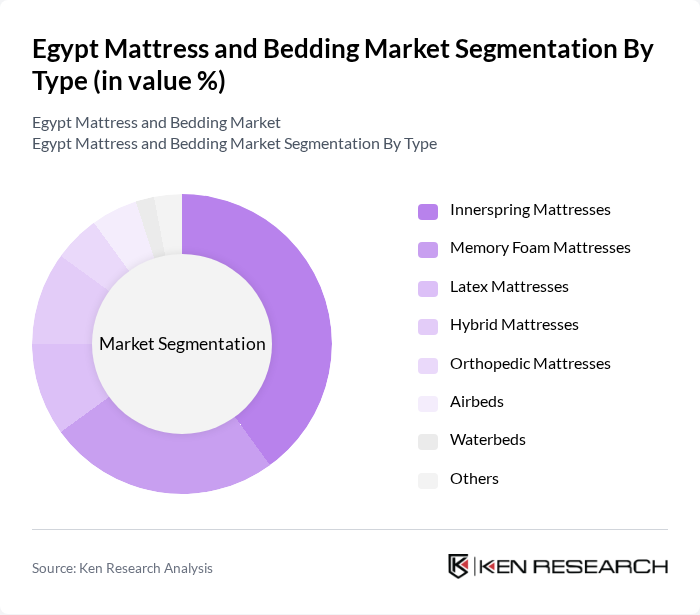

By Type:The mattress and bedding market can be segmented into various types, including Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Hybrid Mattresses, Orthopedic Mattresses, Airbeds, Waterbeds, and Others. Among these, Innerspring Mattresses dominate the market due to their widespread availability and affordability. They are favored for their traditional design and comfort, appealing to a broad consumer base. Memory Foam Mattresses are gaining traction as consumers increasingly seek products that offer better support and pressure relief, reflecting a growing trend towards health-conscious purchasing. Hybrid mattresses are also experiencing increased demand, as they combine the benefits of both innerspring and foam technologies, appealing to a wider audience .

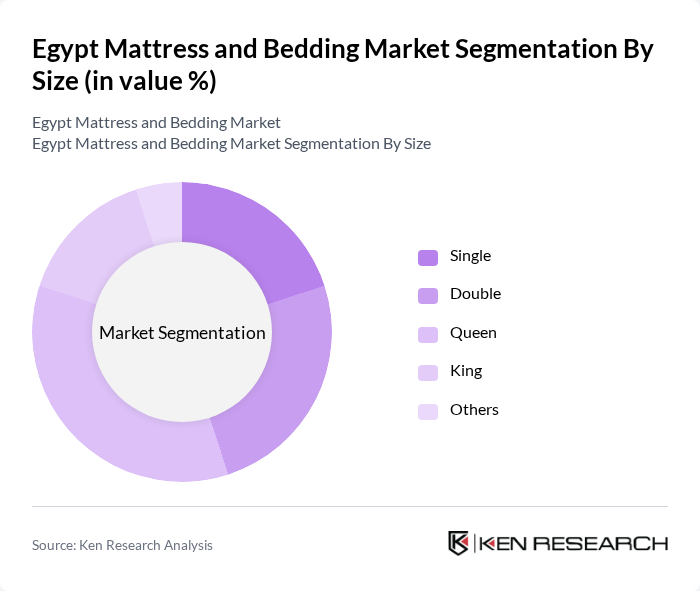

By Size:The market can also be segmented by size, including Single, Double, Queen, King, and Others. The Queen size mattresses are currently leading the market due to their balance of space and comfort, making them a popular choice for couples and individuals alike. The growing trend of home improvement and interior design has also contributed to the demand for larger mattress sizes, as consumers seek to enhance their living spaces. King size mattresses are also gaining popularity in the premium segment, reflecting a shift towards luxury and spacious bedding solutions .

The Egypt Mattress and Bedding Market is characterized by a dynamic mix of regional and international players. Leading participants such as El Dawlia for Sponge & Mattress (??????? ??????? ????????), Masterbed (????? ??), El Helow Group (????? ????), La Casa Mattress, El Maleka Foam (?????? ???), American Mattress Egypt, Comfy Mattress Egypt, Sleep High Egypt, Sealy Egypt, King Koil Egypt, Tempur Egypt, IKEA Egypt, Simmons Egypt, Spring Air Egypt, El Mohandes Foam (??????? ???) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Egypt mattress and bedding market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize health and wellness, the demand for high-quality sleep products is expected to grow. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. Companies that adapt to these trends and invest in innovative, sustainable solutions will likely capture significant market share in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Orthopedic Mattresses Airbeds Waterbeds Others |

| By Size | Single Double Queen King Others |

| By End-User | Residential Commercial Hospitality Healthcare Others |

| By Distribution Channel | Offline Retail (Specialty Stores, Hypermarkets, Supermarkets, General Stores) Online Retail Direct Sales Wholesale Distributors Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Material | Natural Materials (Latex, Organic Cotton, Wool) Synthetic Materials (PU Foam, Memory Foam, Polyester) Metal Wood Others |

| By Brand Positioning | Luxury Brands Value-for-Money Brands Budget-Friendly Brands Mass Market Brands Others |

| By User Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Preferences | 100 | Homeowners, Renters, Newlyweds |

| Retail Sales Insights | 60 | Store Managers, Sales Associates |

| Manufacturing Trends | 40 | Production Managers, Quality Control Officers |

| Distribution Channel Effectiveness | 50 | Logistics Coordinators, Supply Chain Analysts |

| Consumer Buying Behavior | 80 | General Consumers, Interior Design Enthusiasts |

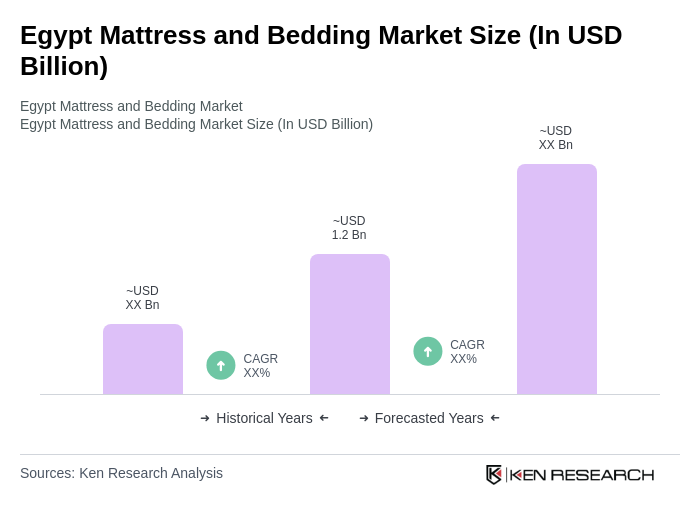

The Egypt Mattress and Bedding Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and increased consumer awareness regarding sleep quality.