Poland Mattress and Bedding Market Overview

- The Poland Mattress and Bedding Market is valued at USD 530 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding sleep health, rising disposable incomes, and a growing trend towards home improvement and interior design. The demand for high-quality bedding products has surged as consumers prioritize comfort, wellness, and sustainability in their purchasing decisions. Innovations such as memory foam, hybrid mattresses, and eco-friendly materials are gaining traction, reflecting broader European trends in sleep technology and wellness-focused products .

- Key cities such as Warsaw, Kraków, and Wroc?aw dominate the Poland Mattress and Bedding Market due to their large populations and economic activity. These urban centers are characterized by a higher concentration of retail outlets and e-commerce platforms, making them pivotal in driving sales and market growth. Additionally, the presence of major manufacturers and distributors in these cities enhances their market dominance .

- In 2023, the Polish government implemented the Regulation of the Minister of Development and Technology of 19 December 2023 on the safety requirements for furniture and bedding products, issued by the Ministry of Development and Technology. This regulation mandates that all bedding products must meet specific health and safety criteria, including fire resistance and the use of non-toxic materials. The regulation requires manufacturers and distributors to certify compliance with these standards and maintain documentation for inspection. The initiative is designed to protect consumers and promote sustainable practices within the industry .

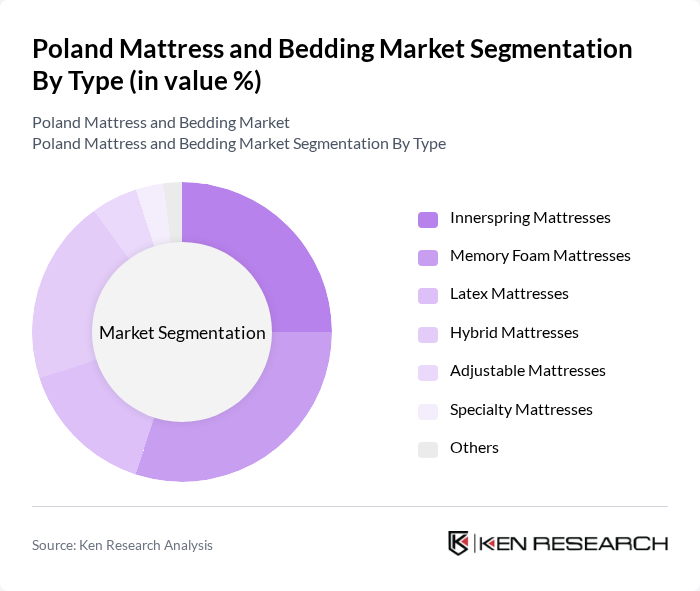

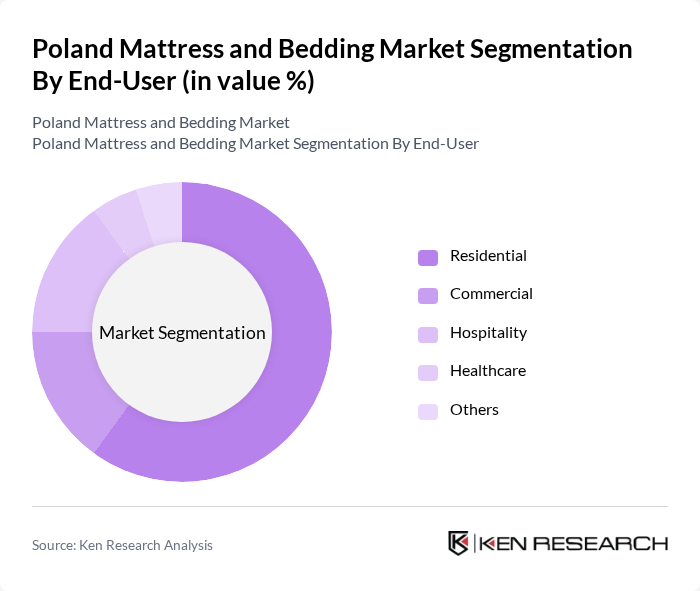

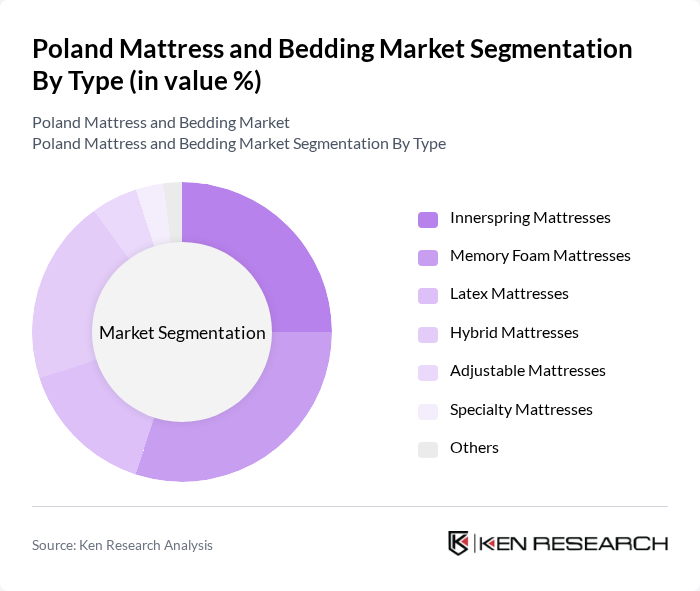

Poland Mattress and Bedding Market Segmentation

By Type:The mattress and bedding market can be segmented into various types, including innerspring mattresses, memory foam mattresses, latex mattresses, hybrid mattresses, adjustable mattresses, specialty mattresses, and others. Each type caters to different consumer preferences and needs, with memory foam and hybrid mattresses gaining significant popularity due to their comfort, support, and advanced features such as pressure relief and temperature regulation. Eco-friendly and sustainable materials, such as natural latex and bamboo fibers, are increasingly favored by environmentally conscious consumers .

By End-User:The market can also be segmented based on end-users, which include residential, commercial, hospitality, healthcare, and others. The residential segment is the largest, driven by increasing consumer spending on home furnishings and a growing focus on sleep quality. The hospitality sector is also significant, as hotels and resorts invest in high-quality bedding to enhance guest experiences. Healthcare facilities are expanding their use of specialized mattresses to improve patient comfort and support .

Poland Mattress and Bedding Market Competitive Landscape

The Poland Mattress and Bedding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., IKEA, Hilding Anders, Serta Simmons Bedding, LLC, Sleep Number Corporation, Magniflex, Zinus, Inc., Emma Mattress, M&N Mattresses, Ko?o, Materasso, D?bowe ?ó?ka, Meble Wójcik, JYSK, Sleepmed, DORMEO contribute to innovation, geographic expansion, and service delivery in this space.

Poland Mattress and Bedding Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Sleep Health:The growing recognition of sleep's impact on overall health is driving mattress sales in Poland. According to a recent report by the Polish Sleep Foundation, 68% of Poles prioritize sleep quality, leading to increased demand for high-quality bedding products. This trend is supported by a 15% rise in health-related spending, which reached approximately PLN 1.3 billion, indicating a shift towards investing in sleep health.

- Rising Disposable Income:Poland's GDP per capita is projected to reach PLN 80,000, reflecting a 4% increase. This rise in disposable income allows consumers to invest more in premium bedding products. The average household expenditure on furniture and bedding has increased by 10% over the past year, indicating a willingness to spend on quality sleep solutions, further propelling market growth.

- Growth in the E-commerce Sector:The e-commerce market in Poland is expected to surpass PLN 120 billion, growing at a rate of 20% annually. This growth facilitates easier access to a variety of mattress options, enhancing consumer choice. Online mattress sales accounted for 30% of total sales, driven by the convenience of home delivery and the ability to compare products, significantly boosting market penetration.

Market Challenges

- Intense Competition Among Local and International Brands:The Polish mattress market is characterized by fierce competition, with over 250 brands vying for market share. This saturation leads to price wars, which can erode profit margins. The top five brands accounted for only 40% of the market, indicating a fragmented landscape where new entrants struggle to establish a foothold amidst established players.

- Fluctuating Raw Material Prices:The volatility in raw material costs, particularly for foam and textiles, poses a significant challenge. The price of polyurethane foam increased by 12%, impacting production costs for mattress manufacturers. This fluctuation can lead to unpredictable pricing strategies, making it difficult for companies to maintain competitive pricing while ensuring profitability in a price-sensitive market.

Poland Mattress and Bedding Market Future Outlook

The Poland mattress and bedding market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of smart technology in bedding products is expected to enhance user experience, while sustainability trends will push manufacturers towards eco-friendly materials. Additionally, the expansion of online sales channels will continue to reshape purchasing behaviors, making it essential for brands to adapt to these shifts to remain competitive in the evolving landscape.

Market Opportunities

- Development of Eco-Friendly Products:With increasing environmental awareness, the demand for eco-friendly mattresses is on the rise. Sales of organic bedding products grew by 25%, indicating a strong market opportunity for brands that prioritize sustainability. This trend is expected to continue, as consumers increasingly seek products that align with their values, potentially capturing a larger market share.

- Customization and Personalization Trends:The trend towards personalized bedding solutions is gaining traction, with 40% of consumers expressing interest in customized mattresses. Companies that offer tailored products can tap into this growing demand, enhancing customer satisfaction and loyalty. This opportunity is further supported by advancements in manufacturing technology, allowing for efficient production of bespoke bedding solutions.