Region:Asia

Author(s):Geetanshi

Product Code:KRAB5735

Pages:92

Published On:October 2025

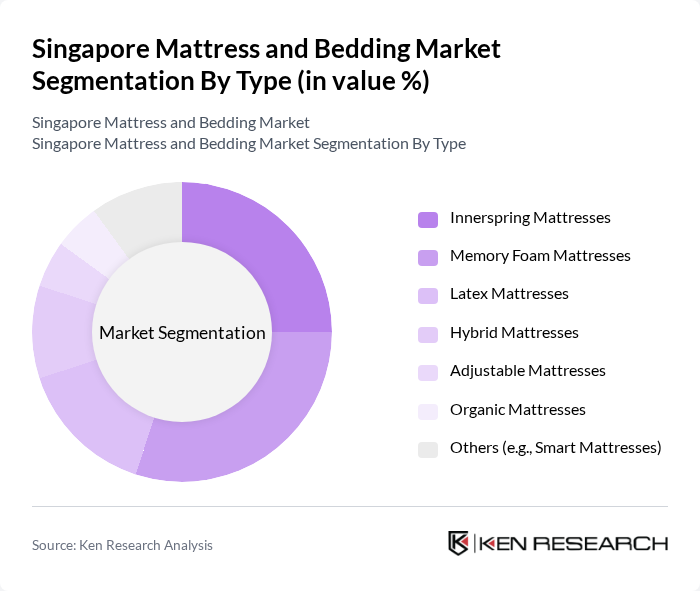

By Type:The mattress and bedding market can be segmented into various types, each catering to different consumer preferences and needs. The primary types include innerspring mattresses, memory foam mattresses, latex mattresses, hybrid mattresses, adjustable mattresses, organic mattresses, and others such as smart mattresses. Each type offers unique features, catering to diverse consumer demands for comfort, support, and sustainability. The increasing demand for hybrid mattresses, which combine materials like memory foam and latex, reflects consumers' need for enhanced comfort and support, while the growing awareness of sustainable materials has led to increased demand for eco-friendly mattresses.

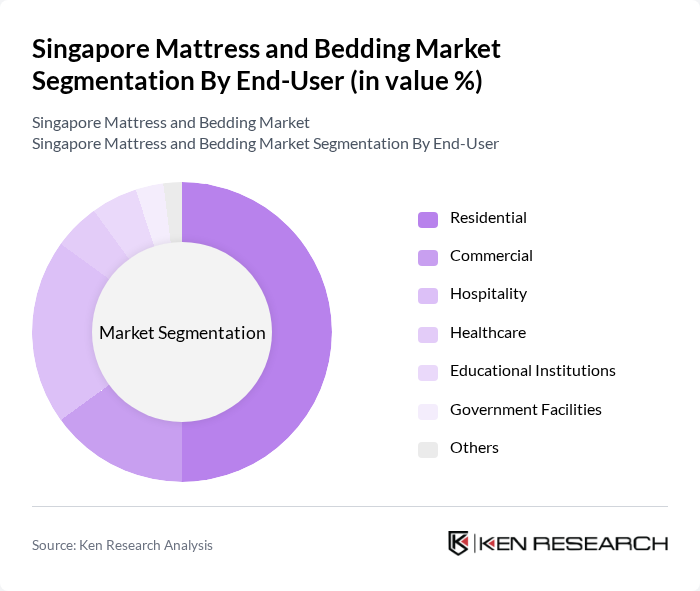

By End-User:The end-user segmentation of the mattress and bedding market includes residential, commercial, hospitality, healthcare, educational institutions, government facilities, and others. Each segment has distinct requirements, with residential consumers focusing on comfort and quality, while commercial and hospitality sectors prioritize durability and cost-effectiveness. The residential segment continues to dominate as consumers increasingly prioritize restful sleep and bedroom aesthetics, seeking personalized and comfortable sleep environments.

The Singapore Mattress and Bedding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Serta Simmons Bedding, LLC, King Koil, Sealy Asia (M) Sdn Bhd, IKEA, Emma Mattress, Zinus, Inc., Dunlopillo, Rest Assured, and Mlily contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore mattress and bedding market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As smart mattresses gain traction, manufacturers are expected to integrate sleep technology, enhancing user experience. Additionally, the rise of e-commerce platforms will facilitate broader market access, allowing brands to reach a wider audience. Sustainability will also play a crucial role, with eco-friendly products becoming increasingly popular among environmentally conscious consumers, shaping future product development and marketing strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Mattresses Organic Mattresses Others (e.g., Smart Mattresses) |

| By End-User | Residential Commercial Hospitality Healthcare Educational Institutions Government Facilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Showrooms Others (e.g., Pop-up Stores) |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Foam Fabric Metal Wood Others (e.g., Bamboo) |

| By Brand | Local Brands International Brands Private Labels Others |

| By Customer Segment | First-time Buyers Repeat Customers Corporate Clients Institutional Buyers Others |

| By Cross Comparison of Key Players | Company Name Group Size (Large, Medium, or Small as per industry convention) Revenue Growth Rate Market Penetration Rate Customer Retention Rate Pricing Strategy (Premium, Mid-range, Budget) Product Diversification Index (e.g., variety of mattress types) Brand Recognition Score (based on consumer surveys) Distribution Network Efficiency (e.g., online vs. offline presence) Customer Satisfaction Index (CSI) Sustainability Practices (e.g., eco-friendly materials) |

| By Detailed Profile of Major Companies | Tempur Sealy International, Inc. Serta Simmons Bedding, LLC King Koil Sealy Asia (M) Sdn Bhd IKEA Emma Mattress Zinus, Inc. Dunlopillo Rest Assured Mlily |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Preferences | 100 | Homeowners, Renters, Interior Design Enthusiasts |

| Retail Sales Insights | 80 | Store Managers, Sales Representatives |

| Manufacturing Trends | 60 | Production Managers, Quality Control Specialists |

| Online Shopping Behavior | 90 | eCommerce Managers, Digital Marketing Specialists |

| Sustainability Practices in Bedding | 50 | Product Development Managers, Sustainability Officers |

The Singapore Mattress and Bedding Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by increased consumer awareness of sleep health, rising disposable incomes, and urbanization trends.