Region:Europe

Author(s):Geetanshi

Product Code:KRAB1452

Pages:87

Published On:October 2025

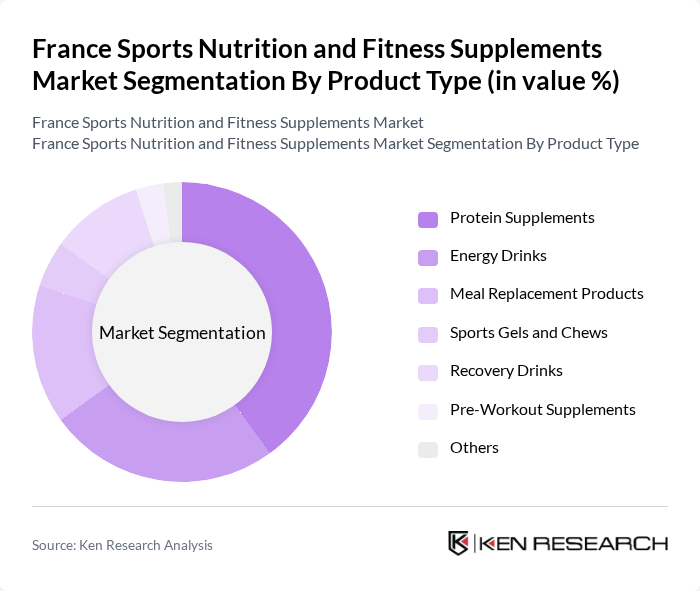

By Product Type:The product type segmentation includes various categories such as Sports Supplements, Sports Foods, Sports Drinks, Meal Replacement Products, and Weight Loss Products. Among these, Sports Supplements, which encompass Protein Powders, Amino Acids, Creatine, Pre-Workout, Post-Workout, Fat Burners, and others, dominate the market due to their widespread use among athletes and fitness enthusiasts seeking performance enhancement and recovery support. The increasing trend of personalized nutrition, demand for plant-based and clean-label ingredients, and the proliferation of e-commerce channels further drive the demand for these products .

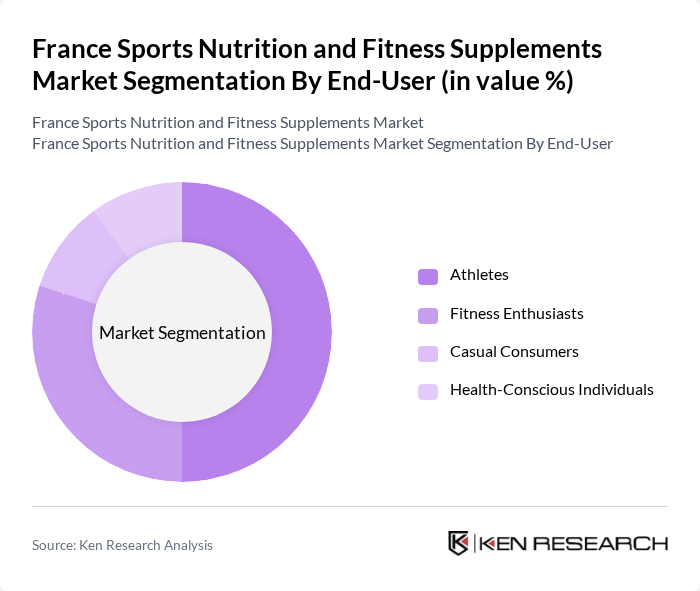

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, Bodybuilders, Recreational Users, and Lifestyle Users. Athletes represent the largest segment, driven by their need for specialized nutrition to enhance performance and recovery. This segment is characterized by a high level of brand loyalty and a willingness to invest in premium products that offer proven benefits, thus significantly influencing market dynamics. Fitness enthusiasts and bodybuilders are also key contributors, with growing demand for targeted supplements and functional foods .

The France Sports Nutrition and Fitness Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyProtein (The Hut Group), Optimum Nutrition (Glanbia plc), Foodspring GmbH, Nutrisport (Laboratoire Nutrisanté), Eric Favre Wellness, STC Nutrition (Ineldea Laboratoires), Prozis, Scitec Nutrition, BiotechUSA, Herbalife Nutrition Ltd., Nestlé Health Science (including PowerBar), Isostar (Nutrition et Santé), Decathlon (Aptonia), Olimp Sport Nutrition, GNC Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France sports nutrition and fitness supplements market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on personalized nutrition solutions is expected to reshape product offerings, catering to individual dietary needs. Additionally, the integration of digital health technologies, such as apps for tracking nutrition and fitness, will likely enhance consumer engagement and drive sales. Brands that adapt to these trends will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sports Supplements (Protein Powders, Amino Acids, Creatine, Pre-Workout, Post-Workout, Fat Burners, Others) Sports Foods (Protein Bars, Energy Bars, Meal Replacement Bars, Gels, Others) Sports Drinks (Isotonic, Hypotonic, Hypertonic, Electrolyte Drinks) Meal Replacement Products Weight Loss Products |

| By End-User | Athletes Fitness Enthusiasts Bodybuilders Recreational Users Lifestyle Users |

| By Distribution Channel | Hypermarkets/Supermarkets Specialty Stores Pharmacies/Drugstores Online Retail Gyms & Fitness Centers |

| By Ingredient Source | Animal-Derived Plant-Based Mixed/Other |

| By Packaging Type | Bottles Sachets Tubs Bars |

| By Price Range | Premium Mid-Range Budget |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sports Supplements | 120 | Fitness Enthusiasts, Casual Gym-Goers |

| Trends in Fitness Center Supplement Sales | 60 | Gym Owners, Fitness Managers |

| Nutritionist Insights on Supplement Efficacy | 40 | Registered Dietitians, Sports Nutritionists |

| Market Dynamics from Retailers | 50 | Retail Managers, Health Store Owners |

| Consumer Awareness and Education on Supplements | 70 | Health Coaches, Personal Trainers |

The France Sports Nutrition and Fitness Supplements Market is valued at approximately USD 690 million, reflecting a significant growth trend driven by increasing health consciousness and fitness activities among consumers.