Region:Europe

Author(s):Dev

Product Code:KRAB0621

Pages:93

Published On:August 2025

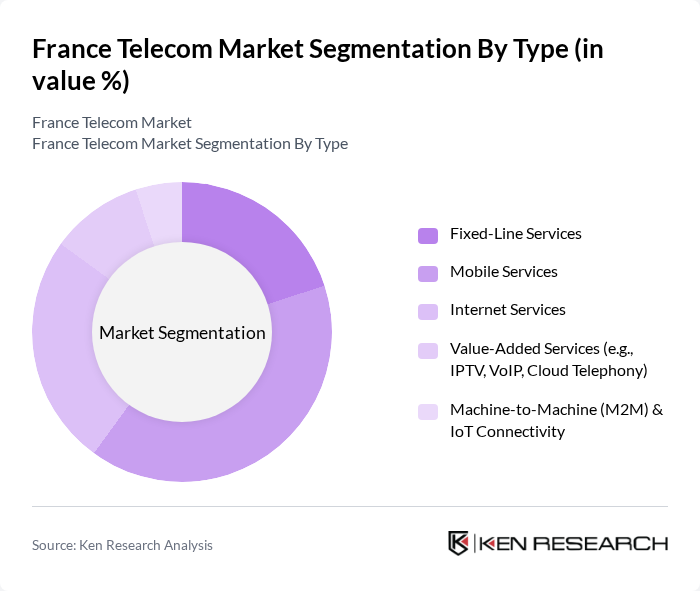

By Type:The telecom market is segmented into Fixed-Line Services, Mobile Services, Internet Services, Value-Added Services, and Machine-to-Machine (M2M) & IoT Connectivity. Among these, Mobile Services dominate the market due to the increasing penetration of smartphones, widespread availability of 4G and 5G networks, and the growing demand for mobile data. The shift towards mobile-first solutions, combined with the proliferation of data-intensive applications and remote work, has led to a surge in mobile subscriptions, making Mobile Services the critical segment for telecom operators .

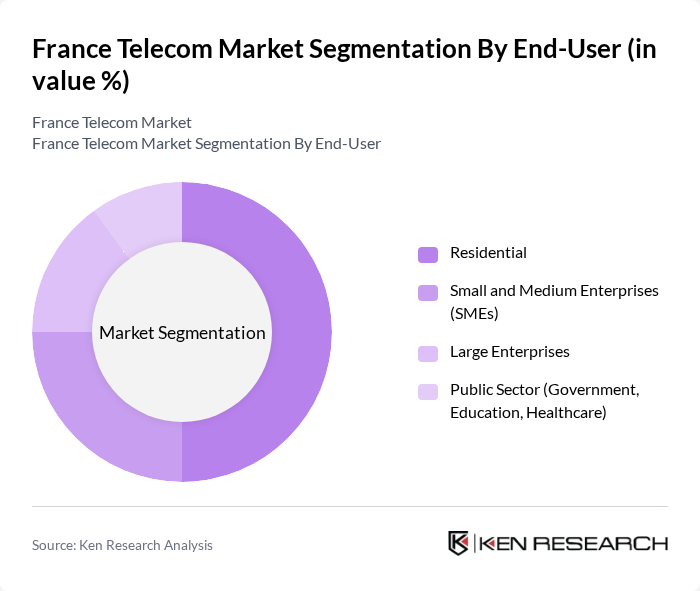

By End-User:The market is segmented by end-users, including Residential, Small and Medium Enterprises (SMEs), Large Enterprises, and the Public Sector. The Residential segment leads the market, driven by the increasing demand for high-speed internet, mobile connectivity, and digital entertainment among households. The continued trend of remote work and online streaming has further accelerated the need for reliable telecom services in residential areas. SMEs and large enterprises are also driving demand for advanced connectivity and cloud-based solutions to support digital transformation initiatives .

The France Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Orange S.A., SFR (Altice France S.A.), Bouygues Telecom S.A., Free Mobile (Iliad S.A.), Iliad S.A., Colt Technology Services Group Limited, TDF Group, Covage (Xp Fibre, part of Altice France), Axione (Bouygues Group), Nokia Corporation, Ericsson AB, Cisco Systems, Inc., Huawei Technologies Co., Ltd., ZTE Corporation, Vodafone Group Plc, Deutsche Telekom AG contribute to innovation, geographic expansion, and service delivery in this space.

The France telecom market is poised for transformative growth, driven by advancements in technology and increasing consumer expectations. The deployment of 5G networks is expected to revolutionize mobile services, enhancing connectivity and enabling new applications. Additionally, the focus on customer experience and sustainability initiatives will shape operational strategies. As telecom providers adapt to these trends, they will likely explore innovative solutions to meet evolving demands, ensuring a competitive edge in the dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Line Services Mobile Services Internet Services Value-Added Services (e.g., IPTV, VoIP, Cloud Telephony) Machine-to-Machine (M2M) & IoT Connectivity |

| By End-User | Residential Small and Medium Enterprises (SMEs) Large Enterprises Public Sector (Government, Education, Healthcare) |

| By Distribution Channel | Direct Sales (Operator-Owned Stores, B2B Sales) Retail Outlets (Multi-brand, Franchise) Online Platforms (Web, Mobile Apps) Third-Party Resellers & Aggregators |

| By Service Bundling | Standalone Services Double Play (e.g., Internet + TV) Triple Play (e.g., Internet + TV + Phone) Quad Play (e.g., Internet + TV + Phone + Mobile) |

| By Pricing Model | Pay-As-You-Go / Prepaid Postpaid / Subscription-Based Tiered Pricing (Data/Speed Tiers) |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations Public Sector |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Overseas Territories |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Providers | 100 | Product Managers, Marketing Directors |

| Broadband Internet Services | 80 | Network Engineers, Customer Experience Managers |

| Telecom Infrastructure Companies | 60 | Operations Managers, Technical Directors |

| Consumer Mobile Usage Patterns | 90 | End-users, Telecom Subscribers |

| 5G Adoption Insights | 50 | Technology Analysts, Business Development Managers |

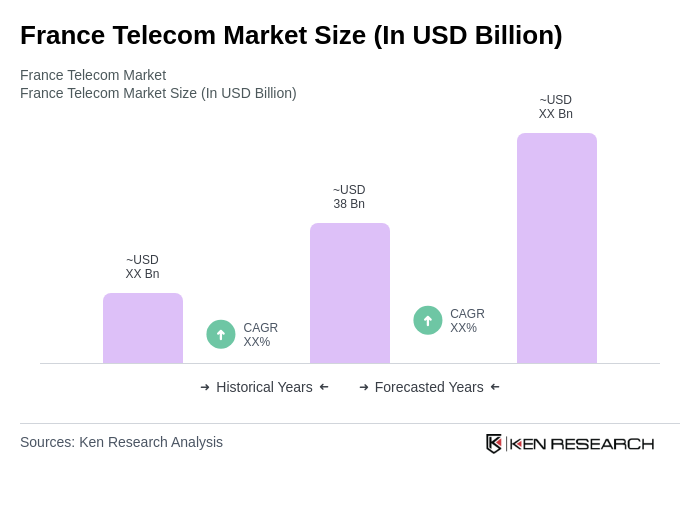

The France Telecom Market is valued at approximately USD 38 billion, driven by the increasing demand for mobile and internet services, the expansion of digital infrastructure, and the rapid adoption of 5G technology.