Region:Asia

Author(s):Shubham

Product Code:KRAC0687

Pages:92

Published On:August 2025

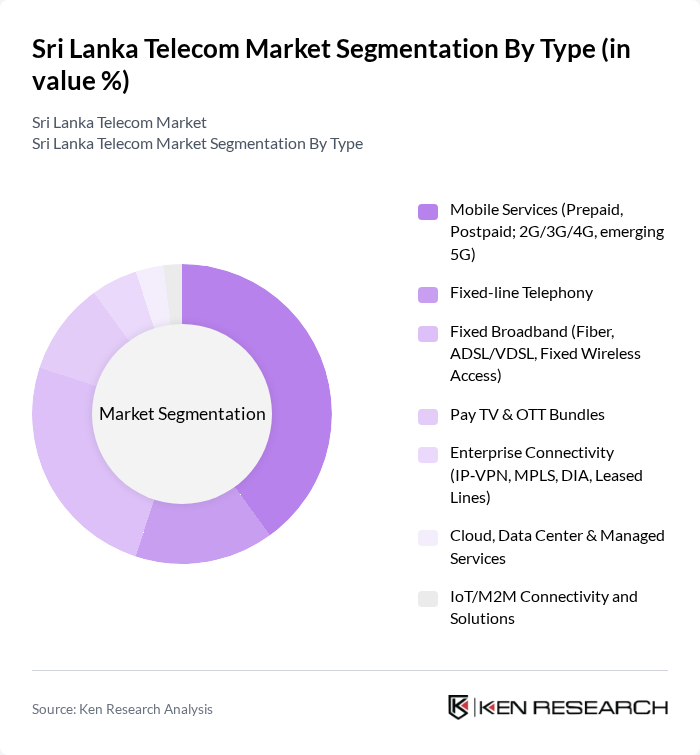

By Type:This segmentation includes various service types offered in the telecom market, focusing on mobile services, fixed-line telephony, broadband, and more. Each sub-segment caters to different consumer needs and preferences, reflecting the diverse landscape of telecommunications in Sri Lanka.

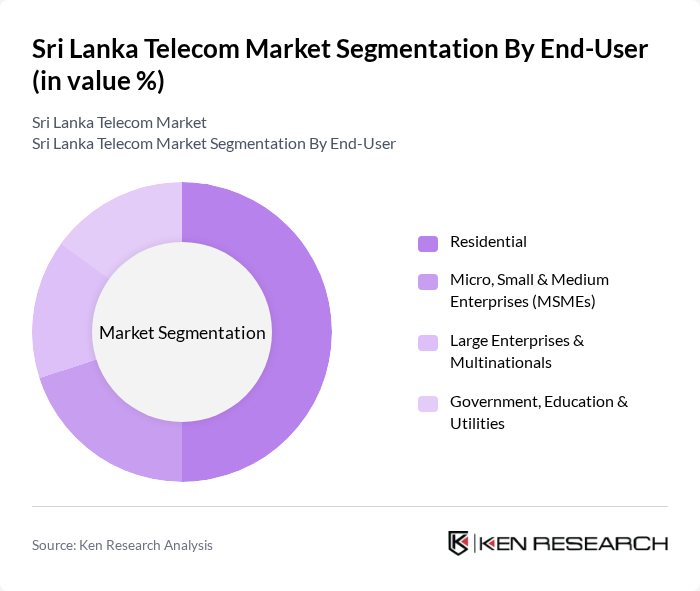

By End-User:This segmentation categorizes the telecom market based on the end-users of the services, including residential customers, small and medium enterprises, large corporations, and government entities. Each segment has unique requirements and usage patterns, influencing the overall market dynamics.

The Sri Lanka Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dialog Axiata PLC, Sri Lanka Telecom PLC, SLT?MOBITEL (Mobile services brand of Sri Lanka Telecom PLC), Hutchison Telecommunications Lanka (Pvt) Ltd, Bharti Airtel Lanka (Pvt) Ltd, Lanka Bell Ltd, Dialog Television (Pvt) Ltd, Lanka Government Information Infrastructure (LGII), Digital Infrastructure & IT (formerly Information and Communication Technology Agency – ICTA), Synopsys Networks (Pvt) Ltd, Lakdata Communications (Pvt) Ltd, Sri Lanka Broadcasting Corporation, Lanka Internet Services (Pvt) Ltd, BellTank (Pvt) Ltd, Suntel (historic; merged into Dialog Broadband Networks) contribute to innovation, geographic expansion, and service delivery in this space.

The Sri Lankan telecom market is poised for significant transformation in the coming years, driven by technological advancements and increasing digital adoption. The integration of AI and machine learning into telecom services is expected to enhance customer experience and operational efficiency. Furthermore, the government's commitment to digital transformation initiatives will likely foster innovation and attract investments, positioning the sector for sustainable growth. As infrastructure improves, the market will see a shift towards more value-added services, catering to evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services (Prepaid, Postpaid; 2G/3G/4G, emerging 5G) Fixed-line Telephony Fixed Broadband (Fiber, ADSL/VDSL, Fixed Wireless Access) Pay TV & OTT Bundles Enterprise Connectivity (IP?VPN, MPLS, DIA, Leased Lines) Cloud, Data Center & Managed Services IoT/M2M Connectivity and Solutions |

| By End-User | Residential Micro, Small & Medium Enterprises (MSMEs) Large Enterprises & Multinationals Government, Education & Utilities |

| By Application | Voice (Circuit-switched & VoIP) Mobile Data & Messaging Fixed Broadband Internet & Video Streaming Cloud/Hosting, Security & Collaboration |

| By Distribution Channel | Direct/Own Stores & Enterprise Sales Third-party Retail & Dealers Online (Web/App) Sales & Self-care Partners/ISPs/Franchisees |

| By Pricing Model | Prepaid (Pay-As-You-Go) Postpaid (Subscription) Converged Bundles (Quad/Triple Play) |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Enterprises & Public Sector |

| By Service Level | Mass-market/Budget Premium Enterprise-grade/SLA-backed |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 150 | Consumers aged 18-45, diverse income levels |

| Broadband Subscribers | 100 | Household decision-makers, IT professionals |

| Corporate Telecom Clients | 80 | IT Managers, Procurement Officers in SMEs |

| Telecom Infrastructure Providers | 60 | Technical Directors, Business Development Managers |

| Regulatory Stakeholders | 40 | Policy Makers, Regulatory Affairs Managers |

The Sri Lanka Telecom Market is valued at approximately USD 1.5 billion, driven by increasing demand for mobile broadband services, expanding 4G capacity, and early-stage 5G introductions, despite facing macroeconomic pressures.