Region:Middle East

Author(s):Dev

Product Code:KRAC2669

Pages:100

Published On:October 2025

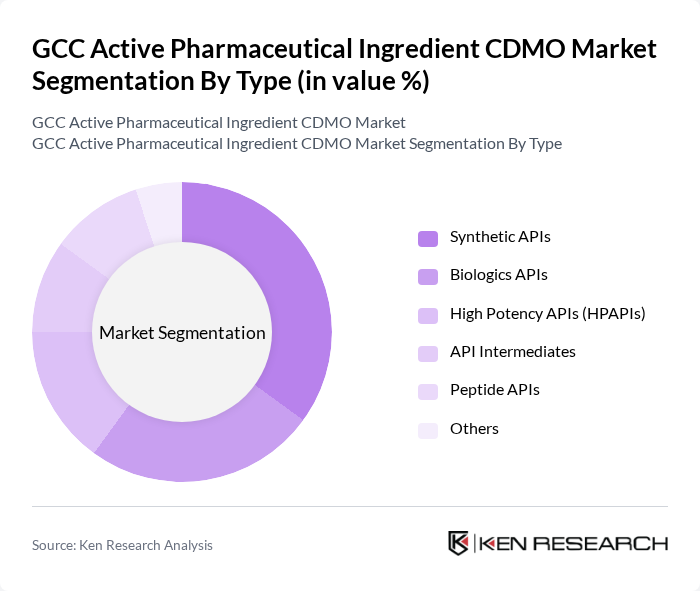

By Type:The market is segmented into various types of active pharmaceutical ingredients, including Synthetic APIs, Biologics APIs, High Potency APIs (HPAPIs), API Intermediates, Peptide APIs, and Others. Synthetic APIs represent the largest segment, driven by their widespread use in generic and branded pharmaceuticals. Biologics APIs are gaining traction due to the rising demand for advanced therapies targeting complex diseases. High Potency APIs (HPAPIs) are increasingly utilized in oncology and specialty treatments, while API Intermediates and Peptide APIs support innovation in drug development and manufacturing efficiency .

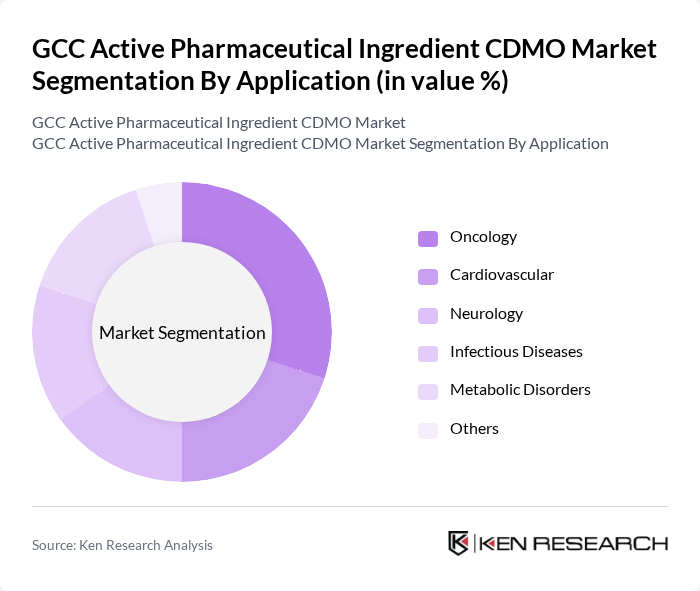

By Application:The applications of active pharmaceutical ingredients in the GCC market include Oncology, Cardiovascular, Neurology, Infectious Diseases, Metabolic Disorders, and Others. Oncology leads due to the increasing incidence of cancer and the need for targeted therapies. Cardiovascular and metabolic disorders remain significant segments, reflecting regional health trends. Neurology and infectious diseases are supported by ongoing advancements in treatment options and the region’s commitment to improving public health outcomes .

The GCC Active Pharmaceutical Ingredient CDMO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lonza Group AG, WuXi AppTec, Cambrex Corporation, Thermo Fisher Scientific (Patheon), Siegfried Holding AG, Aenova Group, Recipharm AB, Piramal Pharma Solutions, Famar Health, Jubilant Life Sciences, Almac Group, Bachem Holding AG, Evonik Industries AG, Hovione, Aurobindo Pharma, Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Tabuk Pharmaceuticals Manufacturing Co., Julphar (Gulf Pharmaceutical Industries), Globalpharma (Dubai Investments), Pharma Solutions Industries (PSI) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC active pharmaceutical ingredient CDMO market appears promising, driven by ongoing advancements in technology and a shift towards sustainable manufacturing practices. As the region continues to enhance its healthcare infrastructure, the demand for high-quality APIs is expected to rise. Furthermore, the increasing focus on personalized medicine will likely create new opportunities for CDMOs to innovate and expand their service offerings, positioning them favorably in the evolving pharmaceutical landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic APIs Biologics APIs High Potency APIs (HPAPIs) API Intermediates Peptide APIs Others |

| By Application | Oncology Cardiovascular Neurology Infectious Diseases Metabolic Disorders Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Research Institutions Contract Research Organizations (CROs) Hospital Pharmacies Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Platforms Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain Others |

| By Regulatory Compliance | FDA Compliance EMA Compliance GCC Local Regulatory Standards Others |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Competitive Pricing Tender-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| API Manufacturing Insights | 60 | Production Managers, Quality Assurance Heads |

| Regulatory Compliance Perspectives | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Market Demand Analysis | 70 | Market Analysts, Business Development Managers |

| Supply Chain Dynamics | 40 | Supply Chain Managers, Procurement Directors |

| Investment Trends in CDMO Sector | 40 | Financial Analysts, Venture Capitalists |

The GCC Active Pharmaceutical Ingredient CDMO Market is valued at approximately USD 0.75 billion, driven by increasing pharmaceutical demand, particularly for chronic diseases and personalized medicine, alongside significant investments in pharmaceutical R&D across the region.