Region:Middle East

Author(s):Rebecca

Product Code:KRAB8143

Pages:88

Published On:October 2025

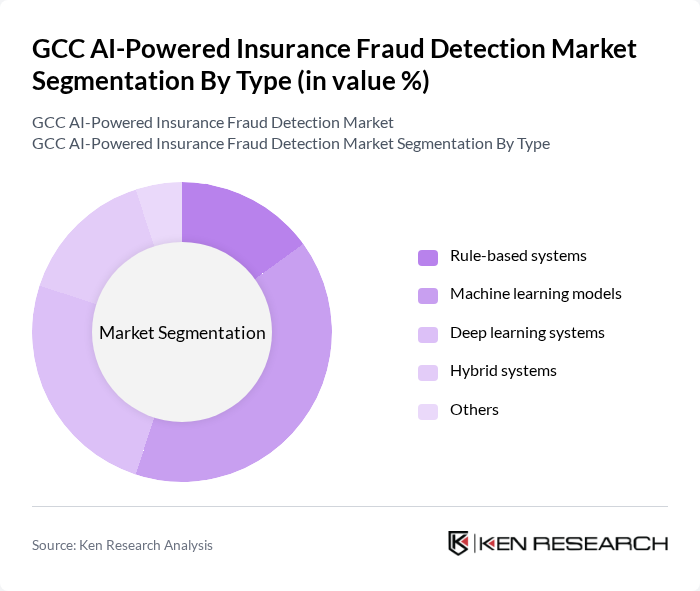

By Type:The market is segmented into various types, including rule-based systems, machine learning models, deep learning systems, hybrid systems, and others. Among these, machine learning models are gaining traction due to their ability to analyze vast amounts of data and identify patterns indicative of fraudulent activities. The increasing sophistication of fraud schemes necessitates the adoption of advanced machine learning techniques, making this sub-segment a leader in the market.

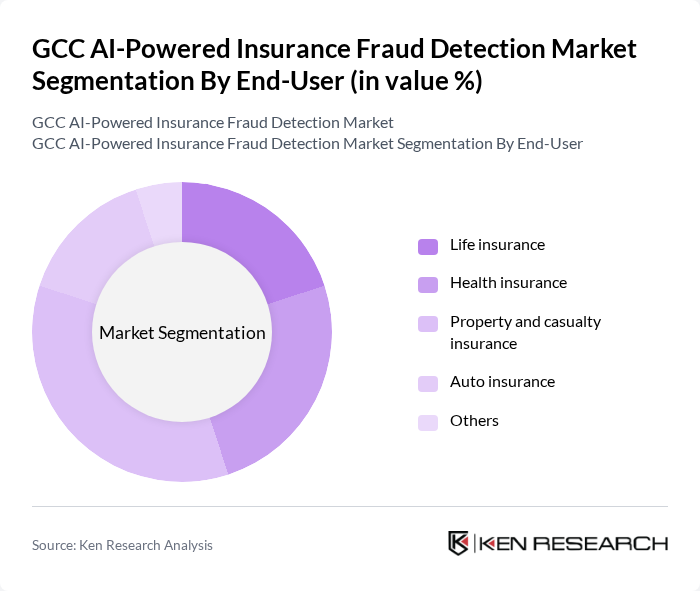

By End-User:The end-user segmentation includes life insurance, health insurance, property and casualty insurance, auto insurance, and others. The property and casualty insurance segment is currently dominating the market due to the high incidence of fraud in this area. Insurers are increasingly leveraging AI technologies to streamline claims processing and enhance risk assessment, which is crucial for maintaining profitability in this competitive landscape.

The GCC AI-Powered Insurance Fraud Detection Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAS Institute Inc., FICO, IBM Corporation, Verisk Analytics, Inc., ACI Worldwide, Inc., BAE Systems, LexisNexis Risk Solutions, Guidewire Software, Inc., SAP SE, Accenture, Cognizant Technology Solutions, Capgemini, DXC Technology, Infosys Limited, Wipro Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-powered insurance fraud detection market appears promising, driven by technological advancements and increasing regulatory scrutiny. As insurers continue to prioritize fraud prevention, the integration of AI and machine learning will become more prevalent. Additionally, the growing emphasis on real-time data analysis and predictive modeling will enhance the effectiveness of fraud detection systems. Companies that invest in innovative solutions and adapt to evolving market demands are likely to gain a competitive edge in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Rule-based systems Machine learning models Deep learning systems Hybrid systems Others |

| By End-User | Life insurance Health insurance Property and casualty insurance Auto insurance Others |

| By Application | Claims processing Underwriting Risk assessment Customer service Others |

| By Deployment Mode | On-premises Cloud-based Hybrid |

| By Sales Channel | Direct sales Distributors Online sales |

| By Region | GCC Countries Others |

| By Pricing Model | Subscription-based Pay-per-use One-time license fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Fraud Detection | 100 | Fraud Analysts, Claims Managers |

| Property Insurance Claims Management | 80 | Underwriters, Risk Assessment Officers |

| Life Insurance Fraud Prevention | 70 | Compliance Officers, Data Scientists |

| Automobile Insurance Fraud Analysis | 90 | Claims Adjusters, IT Security Managers |

| Insurance Technology Adoption Insights | 75 | Chief Technology Officers, Innovation Leads |

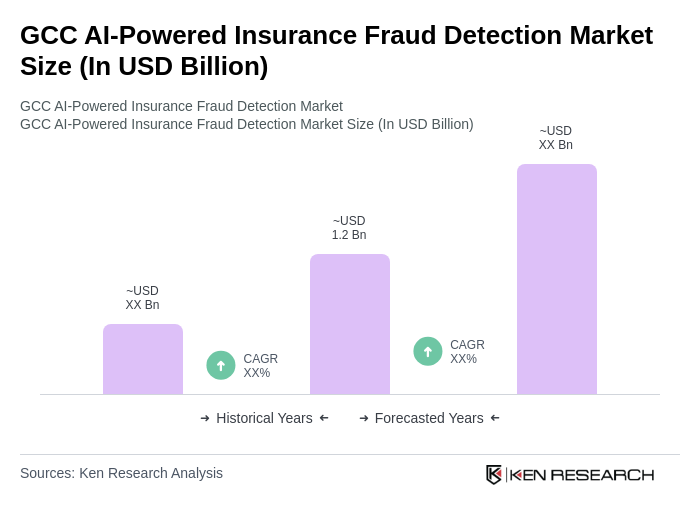

The GCC AI-Powered Insurance Fraud Detection Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advanced technology adoption, rising fraudulent activities, and the need for efficient claims processing in the insurance sector.