Region:Middle East

Author(s):Dev

Product Code:KRAD1612

Pages:80

Published On:November 2025

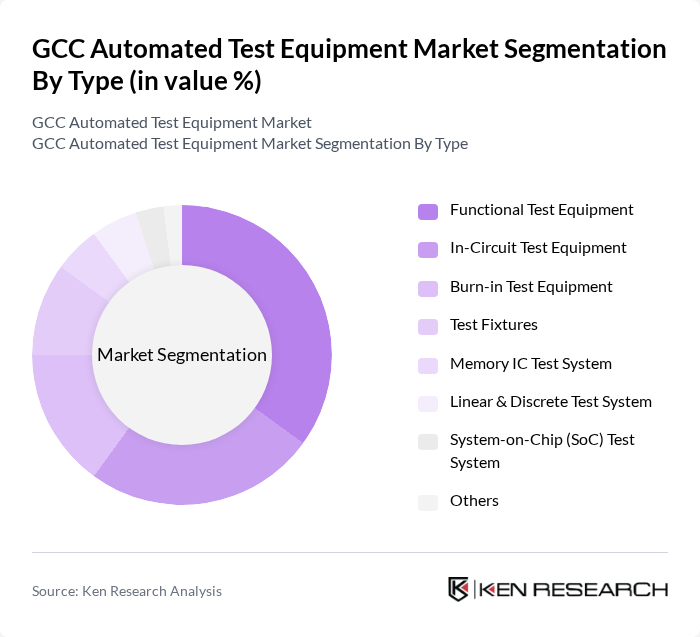

By Type:The market is segmented into various types of automated test equipment, including Functional Test Equipment, In-Circuit Test Equipment, Burn-in Test Equipment, Test Fixtures, Memory IC Test System, Linear & Discrete Test System, System-on-Chip (SoC) Test System, and Others. Among these, Functional Test Equipment is the most dominant segment, driven by its widespread application in testing the performance and functionality of electronic devices. The increasing complexity of electronic systems necessitates the use of advanced functional testing solutions, making it a preferred choice for manufacturers.

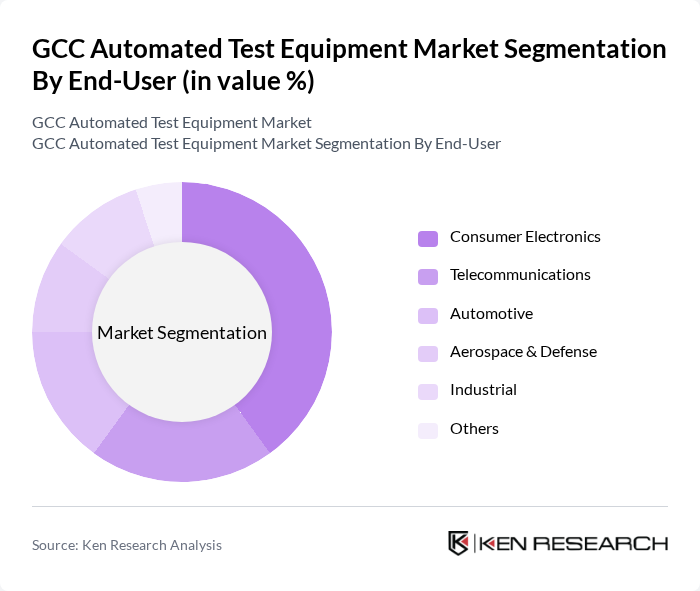

By End-User:The end-user segmentation includes Consumer Electronics, Telecommunications, Automotive, Aerospace & Defense, Industrial, and Others. The Consumer Electronics segment leads the market, driven by the increasing demand for smartphones, tablets, and other electronic devices. The rapid pace of innovation in consumer electronics necessitates rigorous testing to ensure product quality and reliability, making this segment a key driver of growth in the automated test equipment market. The rise in demand for System-on-Chip devices and the rapid increase in demand for electric vehicles in the automotive sector are also anticipated to boost market growth.

The GCC Automated Test Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Keysight Technologies, National Instruments (now NI, a part of Emerson Electric Co.), Teradyne, Inc., Advantest Corporation, Anritsu Corporation, Rohde & Schwarz GmbH & Co. KG, Tektronix, Inc., Fluke Corporation, Agilent Technologies, Inc., JTAG Technologies B.V., Chroma ATE Inc., VIAVI Solutions Inc., AMETEK Programmable Power, Astronics Corporation, Test Research, Inc. (TRI) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC automated test equipment market appears promising, driven by ongoing technological innovations and a strong push towards Industry 4.0. As manufacturers increasingly adopt smart technologies, the integration of artificial intelligence in testing processes is expected to enhance efficiency and accuracy. Furthermore, the focus on sustainability will likely lead to the development of eco-friendly testing solutions, aligning with global environmental standards and consumer preferences, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Functional Test Equipment In-Circuit Test Equipment Burn-in Test Equipment Test Fixtures Memory IC Test System Linear & Discrete Test System System-on-Chip (SoC) Test System Others |

| By End-User | Consumer Electronics Telecommunications Automotive Aerospace & Defense Industrial Others |

| By Application | Research & Development Production Testing Quality Assurance Maintenance & Repair Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Technology | Automated Optical Inspection (AOI) Automated X-ray Inspection (AXI) Test Automation Software Handler/Prober Systems Others |

| By Investment Source | Private Investments Government Funding Venture Capital Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Testing | 100 | Test Engineers, Product Managers |

| Aerospace Component Testing | 60 | Quality Assurance Managers, Compliance Officers |

| Automotive Electronics Testing | 70 | R&D Engineers, Procurement Specialists |

| Telecommunications Equipment Testing | 80 | Network Engineers, Technical Directors |

| Industrial Automation Testing | 50 | Operations Managers, Systems Integrators |

The GCC Automated Test Equipment market is valued at approximately USD 1.4 billion. This growth is driven by the increasing demand for high-quality electronic devices and advancements in technology and automation across various sectors.