Region:Middle East

Author(s):Rebecca

Product Code:KRAD2936

Pages:97

Published On:November 2025

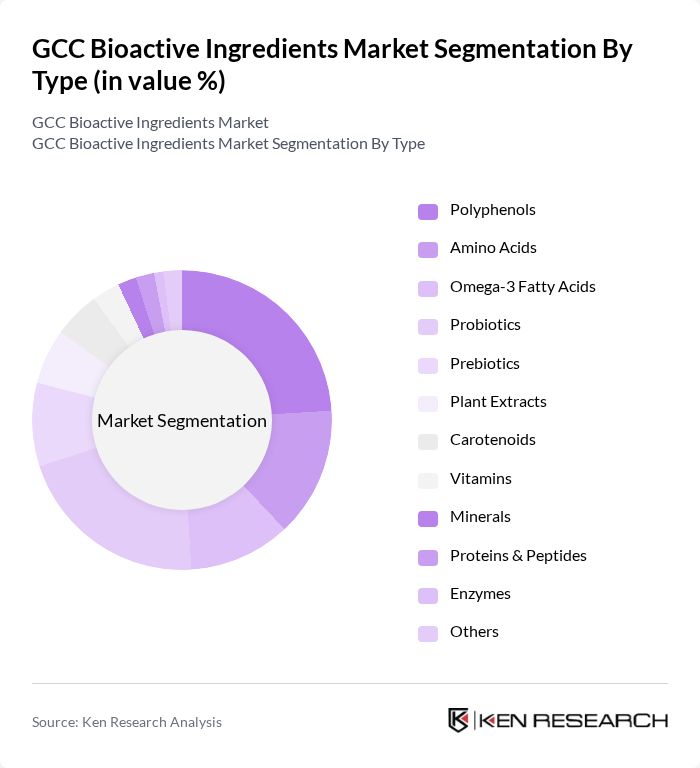

By Type:The bioactive ingredients market is segmented into various types, including Polyphenols, Amino Acids, Omega-3 Fatty Acids, Probiotics, Prebiotics, Plant Extracts, Carotenoids, Vitamins, Minerals, Proteins & Peptides, Enzymes, and Others. Among these, Polyphenols and Probiotics are particularly dominant due to their extensive health benefits, including antioxidant properties and gut health support. The increasing consumer preference for functional foods and dietary supplements, as well as the rising focus on preventive health and immunity, has significantly boosted the demand for these subsegments.

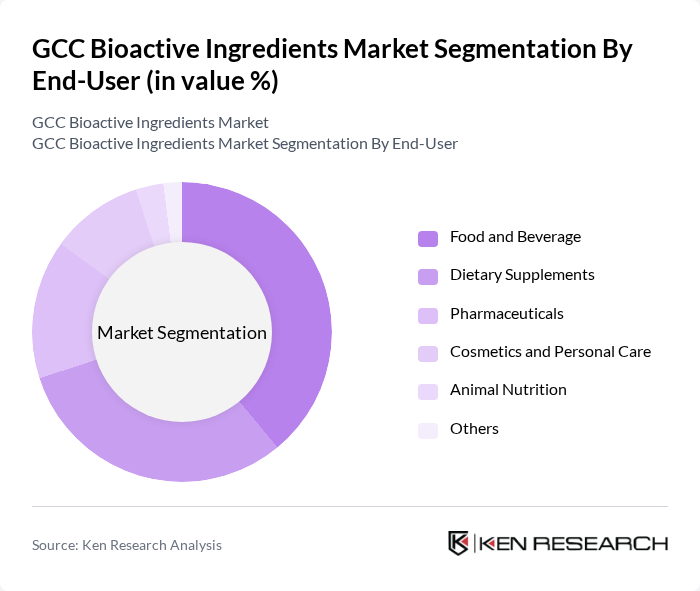

By End-User:The market is also segmented by end-user applications, which include Food and Beverage, Dietary Supplements, Pharmaceuticals, Cosmetics and Personal Care, Animal Nutrition, and Others. The Food and Beverage sector is the largest consumer of bioactive ingredients, driven by the growing trend of health-conscious eating, increasing demand for fortified and functional foods, and the incorporation of clean-label ingredients in everyday products. Dietary Supplements also represent a significant portion of the market, reflecting the increasing consumer focus on preventive healthcare and wellness.

The GCC Bioactive Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, DSM-Firmenich AG, Kerry Group plc, Naturex S.A. (a Givaudan company), Givaudan SA, Chr. Hansen Holding A/S, BioCare Copenhagen A/S, Sabinsa Corporation, Herbalife Nutrition Ltd., Amway Corporation, Nutraceutical Corporation, Almarai Company, Agthia Group PJSC, Gulf Biotechnology Industries, Al Ain Dairy, Al Kabeer Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC bioactive ingredients market appears promising, driven by increasing consumer demand for health-oriented products and innovations in extraction technologies. As the market evolves, companies are likely to invest more in research and development, focusing on sustainable sourcing and plant-based ingredients. Additionally, the rise of e-commerce platforms will facilitate greater access to bioactive products, enabling manufacturers to reach a broader audience and capitalize on emerging market trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyphenols Amino Acids Omega-3 Fatty Acids Probiotics Prebiotics Plant Extracts Carotenoids Vitamins Minerals Proteins & Peptides Enzymes Others |

| By End-User | Food and Beverage Dietary Supplements Pharmaceuticals Cosmetics and Personal Care Animal Nutrition Others |

| By Source | Plant-Based Animal-Based Microbial Marine Others |

| By Application | Dietary Supplements Functional Foods Fortified Foods Personal and Beauty Care Pharmaceuticals Animal Nutrition Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Sector | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceuticals and Nutraceuticals | 80 | Regulatory Affairs Managers, R&D Directors |

| Cosmetics and Personal Care | 60 | Formulation Chemists, Brand Managers |

| Health and Wellness Products | 70 | Marketing Managers, Supply Chain Coordinators |

| Research Institutions and Academia | 40 | Research Scientists, Professors in Food Science |

The GCC Bioactive Ingredients Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing consumer awareness of health and wellness, and a rising demand for natural and organic products.