Global Bioactive Ingredients Market Overview

- The Global Bioactive Ingredients Market is valued at USD 216,900 million, based on a five-year historical analysis. This growth is primarily driven by the increasing consumer demand for natural and organic products, a rising awareness of health and wellness, and the expansion of functional foods, dietary supplements, and pharmaceuticals. The market has seen a significant uptick in the use of bioactive ingredients across these sectors, as consumers seek products that offer proven health benefits such as antioxidant, anti-inflammatory, and immune-support properties. Major trends include the adoption of plant-based nutrition, clean-label products, and innovations in extraction technologies, all contributing to robust market expansion .

- Key players in this market include the United States, Germany, and China, which dominate due to their advanced research and development capabilities, robust manufacturing infrastructure, and strong consumer bases. The United States leads in innovation and product development, Germany is recognized for its stringent quality standards and regulatory frameworks, and China leverages its vast supply chain and production capacity to support global demand for bioactive ingredients .

- In 2023, the European Union implemented Regulation (EU) 2015/2283 on Novel Foods, issued by the European Parliament and Council. This regulation mandates comprehensive safety assessments and authorizations for new food ingredients, including bioactive substances, prior to market entry. The regulation covers scope, compliance requirements, and safety thresholds, thereby enhancing consumer safety and confidence in bioactive products .

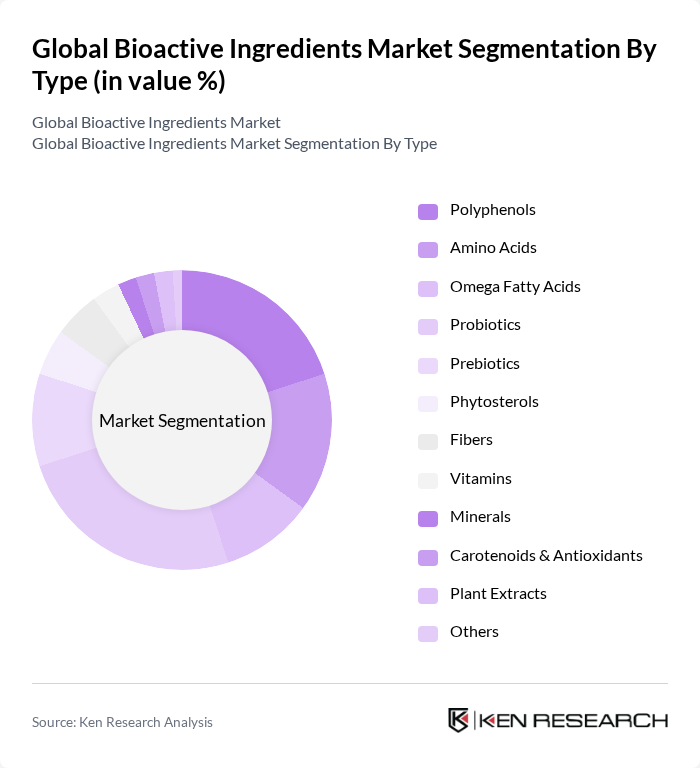

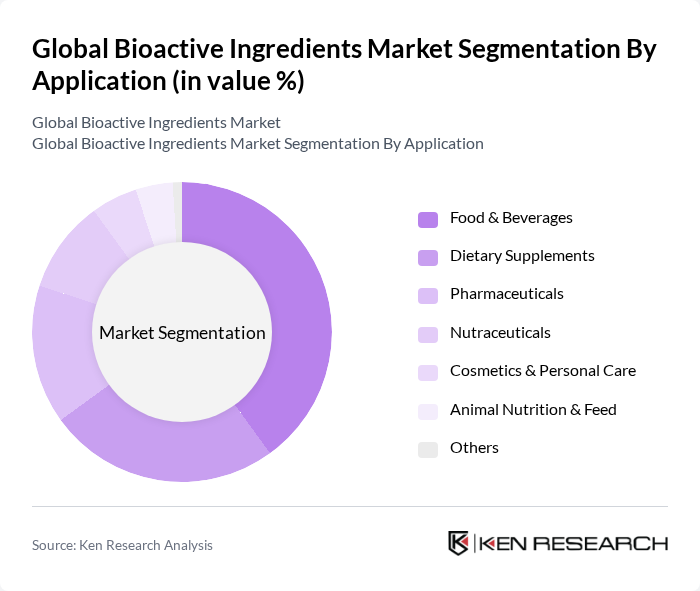

Global Bioactive Ingredients Market Segmentation

By Type:The bioactive ingredients market is segmented into Polyphenols, Amino Acids, Omega Fatty Acids, Probiotics, Prebiotics, Phytosterols, Fibers, Vitamins, Minerals, Carotenoids & Antioxidants, Plant Extracts, and Others. Among these, Probiotics and Polyphenols are particularly prominent due to their extensive health benefits, such as supporting gut health, immunity, and cardiovascular function, and their increasing incorporation into functional foods and dietary supplements. The market is also witnessing rising demand for omega fatty acids and plant extracts, driven by consumer preference for natural and sustainable ingredients .

By Application:Bioactive ingredients are applied across Food & Beverages, Dietary Supplements, Pharmaceuticals, Nutraceuticals, Cosmetics & Personal Care, Animal Nutrition & Feed, and Others. The Food & Beverages segment is the largest, driven by the growing trend of health-conscious eating and the incorporation of functional ingredients into everyday products. Dietary supplements and nutraceuticals are also rapidly expanding segments, supported by consumer interest in preventive healthcare and wellness solutions .

Global Bioactive Ingredients Market Competitive Landscape

The Global Bioactive Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, DSM Nutritional Products, Kerry Group plc, Chr. Hansen Holding A/S, Naturex S.A., Ginkgo Bioworks, Inc., BioCare Copenhagen A/S, Sabinsa Corporation, Frutarom Industries Ltd., Kemin Industries, Inc., Herbalife Nutrition Ltd., Ajinomoto Co., Inc., Arla Foods amba, FMC Corporation, Roquette Frères, Mazza Innovation Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Bioactive Ingredients Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The global health and wellness market is projected to reach $4.5 trillion in future, driven by a growing awareness of health issues. Consumers are increasingly seeking products that enhance their well-being, leading to a surge in demand for bioactive ingredients. For instance, the functional food sector, which heavily incorporates bioactive compounds, is expected to grow significantly, with the market size estimated at $300 billion in future, reflecting a robust shift towards healthier dietary choices.

- Rising Demand for Natural Ingredients:The global natural food market is anticipated to reach $1.2 trillion in future, as consumers prefer products with natural ingredients over synthetic alternatives. This trend is particularly evident in the food and beverage sector, where bioactive ingredients derived from plants are increasingly favored. The clean label movement, which emphasizes transparency and natural sourcing, is driving manufacturers to incorporate bioactive compounds, thus expanding their product offerings and appealing to health-conscious consumers.

- Technological Advancements in Extraction Processes:Innovations in extraction technologies, such as supercritical fluid extraction and enzymatic methods, are enhancing the efficiency and yield of bioactive compounds. The global market for extraction technologies is projected to reach $12 billion in future, reflecting a growing investment in R&D. These advancements not only improve the quality of bioactive ingredients but also reduce production costs, making them more accessible to manufacturers and driving their incorporation into various products across industries.

Market Challenges

- Regulatory Compliance Issues:The bioactive ingredients sector faces stringent regulatory frameworks that vary by region, complicating market entry and product development. For instance, the European Food Safety Authority (EFSA) has strict guidelines for health claims, which can delay product launches. In future, compliance costs are expected to rise, with companies spending an average of $2 million annually to meet regulatory requirements, impacting profitability and innovation in the sector.

- High Production Costs:The production of bioactive ingredients often involves complex processes and high-quality raw materials, leading to elevated costs. For example, the average cost of producing high-purity bioactive compounds can exceed $600 per kilogram. As demand increases, manufacturers face pressure to maintain quality while managing costs. In future, rising raw material prices, particularly for organic sources, are projected to further strain profit margins, challenging the sustainability of production.

Global Bioactive Ingredients Market Future Outlook

The future of the bioactive ingredients market appears promising, driven by increasing consumer demand for health-oriented products and innovations in extraction technologies. As the trend towards plant-based and natural ingredients continues to gain momentum, companies are likely to invest in R&D to develop new bioactive compounds. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, enabling manufacturers to reach a broader audience and capitalize on emerging market opportunities in health and wellness sectors.

Market Opportunities

- Growth in Functional Foods:The functional foods market is projected to reach $300 billion in future, presenting significant opportunities for bioactive ingredient manufacturers. As consumers increasingly seek foods that provide health benefits beyond basic nutrition, companies can leverage bioactive compounds to create innovative products that cater to this demand, enhancing their market presence and profitability.

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing a surge in demand for bioactive ingredients. With a combined population exceeding 4 billion, these regions are experiencing rapid urbanization and rising disposable incomes. In future, the demand for health and wellness products in these markets is expected to grow significantly, offering lucrative opportunities for companies to expand their footprint and tap into new consumer bases.