Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4512

Pages:85

Published On:October 2025

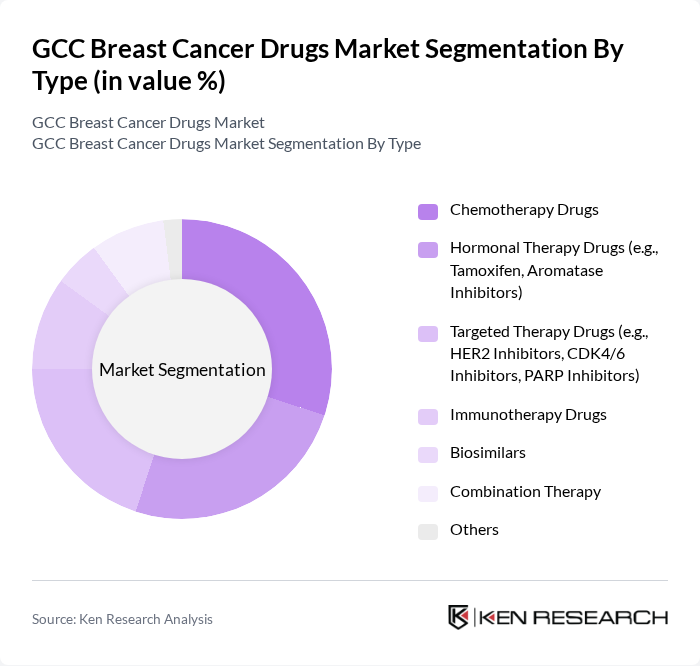

By Type:The market is segmented into various types of drugs used in the treatment of breast cancer. The primary subsegments include Chemotherapy Drugs, Hormonal Therapy Drugs (e.g., Tamoxifen, Aromatase Inhibitors), Targeted Therapy Drugs (e.g., HER2 Inhibitors, CDK4/6 Inhibitors, PARP Inhibitors), Immunotherapy Drugs, Biosimilars, Combination Therapy, and Others. Each of these subsegments plays a crucial role in addressing different aspects of breast cancer treatment. The market is witnessing a shift towards targeted and immunotherapy drugs, reflecting the global trend of adopting therapies with improved efficacy and safety profiles .

The Chemotherapy Drugs subsegment is currently dominating the market due to its long-standing use and effectiveness in treating various stages of breast cancer. Patients and healthcare providers often prefer chemotherapy as a first-line treatment option, especially for aggressive cancer types. The availability of a wide range of chemotherapy agents and their proven efficacy in clinical settings contribute to their popularity. Additionally, ongoing research and development efforts are focused on enhancing the effectiveness and reducing the side effects of these drugs, further solidifying their market position. However, targeted therapies and immunotherapies are rapidly gaining market share as they offer improved outcomes and reduced toxicity .

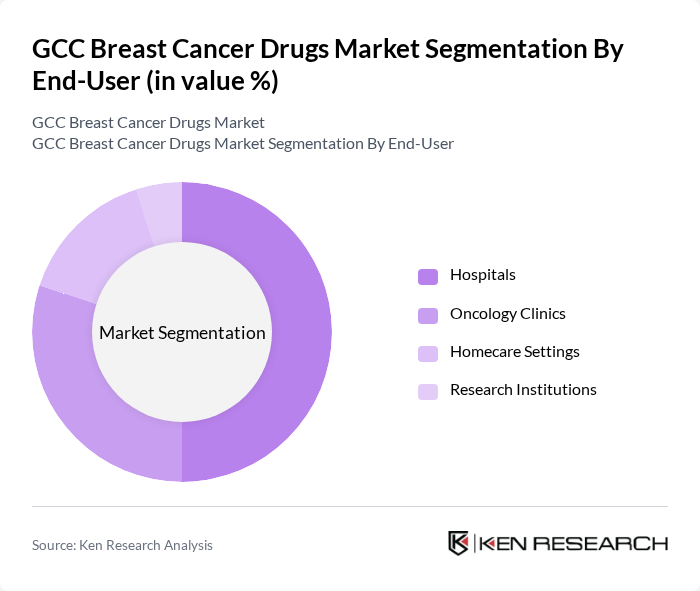

By End-User:The market is segmented based on the end-users of breast cancer drugs, which include Hospitals, Oncology Clinics, Homecare Settings, and Research Institutions. Each of these end-users plays a significant role in the distribution and administration of breast cancer treatments, catering to different patient needs and preferences. Hospitals remain the primary channel for administration due to the complexity of treatment protocols and the need for multidisciplinary care .

Hospitals are the leading end-user segment in the market, primarily due to their comprehensive facilities and access to advanced treatment technologies. They provide a wide range of services, including surgical interventions, chemotherapy, and supportive care, making them the preferred choice for patients requiring extensive treatment. The presence of specialized oncology departments and multidisciplinary teams in hospitals further enhances their capability to deliver effective breast cancer care, thereby driving their dominance in the market .

The GCC Breast Cancer Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Holding AG, Novartis AG, Pfizer Inc., AstraZeneca PLC, Merck & Co., Inc., Eli Lilly and Company, Sanofi S.A., GSK (GlaxoSmithKline) PLC, Amgen Inc., Teva Pharmaceutical Industries Ltd., AbbVie Inc., Bayer AG, Johnson & Johnson, Biogen Inc., Astellas Pharma Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC breast cancer drugs market appears promising, driven by ongoing advancements in personalized medicine and the integration of digital health technologies. As healthcare systems increasingly adopt telemedicine, patient access to specialized care will improve, facilitating timely interventions. Furthermore, the collaboration between pharmaceutical companies and research institutions is expected to yield innovative therapies, enhancing treatment efficacy and patient outcomes. The focus on targeted therapies and immunotherapy will likely reshape the treatment landscape, offering new hope for patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemotherapy Drugs Hormonal Therapy Drugs (e.g., Tamoxifen, Aromatase Inhibitors) Targeted Therapy Drugs (e.g., HER2 Inhibitors, CDK4/6 Inhibitors, PARP Inhibitors) Immunotherapy Drugs Biosimilars Combination Therapy Others |

| By End-User | Hospitals Oncology Clinics Homecare Settings Research Institutions |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospital Pharmacies Wholesalers |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Patient Demographics | Age Group Gender Socioeconomic Status |

| By Treatment Stage | Early Stage Advanced Stage Recurrence |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncologists in GCC Hospitals | 100 | Medical Oncologists, Surgical Oncologists |

| Pharmaceutical Sales Representatives | 70 | Sales Managers, Territory Managers |

| Healthcare Policy Makers | 45 | Health Ministry Officials, Regulatory Affairs Specialists |

| Patient Advocacy Groups | 50 | Patient Representatives, Support Group Leaders |

| Clinical Researchers in Oncology | 60 | Clinical Trial Coordinators, Research Scientists |

The GCC Breast Cancer Drugs Market is valued at approximately USD 1.45 billion, reflecting a significant growth driven by increased awareness, advancements in drug development, and rising healthcare expenditures in the region.