Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2323

Pages:85

Published On:October 2025

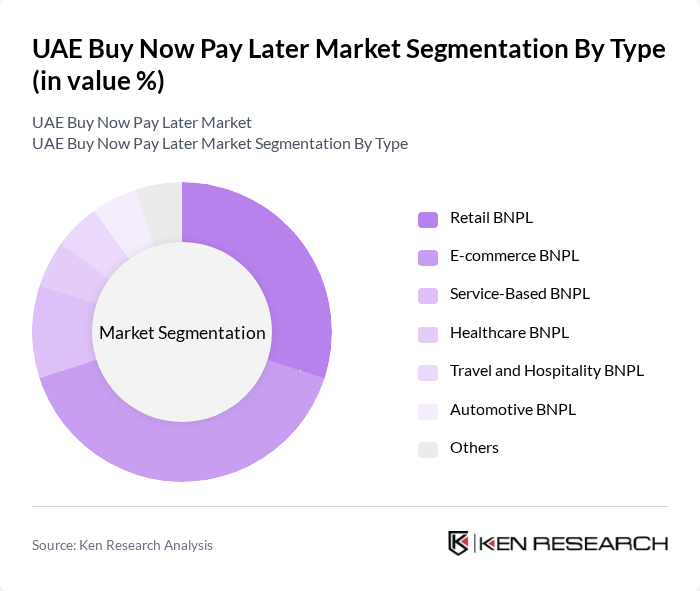

By Type:The market is segmented into various types, including Retail BNPL, E-commerce BNPL, Service-Based BNPL, Healthcare BNPL, Travel and Hospitality BNPL, Automotive BNPL, and Others. Among these, E-commerce BNPL is currently the leading sub-segment, driven by the rapid growth of online shopping and the increasing preference for flexible payment options among consumers. Retail BNPL also holds a significant share, as brick-and-mortar stores adopt BNPL solutions to enhance customer experience.

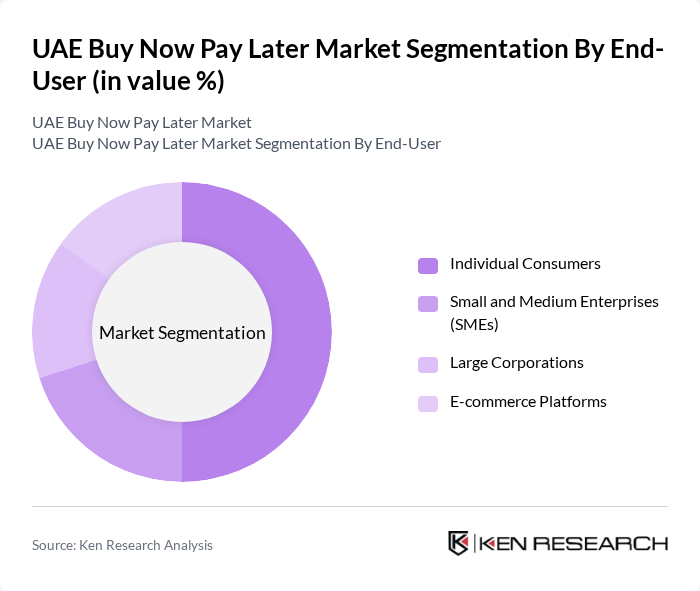

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and E-commerce Platforms. Individual Consumers dominate the market, as they increasingly seek flexible payment solutions for personal purchases. E-commerce Platforms also play a crucial role, as they integrate BNPL options to enhance customer satisfaction and drive sales.

The UAE Buy Now Pay Later Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tabby, Tamara, Postpay, Spotii, Cashew, ZoodPay, Payfort (an Amazon company), RAKBANK, Emirates NBD, Abu Dhabi Commercial Bank (ADCB), Al-Futtaim Group, Carrefour UAE, LuLu Hypermarket, Namshi, Noon contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Buy Now Pay Later market appears promising, driven by ongoing technological advancements and a shift in consumer behavior towards digital payment solutions. As e-commerce continues to expand, BNPL services are likely to become more integrated into online shopping platforms. Additionally, the increasing focus on consumer protection and responsible lending will shape the regulatory landscape, ensuring that BNPL providers operate sustainably while meeting consumer needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail BNPL E-commerce BNPL Service-Based BNPL Healthcare BNPL Travel and Hospitality BNPL Automotive BNPL Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations E-commerce Platforms |

| By Sales Channel | Online Sales In-Store Sales (POS) Mobile Applications Others |

| By Payment Frequency | Weekly Payments Monthly Payments Bi-Weekly Payments Others |

| By Demographic Segment | Millennials Gen Z Working Professionals Retirees |

| By Credit Score Range | Low Credit Score Medium Credit Score High Credit Score |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of BNPL Services | 120 | Millennials, Gen Z Consumers |

| Merchant Perspectives on BNPL | 80 | Retail Store Managers, E-commerce Managers |

| Financial Institutions' View on BNPL | 60 | Banking Executives, Financial Analysts |

| Regulatory Impact Assessment | 40 | Policy Makers, Regulatory Affairs Specialists |

| Market Trends and Future Outlook | 50 | Industry Experts, Market Researchers |

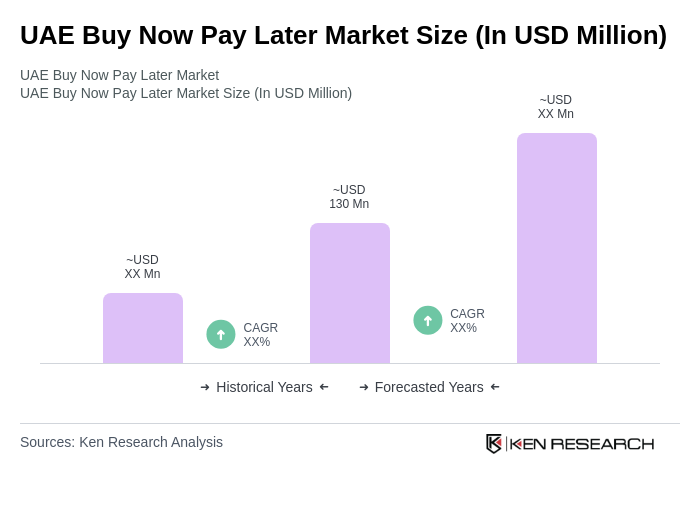

The UAE Buy Now Pay Later market is valued at approximately USD 130 million, driven by the increasing adoption of digital payment solutions and a surge in e-commerce activities, reflecting a growing consumer preference for flexible payment options.