Region:Asia

Author(s):Shubham

Product Code:KRAC0632

Pages:84

Published On:August 2025

By Type:The cement market can be segmented into various types, including Ordinary Portland Cement (OPC), Portland Composite Cement (PCC/Blended), Portland Pozzolana Cement (PPC), White Cement, Sulfate-Resistant Cement (SRC), Oil Well Cement, and Others (Masonry, Rapid Hardening, Low Heat). Among these, Portland Composite Cement (PCC/Blended) holds a prominent share in Indonesia due to industry-wide shifts toward blended cements for cost and sustainability benefits, while OPC remains widely used in structural applications and projects requiring specific performance.

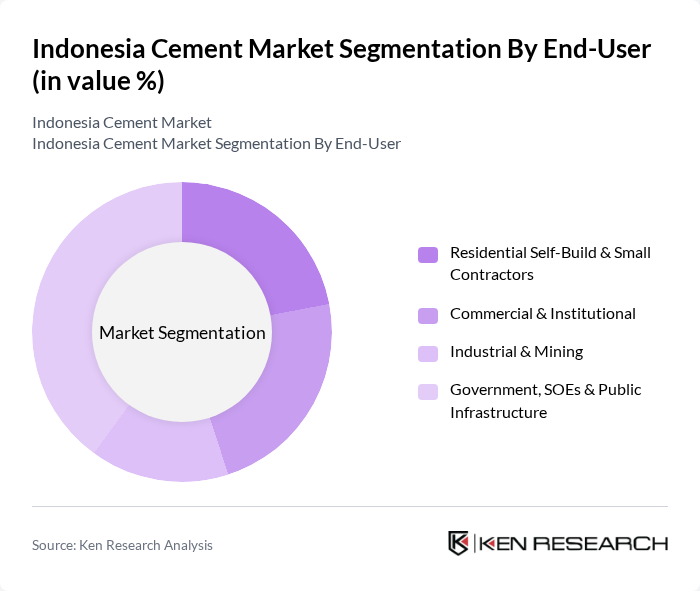

By End-User:The cement market is segmented by end-users, including Residential Self-Build & Small Contractors, Commercial & Institutional, Industrial & Mining, and Government, SOEs & Public Infrastructure. The Government, SOEs & Public Infrastructure segment is the leading end-user, supported by National Strategic Projects, the new capital city program, and toll road and seaport expansions that require significant cement volumes.

The Indonesia Cement Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Semen Indonesia (Persero) Tbk, PT Solusi Bangun Indonesia Tbk (formerly Holcim Indonesia), PT Indocement Tunggal Prakarsa Tbk, PT Semen Baturaja (Persero) Tbk, PT Cemindo Gemilang (Merah Putih Cement), PT Bosowa Cement, PT Semen Padang (Semen Indonesia Group), PT Semen Gresik (Semen Indonesia Group), PT Solusi Bangun Beton (Ready-mix, SIG Group), PT Cipta Mortar Utama (MU-Weber, Saint-Gobain), PT Jayamix by SCG (PT SCG Readymix Indonesia), PT Waskita Beton Precast Tbk, PT Adhimix Precast Indonesia, PT Pionirbeton Industri, PT Kedawung Setia Industrial Tbk (Fiber Cement – Kalsi brand) contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesian cement market is poised for growth, driven by ongoing infrastructure projects and urbanization. The government's commitment to affordable housing and sustainable construction practices will likely shape the industry's future. Additionally, the adoption of digital technologies in supply chain management is expected to enhance operational efficiency. As environmental regulations tighten, companies that invest in eco-friendly practices will gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ordinary Portland Cement (OPC) Portland Composite Cement (PCC/Blended) Portland Pozzolana Cement (PPC) White Cement Sulfate-Resistant Cement (SRC) Oil Well Cement Others (Masonry, Rapid Hardening, Low Heat) |

| By End-User | Residential Self-Build & Small Contractors Commercial & Institutional Industrial & Mining Government, SOEs & Public Infrastructure |

| By Application | Buildings (Structural & Non-Structural) Roads & Highways Bridges, Ports & Marine Works Dams & Power Plants Precast & Ready-Mix Concrete Others |

| By Distribution Channel | Direct Institutional/Project Sales Distributor/Dealer Network (Traditional Retail) Modern Trade & Building Material Stores Ready-Mix Concrete (RMC) Channel Online/Marketplace |

| By Price Range | Economy Mid Premium |

| By Region | Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Maluku & Papua |

| By Policy Support | Public Works & Housing Programs Tax Incentives & Import Duty Policies Local Content & Environmental Compliance State-Owned Enterprise (SOE) Procurement |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cement Manufacturing Insights | 120 | Plant Managers, Production Supervisors |

| Construction Sector Demand Analysis | 100 | Project Managers, Procurement Officers |

| Distribution Channel Effectiveness | 90 | Sales Managers, Logistics Coordinators |

| Regulatory Impact Assessment | 60 | Compliance Officers, Industry Analysts |

| Market Trends and Innovations | 110 | R&D Managers, Marketing Directors |

The Indonesia Cement Market is valued at approximately USD 5.3 billion, reflecting sustained demand driven by construction, infrastructure, and housing projects, supported by both government initiatives and private investments.