Region:Asia

Author(s):Harsh Saxena

Product Code:KR1560

Pages:90

Published On:July 2024

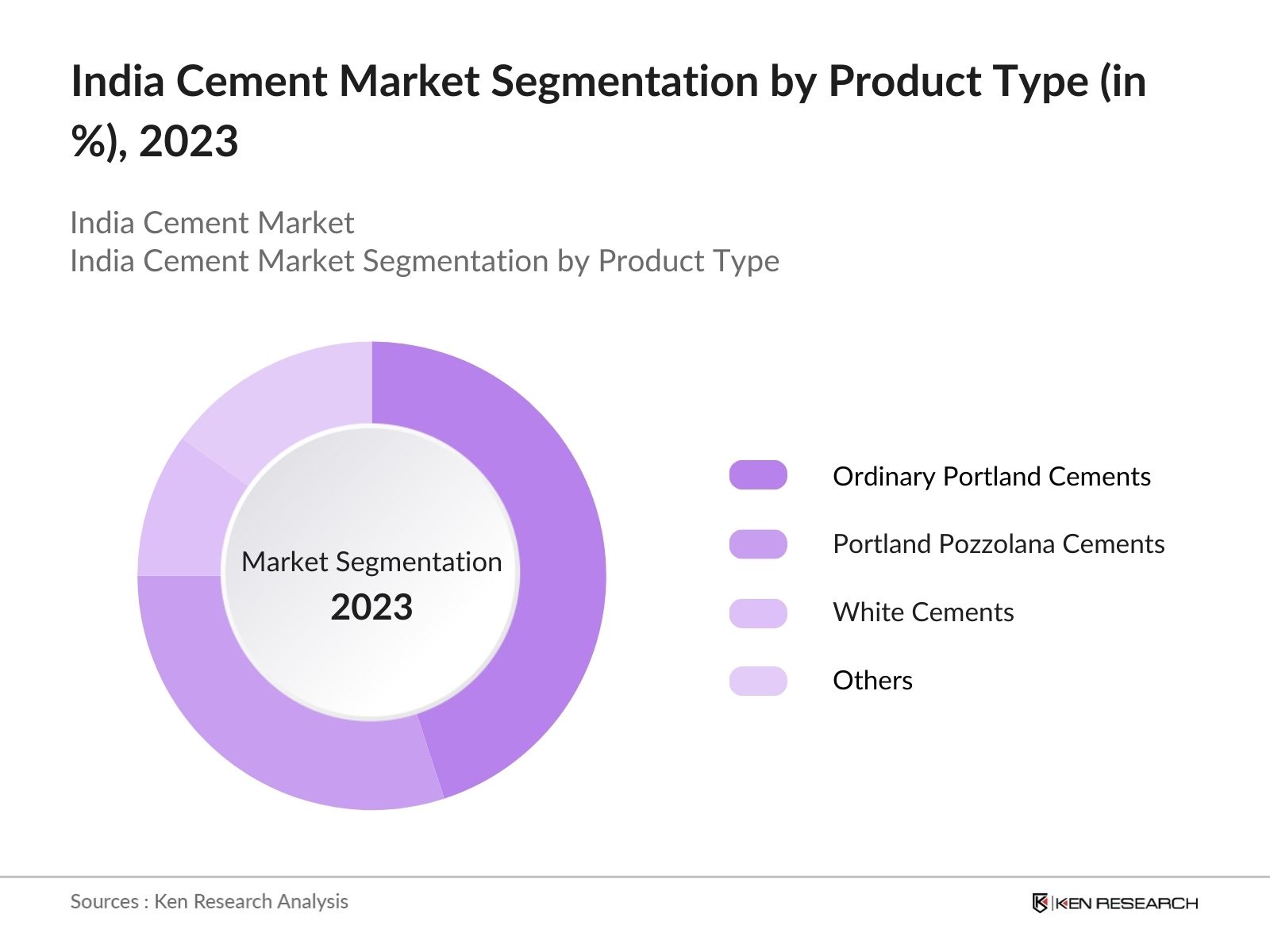

By Product Type:The Indian cement market is segmented into Portland Pozzolana Cement (PPC), Ordinary Portland Cement (OPC), Portland Slag Cement (PSC), and Composite Cement. Among these, PPC holds the dominant position in the market, driven by its cost-efficiency, environmental advantages, and widespread applicability across construction types. PSC and Composite cements are gaining faster adoption, especially in coastal, marine, and industrial infrastructure due to their superior resistance to chloride and sulfate attacks. Composite Cement is also becoming prominent for its low carbon footprint and enhanced workability, aligned with India’s decarbonization roadmap and ESG-focused procurement.

By Mode of Sales:The cement market is segmented into Trade and Non-Trade. Trade dominates, driven by high-volume purchases by individual home builders and small contractors through dealer networks. This channel benefits from wide distribution and serves fragmented demand across urban and rural areas. Non-Trade sales, while smaller, are gaining momentum due to large-scale infrastructure and real estate projects that demand direct supply from manufacturers. These institutional buyers prioritize bulk delivery and project-specific requirements, offering scope for customized cement variants and long-term supply contracts.

The India Cement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ambuja Cements Ltd, UltraTech Cement Ltd, JK Cement Ltd, ACC Limited, and Shree Cement Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The India cement market is poised for significant growth, driven by ongoing infrastructure projects and urbanization trends. With the government's commitment to enhancing housing and infrastructure, cement demand is expected to remain robust. Additionally, the industry's shift towards sustainable practices, including the adoption of green cement, will likely shape future developments. As companies invest in technology and innovation, the market will adapt to meet evolving consumer needs and regulatory requirements, ensuring long-term viability and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Product Type | StartFragment PPC (Portland Pozzolana Cement) OPC (Ordinary Portland Cement) PSC (Portland Slag Cement) Composite Cement EndFragment |

| ByStartFragmentMode of SalesEndFragment | StartFragment Trade Non-Trade EndFragment |

| By Region | StartFragment Rajasthan Madhya Pradesh Gujarat Chhattisgarh Uttar Pradesh Maharashtra Bihar Jharkhand Himachal Pradesh Uttarakhand Haryana EndFragment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Architects |

| Commercial Building Developments | 90 | Construction Managers, Real Estate Developers |

| Infrastructure Projects (Highways, Bridges) | 80 | Civil Engineers, Government Officials |

| Cement Distribution and Supply Chain | 70 | Logistics Managers, Supply Chain Coordinators |

| Environmental Compliance in Cement Production | 60 | Environmental Officers, Compliance Managers |

The India Cement Market is valued at approximately 430 Mn Tonnes, driven by rapid urbanization, infrastructure expansion, and government housing initiatives. This growth reflects the increasing demand for cement across various construction sectors, including residential, commercial, and industrial projects.