Region:North America

Author(s):Rebecca

Product Code:KRAD0199

Pages:95

Published On:August 2025

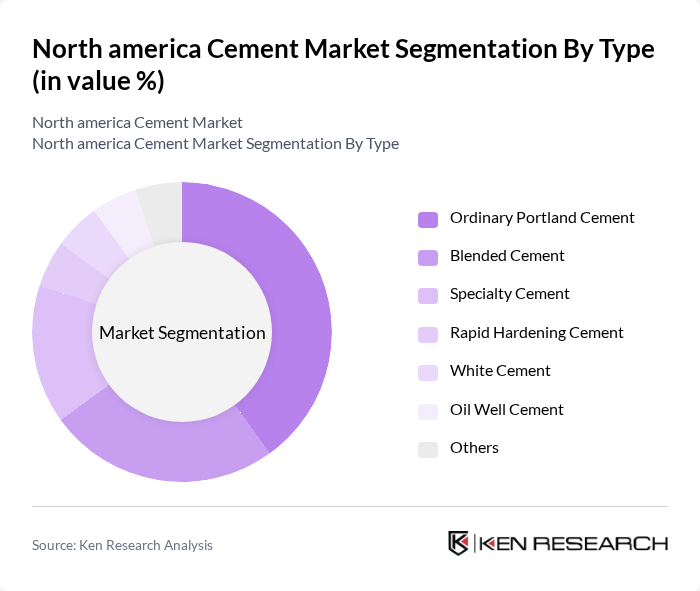

By Type:The cement market is segmented into Ordinary Portland Cement, Blended Cement, Specialty Cement, Rapid Hardening Cement, White Cement, Oil Well Cement, and Others. Ordinary Portland Cement remains the most widely used type due to its versatility and cost-effectiveness. Blended and specialty cements are gaining traction, driven by sustainability initiatives and the need for tailored performance in specific applications. Rapid hardening and oil well cements serve niche construction and energy sector needs, while white cement is preferred for architectural and decorative purposes.

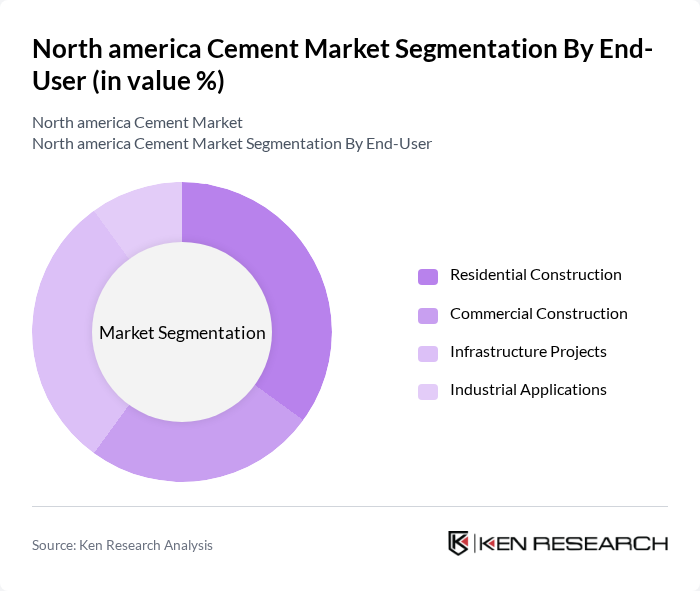

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Infrastructure Projects (roads, bridges, airports, dams), and Industrial Applications. Residential and infrastructure sectors are the largest consumers of cement, supported by ongoing urban development, population growth, and government-funded projects. Commercial construction continues to expand, driven by retail, office, and hospitality investments, while industrial applications reflect steady demand from manufacturing and energy sectors.

The North America Cement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Holcim Ltd., CEMEX S.A.B. de C.V., Martin Marietta Materials, Inc., Heidelberg Materials AG, CRH plc, Buzzi Unicem S.p.A., Eagle Materials Inc., Ash Grove Cement Company, Argos USA LLC, Lehigh Hanson, Inc., St. Marys Cement Inc., CalPortland Company, Summit Materials, Inc., GCC S.A.B. de C.V., Titan America LLC contribute to innovation, geographic expansion, and service delivery in this space.

The North American cement market is poised for growth, driven by ongoing infrastructure investments and urbanization trends. As cities expand, the demand for sustainable and high-performance cement products will increase. Additionally, technological advancements in production processes are expected to enhance efficiency and reduce environmental impact. The focus on green building initiatives will further shape the market, encouraging innovation and the adoption of eco-friendly materials, ultimately leading to a more sustainable construction landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ordinary Portland Cement Blended Cement Specialty Cement Rapid Hardening Cement White Cement Oil Well Cement Others |

| By End-User | Residential Construction Commercial Construction Infrastructure Projects (roads, bridges, airports, dams) Industrial Applications |

| By Application | Concrete Production Road Construction Precast Concrete Products Masonry/Plastering Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Retail Outlets Online Sales |

| By Price Range | Low Price Mid Price High Price |

| By Region | United States Canada Mexico |

| By Sustainability Certification | LEED Certified Green Seal Certified Energy Star Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cement Production Facilities | 100 | Plant Managers, Operations Directors |

| Construction Project Management | 70 | Project Managers, Site Engineers |

| Distribution and Logistics | 60 | Logistics Coordinators, Supply Chain Managers |

| Regulatory Compliance and Standards | 40 | Compliance Officers, Quality Assurance Managers |

| Market Research and Analysis | 50 | Market Analysts, Business Development Managers |

The North America Cement Market is valued at approximately USD 15 billion, driven by increasing construction activities, infrastructure development, and urbanization trends across the region.