GCC Dental 3D Printing Market Overview

- The GCC Dental 3D Printing Market is valued at USD 160 million, based on a five-year historical analysis of regional adoption within the broader GCC 3D printing and global dental 3D printing markets. This growth is primarily driven by advancements in dental technology, increasing demand for customized and chairside dental solutions, digital workflows (intraoral scanners, CAD/CAM, and cloud-based design), and the rising prevalence of dental caries and tooth loss in aging and lifestyle-affected populations. The integration of 3D printing in dental practices and laboratories has transformed the production of dental implants, crowns, bridges, dentures, aligners, and surgical guides, supporting same-day dentistry, improving treatment accuracy, and enhancing operational efficiency.

- Key players in this market include Saudi Arabia and the UAE, which dominate due to their robust healthcare infrastructure, higher healthcare expenditure, supportive national digital health strategies, and strong focus on cosmetic and restorative dentistry. The presence of leading dental technology vendors, specialized dental labs, and academic and research institutions in these countries further supports market growth, making them pivotal hubs for innovation, training, and adoption of 3D printing technologies in dentistry within the GCC.

- In 2023, the UAE government implemented regulations to promote the use of advanced technologies in healthcare, including dental 3D printing. A key framework is Federal Decree-Law No. 8 of 2019 on Medical Products, the Pharmacy Profession and Healthcare Facilities, issued by the UAE Ministry of Health and Prevention, which governs manufacture, import, registration, and quality and safety requirements for medical devices, including 3D?printed medical and dental products, and requires licensing of facilities, device registration, and adherence to recognized technical standards. In parallel, Dubai Health Authority and the Dubai Health Regulator framework require healthcare providers using 3D-printed devices for clinical applications to obtain facility and service licensing, maintain documented quality management systems, and ensure traceability and validation of 3D-printed dental devices in line with international best practice.

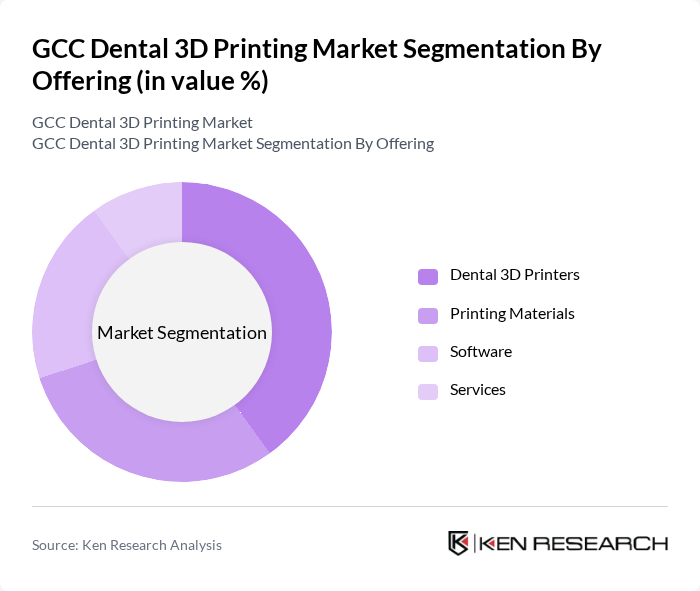

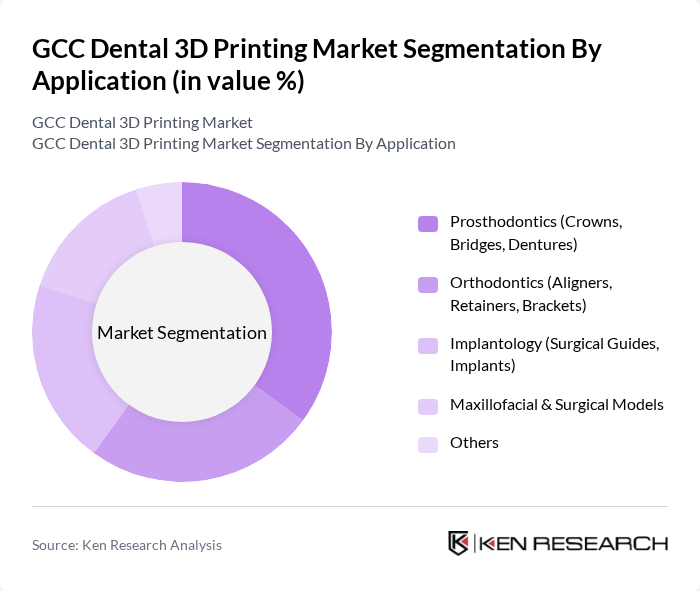

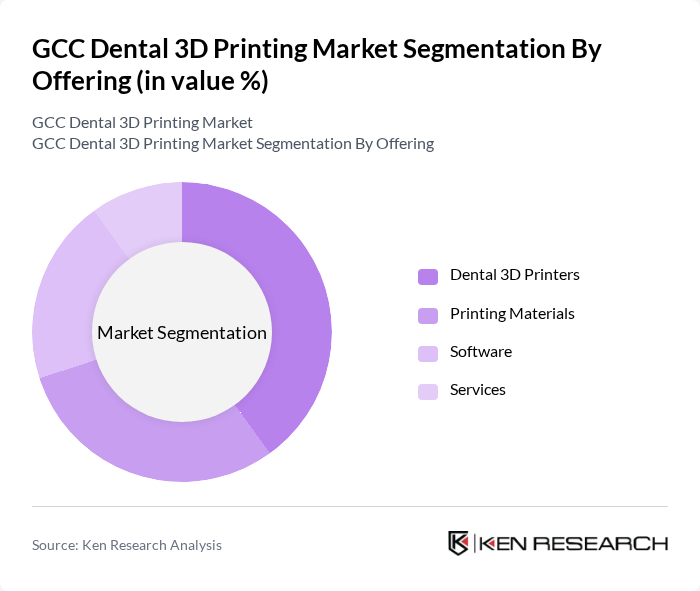

GCC Dental 3D Printing Market Segmentation

By Offering:The market is segmented into four main categories: Dental 3D Printers, Printing Materials, Software, and Services. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and technologies driving their growth, and with hardware and materials currently accounting for the majority of spending, while software and services gain share as digital workflows and outsourced design/printing models expand.

By Application:The applications of dental 3D printing are diverse, including Prosthodontics (Crowns, Bridges, Dentures), Orthodontics (Aligners, Retainers, Brackets), Implantology (Surgical Guides, Implants), Maxillofacial & Surgical Models, and Others. Each application addresses specific dental needs and contributes to the overall market growth, with prosthodontics and orthodontics currently representing the largest demand globally owing to high procedure volumes, increasing use of clear aligners, and broader adoption of digital indirect bonding and model production in labs.

GCC Dental 3D Printing Market Competitive Landscape

The GCC Dental 3D Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, Formlabs Inc., EnvisionTEC GmbH (Desktop Health), Dentsply Sirona Inc., Align Technology, Inc., Materialise NV, Dental Wings Inc., Renishaw plc, EOS GmbH, SprintRay Inc., 3Shape A/S, BEGO GmbH & Co. KG, Carbon, Inc., Local & Regional GCC Dental 3D Printing Players contribute to innovation, geographic expansion, and service delivery in this space.

GCC Dental 3D Printing Market Industry Analysis

Growth Drivers

- Increasing Demand for Customized Dental Solutions:The GCC region has witnessed a significant rise in the demand for customized dental solutions, driven by a growing population of over 59 million. This demographic shift is accompanied by an increase in disposable income, with average per capita income projected at around $30,000. As patients seek personalized dental care, the adoption of 3D printing technology, which allows for tailored dental products, is expected to surge, enhancing patient satisfaction and treatment outcomes.

- Advancements in 3D Printing Technology:Technological advancements in 3D printing are propelling the GCC dental market forward. In future, the introduction of faster and more precise 3D printers is anticipated, with capabilities to produce dental models in under two hours. The global 3D printing market is projected to reach about $30 billion, indicating a robust investment in research and development. These innovations are expected to improve the efficiency and quality of dental products, making them more accessible to dental professionals.

- Rising Awareness of Dental Aesthetics:The increasing awareness of dental aesthetics among the GCC population is a key growth driver. With a focus on cosmetic dentistry, the market for aesthetic dental solutions is projected to grow, supported by an increase in dental tourism in the region. Patients are increasingly seeking procedures that enhance their smiles, leading to a higher demand for 3D printed dental products that offer superior aesthetics and functionality, thus driving market growth.

Market Challenges

- High Initial Investment Costs:One of the significant challenges facing the GCC dental 3D printing market is the high initial investment required for advanced 3D printing equipment. The cost of high-quality 3D printers can range from about $15,000 for entry-level professional systems to over $200,000 for advanced industrial-grade dental 3D printers, which poses a barrier for many dental clinics and laboratories. This financial hurdle can limit the adoption of 3D printing technology, particularly among smaller practices that may struggle to allocate such capital for equipment.

- Regulatory Compliance Issues:Regulatory compliance remains a critical challenge in the GCC dental 3D printing market. The region's regulatory framework for dental products is still evolving, with varying standards across countries. In future, the lack of clear guidelines can lead to delays in product approvals, hindering market entry for new technologies. This uncertainty can deter investment and innovation, impacting the overall growth of the dental 3D printing sector.

GCC Dental 3D Printing Market Future Outlook

The future of the GCC dental 3D printing market appears promising, driven by technological advancements and increasing consumer demand for personalized dental solutions. As the region's healthcare infrastructure continues to improve, the integration of digital dentistry and AI technologies is expected to enhance operational efficiencies in future. Furthermore, the growing geriatric population in GCC countries is projected to increase substantially in future, creating higher demand for dental care solutions. This will necessitate innovative dental care solutions, further propelling market growth and adoption of 3D printing technologies.

Market Opportunities

- Expansion of Dental Clinics and Laboratories:The rapid expansion of dental clinics and laboratories in the GCC region presents a significant opportunity for 3D printing technology. As the number of dental facilities increases in future, the demand for efficient and cost-effective dental solutions will increase, creating a favorable environment for 3D printing adoption in dental practices.

- Integration of AI and Machine Learning in 3D Printing:The integration of AI and machine learning into 3D printing processes offers substantial opportunities for innovation. AI-driven design software is expected to enhance the customization of dental products in future, improving accuracy and reducing production time. This technological synergy can lead to better patient outcomes and increased operational efficiency for dental practices.