Region:Global

Author(s):Geetanshi

Product Code:KRAD1324

Pages:84

Published On:November 2025

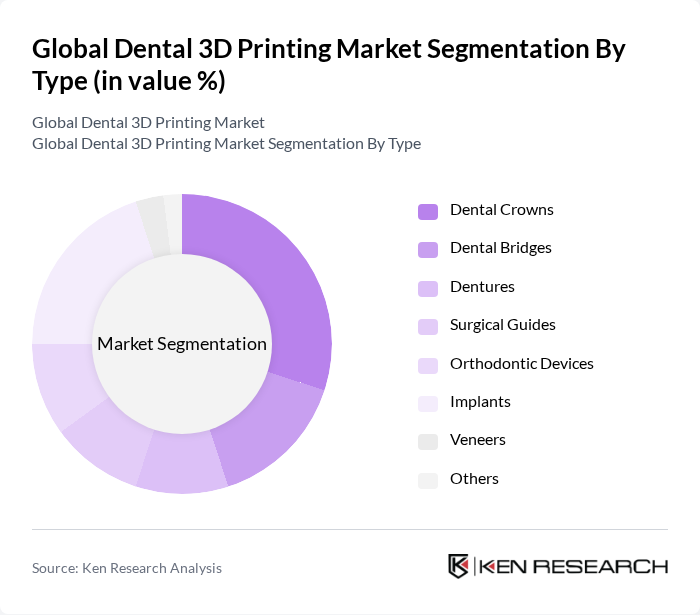

By Type:The market is segmented into various types, including Dental Crowns, Dental Bridges, Dentures, Surgical Guides, Orthodontic Devices, Implants, Veneers, and Others. Among these, Dental Crowns and Implants are particularly prominent due to their high demand for restorative and cosmetic dental procedures. The increasing trend towards personalized dental solutions has also led to a rise in the adoption of these products. Prosthodontic applications (crowns, bridges, dentures, veneers) collectively account for the largest share, driven by the need for precise, customized restorations and the shift toward digital workflows in dental labs .

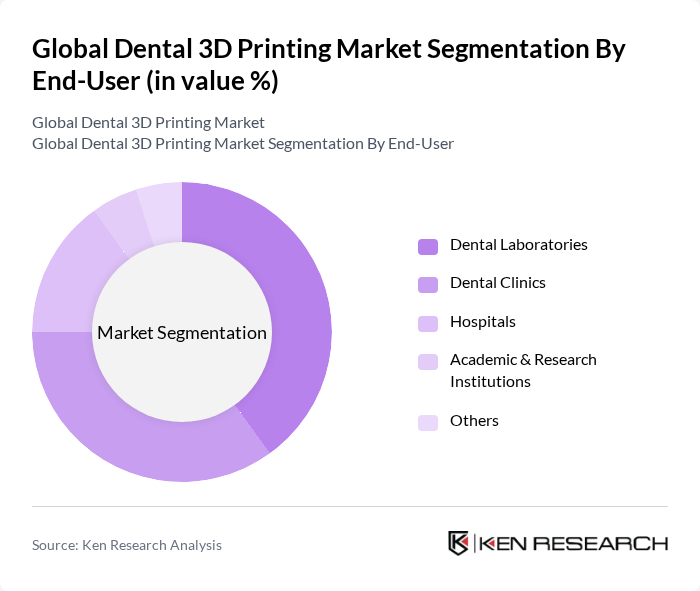

By End-User:The end-user segmentation includes Dental Laboratories, Dental Clinics, Hospitals, Academic & Research Institutions, and Others. Dental Clinics and Laboratories are the primary consumers of 3D printing technologies, driven by the need for efficient and precise dental solutions. The increasing number of dental practices adopting advanced technologies is propelling the growth of this segment. Dental laboratories lead in adoption due to their role in producing customized prosthetics and restorative devices, while clinics increasingly utilize chairside 3D printing for rapid patient care .

The Global Dental 3D Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, Align Technology, Inc., Dentsply Sirona Inc., Materialise NV, Formlabs Inc., EnvisionTEC GmbH, Carbon, Inc., Renishaw plc, EOS GmbH, Zortrax S.A., Prodways Group, SLM Solutions Group AG, Asiga, SprintRay Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental 3D printing market appears promising, driven by technological advancements and increasing consumer awareness. As dental professionals become more familiar with 3D printing capabilities, the integration of AI and machine learning is expected to enhance design and production processes. Additionally, the growing trend of digital dentistry will likely lead to more efficient workflows, improving patient outcomes and satisfaction. These factors will collectively contribute to a more robust market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dental Crowns Dental Bridges Dentures Surgical Guides Orthodontic Devices Implants Veneers Others |

| By End-User | Dental Laboratories Dental Clinics Hospitals Academic & Research Institutions Others |

| By Material | Photopolymer Resins Metal Alloys Ceramics Polymers/Plastics Composites Others |

| By Technology | Vat Photopolymerization (SLA, DLP) PolyJet Technology Fused Deposition Modeling (FDM) Selective Laser Sintering (SLS) Others |

| By Application | Prosthodontics Orthodontics Implantology Oral Surgery Aesthetic Dentistry Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Subsidies for dental technology adoption Tax incentives for dental practices Grants for research and development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics Utilizing 3D Printing | 120 | Dentists, Clinic Managers |

| Dental Laboratories Adopting 3D Technology | 100 | Lab Technicians, Operations Managers |

| 3D Printer Manufacturers in Dental Sector | 80 | Product Managers, Sales Directors |

| Orthodontic Practices Implementing 3D Solutions | 70 | Orthodontists, Practice Owners |

| Dental Technology Researchers and Academics | 60 | Research Scientists, University Professors |

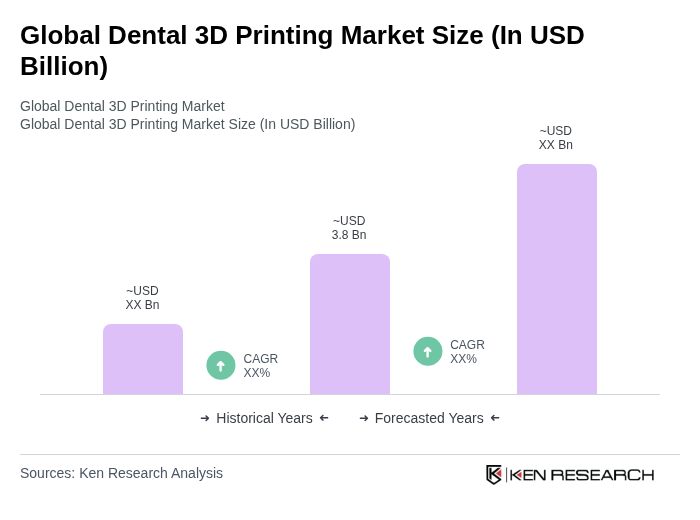

The Global Dental 3D Printing Market is valued at approximately USD 3.8 billion, reflecting significant growth driven by advancements in dental technology, increased demand for customized solutions, and a rise in dental disorders.