Region:Asia

Author(s):Rebecca

Product Code:KRAA4862

Pages:92

Published On:September 2025

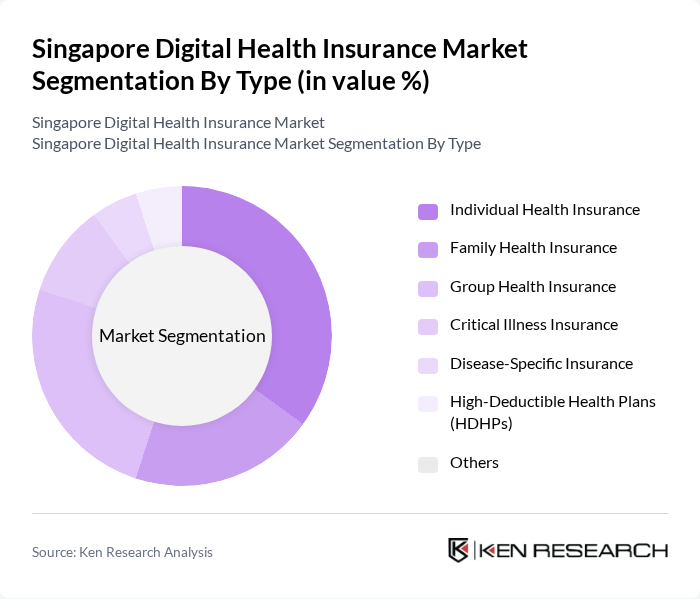

By Type:

The segmentation by type includes Individual Health Insurance, Family Health Insurance, Group Health Insurance, Critical Illness Insurance, Disease-Specific Insurance, High-Deductible Health Plans (HDHPs), and Others. Group Health Insurance remains the dominant segment, driven by the increasing trend of employers providing health benefits to their employees. This segment is favored for its cost-effectiveness and comprehensive coverage options, making it a preferred choice for corporates seeking to enhance employee welfare. Individual Health Insurance is also significant, reflecting consumer demand for customized and independent coverage solutions .

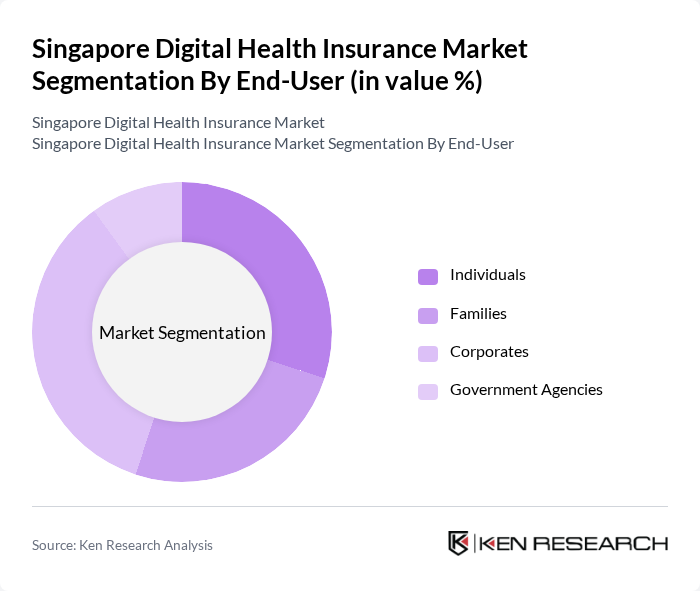

By End-User:

The end-user segmentation includes Individuals, Families, Corporates, and Government Agencies. Corporates lead this segment, increasingly recognizing the importance of providing health insurance benefits to employees. This trend is driven by the need to attract and retain talent, promote a healthier workforce, and enhance productivity. Individual and family segments also show strong growth, reflecting rising demand for flexible and personalized coverage .

The Singapore Digital Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AIA Group Limited, Prudential Assurance Company Singapore, Great Eastern Life Assurance Co Ltd, NTUC Income Insurance Co-operative Ltd, AXA Insurance Pte Ltd (now part of HSBC Life Singapore), Manulife (Singapore) Pte Ltd, Allianz Insurance Singapore Pte Ltd, Tokio Marine Life Insurance Singapore Ltd, Zurich Insurance Company Ltd (Singapore Branch), Raffles Health Insurance Pte Ltd, FWD Singapore Pte Ltd, Singapore Life Ltd (Singlife), OCBC Great Eastern Holdings Ltd, Aviva Ltd (now part of Singlife), and Hong Leong Assurance Singapore contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore digital health insurance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As telemedicine becomes more mainstream, insurers will likely enhance their offerings to include comprehensive digital health solutions. The integration of artificial intelligence and data analytics will further personalize health insurance products, catering to individual needs. Additionally, partnerships between insurers and technology firms will foster innovation, creating a more competitive landscape that prioritizes consumer-centric services and preventive healthcare strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Critical Illness Insurance Disease-Specific Insurance High-Deductible Health Plans (HDHPs) Others |

| By End-User | Individuals Families Corporates Government Agencies |

| By Distribution Channel | Direct Sales Insurance Aggregators Online Platforms Agents/Brokers Bancassurance |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Plans |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Policy Duration | Short-term Policies Long-term Policies Annual Renewals |

| By Health Condition Coverage | Pre-existing Conditions Chronic Illnesses Maternity Coverage Others |

| By Health Plan Category/Metal Levels | Bronze Silver Gold Platinum Others |

| By Provider Type | Health Maintenance Organizations (HMOs) Preferred Provider Organizations (PPOs) Exclusive Provider Organizations (EPOs) Point-of-Service (POS) Plans Others |

| By Age Group | Young Adulthood (18–34) Middle Adulthood (35–54) Older Adulthood (55+) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Providers | 60 | CEOs, Product Managers, Marketing Directors |

| Healthcare Professionals | 50 | Doctors, Nurses, Health Administrators |

| Insurance Agents | 40 | Insurance Brokers, Sales Representatives |

| Consumer Insights | 100 | Policyholders, Potential Customers, Health Tech Users |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers, Health Economists |

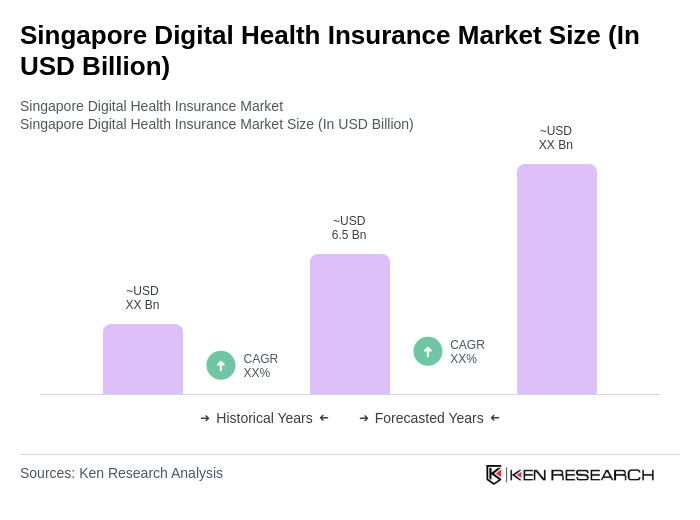

The Singapore Digital Health Insurance Market is valued at approximately USD 6.5 billion, reflecting significant growth driven by the adoption of digital health technologies, rising healthcare costs, and increased consumer awareness of health and wellness.