Region:Asia

Author(s):Geetanshi

Product Code:KRAB1459

Pages:100

Published On:October 2025

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Critical Illness Insurance, Personal Accident & Health Insurance, Dental Insurance, and Others. Each of these sub-segments addresses distinct consumer needs and preferences. Individual and Family Health Insurance remain particularly popular, driven by increasing focus on personal health, family well-being, and the expansion of digital-first insurance offerings. Digital platforms also facilitate micro-insurance and embedded products, broadening access to underserved segments .

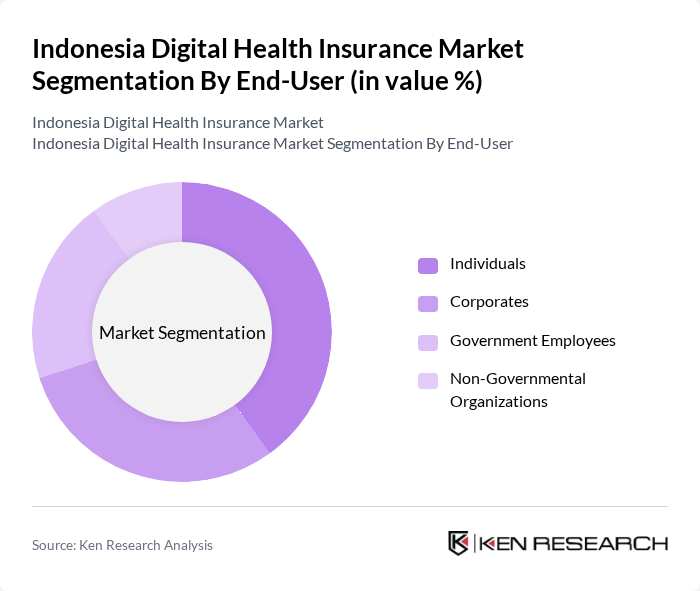

By End-User:The end-user segmentation includes Individuals, Corporates, Government Employees, and Non-Governmental Organizations. Each segment exhibits distinct requirements and purchasing behaviors. Corporates frequently opt for group health insurance plans to cover employees, while Individuals and Families seek personalized coverage options. The digitalization of insurance has enabled more flexible and accessible products for both individual and group buyers, with corporates increasingly adopting digital wellness and telemedicine as part of employee benefits .

The Indonesia Digital Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Indonesia, Prudential Indonesia, AXA Mandiri Financial Services, Manulife Indonesia, Cigna Indonesia, BNI Life Insurance, AIA Financial, Sinarmas MSIG Life, Sequis Life, FWD Insurance Indonesia, Tokio Marine Life Insurance Indonesia, Great Eastern Life Indonesia, Asuransi Jiwa Bersama (AJB) Bumiputera 1912, Adira Insurance (Asuransi Adira Dinamika), and Zurich Topas Life contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's digital health insurance market appears promising, driven by technological advancements and increasing consumer demand for accessible healthcare solutions. As the government continues to invest in digital health initiatives, the integration of artificial intelligence and mobile health applications is expected to enhance service delivery. Additionally, the rise of personalized health insurance products will cater to diverse consumer needs, fostering a more competitive landscape that encourages innovation and improved healthcare access for all Indonesians.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Critical Illness Insurance Personal Accident & Health Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Employees Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents E-Commerce |

| By Coverage Type | Inpatient Coverage Outpatient Coverage Maternity Coverage Emergency Coverage Dental Coverage Lifetime Coverage |

| By Payment Model | Premium-Based Pay-Per-Use Subscription-Based |

| By Age Group | Children Adults Seniors |

| By Policy Duration | Short-Term Policies Long-Term Policies Lifetime Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Providers | 60 | CEOs, Product Managers, Marketing Directors |

| Healthcare Professionals | 50 | Doctors, Nurses, Health Administrators |

| Insurance Agents and Brokers | 40 | Insurance Sales Agents, Brokers, Financial Advisors |

| Consumers of Health Insurance | 100 | Policyholders, Potential Buyers, Health Insurance Seekers |

| Regulatory Bodies and Health Policy Experts | 40 | Government Officials, Policy Analysts, Health Economists |

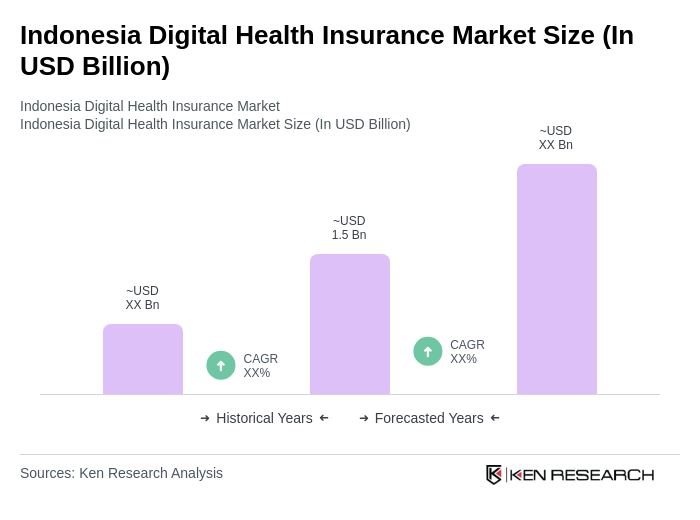

The Indonesia Digital Health Insurance Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital health solutions, rising healthcare costs, and growing awareness of health insurance among the population.