Region:Europe

Author(s):Dev

Product Code:KRAB4233

Pages:84

Published On:October 2025

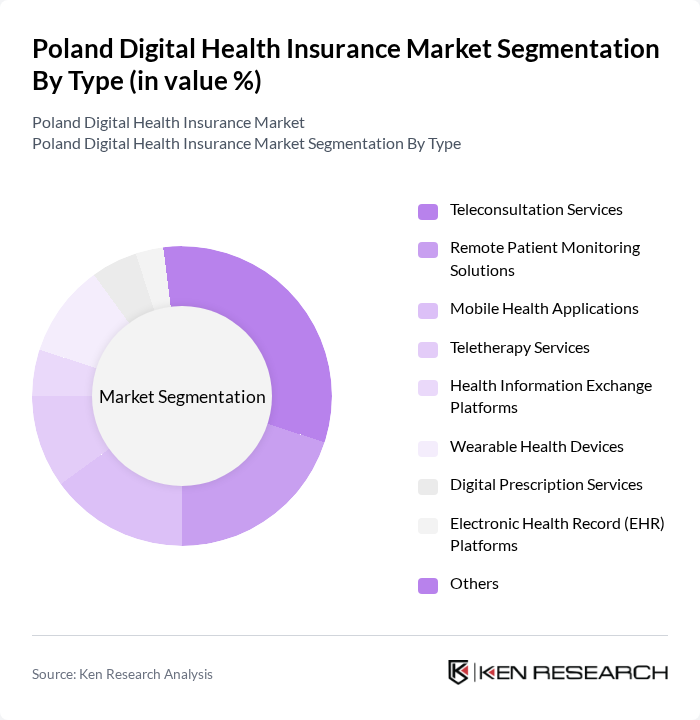

By Type:The market is segmented into various types of digital health services, including teleconsultation services, remote patient monitoring solutions, mobile health applications, teletherapy services, health information exchange platforms, wearable health devices, digital prescription services, electronic health record (EHR) platforms, and others. Among these, teleconsultation services are currently leading the market due to their convenience and the growing acceptance of virtual healthcare consultations. The increasing demand for remote healthcare solutions, especially post-pandemic, has significantly boosted the adoption of teleconsultation services.

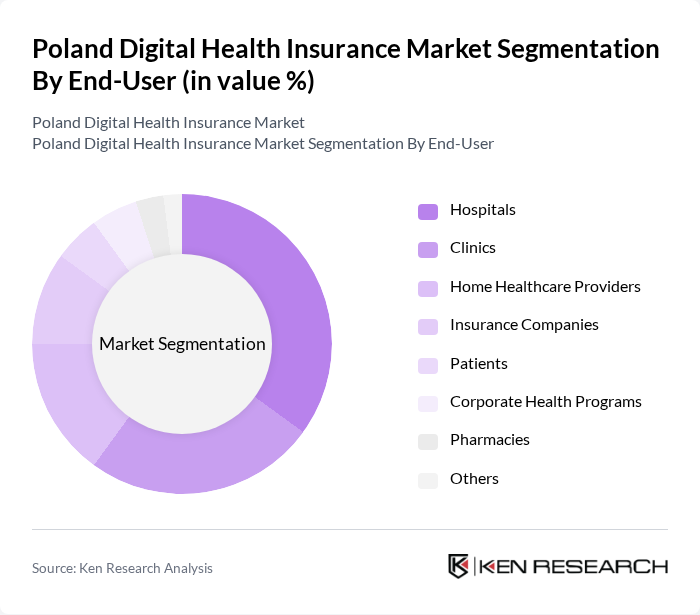

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare providers, insurance companies, patients, corporate health programs, pharmacies, and others. Hospitals and clinics are the primary users of digital health insurance solutions, as they seek to enhance patient care and streamline operations. The increasing focus on patient-centered care and the need for efficient healthcare delivery systems are driving the adoption of digital health solutions in these settings.

The Poland Digital Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as PZU Zdrowie S.A., Allianz Polska S.A., Compensa TU S.A. Vienna Insurance Group, Medicover Sp. z o.o., Lux Med Sp. z o.o., Signal Iduna Polska TU S.A., Inter Polska S.A., Generali Polska S.A., UNIQA Polska S.A., Nationale-Nederlanden Towarzystwo Ubezpiecze? na ?ycie S.A., Aviva Polska S.A., Ergo Hestia S.A., AXA Ubezpieczenia TUiR S.A., InterRisk TU S.A. Vienna Insurance Group, Link4 TU S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital health insurance market in Poland appears promising, driven by technological advancements and increasing consumer acceptance. As telemedicine becomes more integrated into healthcare, the demand for personalized health insurance plans is expected to rise. Additionally, the expansion of mobile health applications will likely enhance patient engagement and streamline healthcare delivery, creating a more efficient ecosystem. The focus on mental health coverage will also shape product offerings, aligning with evolving consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Services Remote Patient Monitoring Solutions Mobile Health Applications Teletherapy Services Health Information Exchange Platforms Wearable Health Devices Digital Prescription Services Electronic Health Record (EHR) Platforms Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Insurance Companies Patients Corporate Health Programs Pharmacies Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Care Rehabilitation Services Remote Diagnostics Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Mobile Applications Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Bundled Services Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Technologies AI and Machine Learning Technologies Blockchain Solutions IoT and Connected Devices Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Digital Health Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Providers | 100 | CEOs, Product Managers, Digital Transformation Leads |

| Healthcare Professionals | 80 | Doctors, Nurses, Health IT Specialists |

| Digital Health Startups | 60 | Founders, CTOs, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers, Health Economists |

| Consumers of Digital Health Services | 120 | Health Insurance Policyholders, Tech-Savvy Users |

The Poland Digital Health Insurance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital health solutions, expansion of private health insurance, and rising healthcare costs.