Region:Middle East

Author(s):Dev

Product Code:KRAB7239

Pages:99

Published On:October 2025

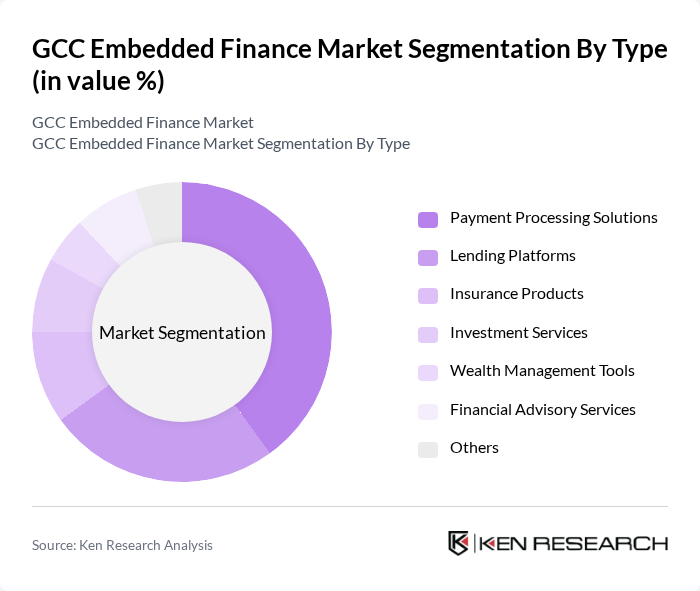

By Type:The market is segmented into various types, including Payment Processing Solutions, Lending Platforms, Insurance Products, Investment Services, Wealth Management Tools, Financial Advisory Services, and Others. Among these, Payment Processing Solutions are leading due to the increasing demand for seamless transactions in e-commerce and mobile applications. The convenience and speed of these solutions are driving consumer adoption, making them a critical component of the embedded finance ecosystem.

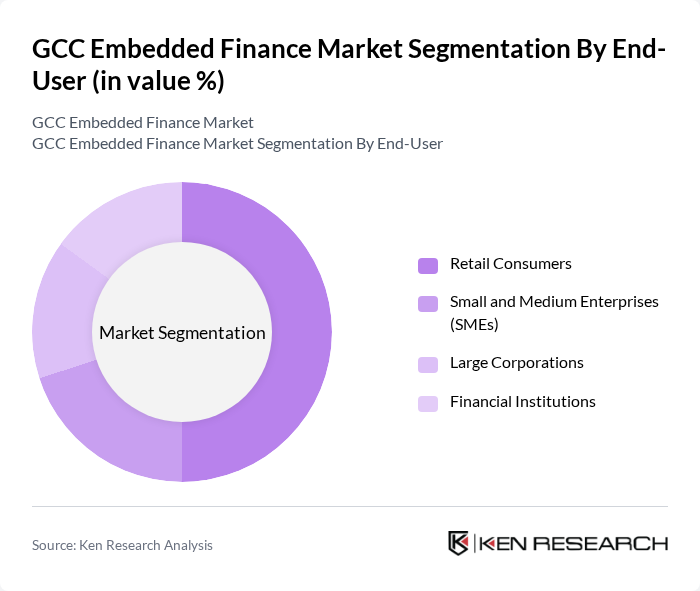

By End-User:The end-user segmentation includes Retail Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Financial Institutions. Retail Consumers dominate the market as they increasingly seek convenient and integrated financial solutions for everyday transactions. The rise of e-commerce and mobile banking has significantly influenced consumer behavior, leading to a higher adoption rate of embedded finance solutions.

The GCC Embedded Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayTabs, Tabby, Tamara, Rain, STC Pay, Fawry, NymCard, YAP, ZoodPay, Checkout.com, Fintech Saudi, Raseed, Qpay, Aion Digital, Bitoasis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC embedded finance market appears promising, driven by technological advancements and evolving consumer preferences. As open banking initiatives gain traction, financial institutions are expected to collaborate more with fintech companies, enhancing service offerings. Additionally, the integration of artificial intelligence and blockchain technology will streamline operations and improve security. With a focus on customer experience and personalized services, the market is poised for significant growth, catering to the diverse needs of consumers across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Solutions Lending Platforms Insurance Products Investment Services Wealth Management Tools Financial Advisory Services Others |

| By End-User | Retail Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions |

| By Application | E-commerce Mobile Applications Point of Sale Systems Online Marketplaces |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Retailers Affiliate Marketing |

| By Customer Segment | Individual Consumers Business Customers Institutional Clients |

| By Pricing Model | Subscription-Based Transaction-Based Freemium Model |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Programs Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Embedded Finance in E-commerce | 150 | E-commerce Managers, Payment Solution Providers |

| Insurance Integration in Banking | 100 | Insurance Executives, Banking Product Managers |

| Consumer Adoption of Fintech Solutions | 120 | End-users, Financial Advisors |

| Regulatory Impact on Embedded Finance | 80 | Compliance Officers, Regulatory Analysts |

| Partnerships between Banks and Fintechs | 90 | Business Development Managers, Strategic Partnership Leads |

The GCC Embedded Finance Market is valued at approximately USD 7 billion, driven by the increasing adoption of digital payment solutions and the rise of fintech companies, enhancing customer experiences and streamlining operations across various platforms.