Region:Middle East

Author(s):Dev

Product Code:KRAB7251

Pages:93

Published On:October 2025

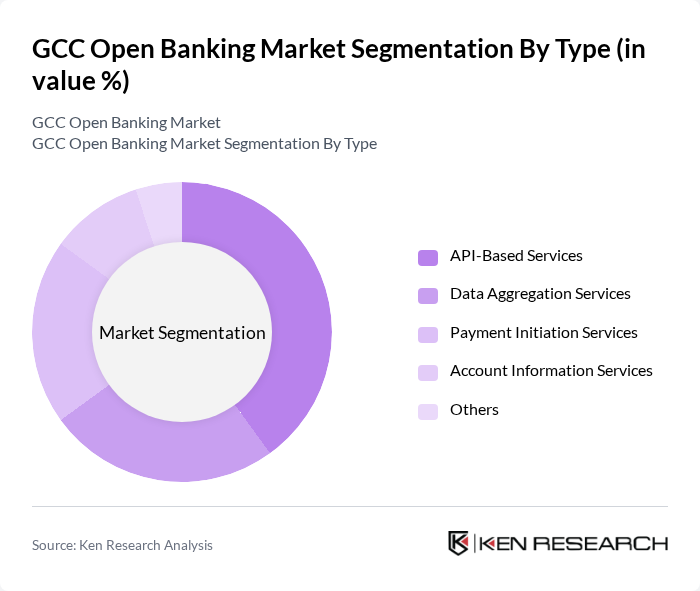

By Type:The market is segmented into API-Based Services, Data Aggregation Services, Payment Initiation Services, Account Information Services, and Others. Among these, API-Based Services are leading due to their ability to facilitate real-time data sharing and enhance customer experiences. The demand for seamless integration of banking services with third-party applications is driving the growth of this segment, as consumers increasingly seek personalized financial solutions.

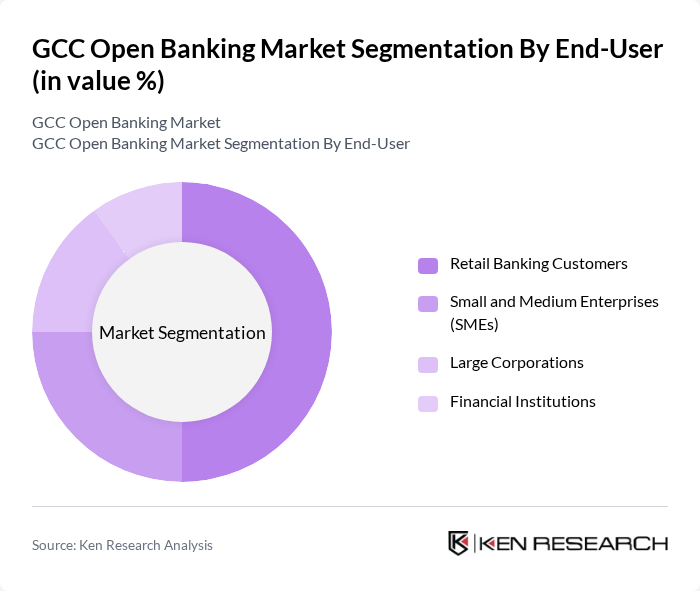

By End-User:The end-user segmentation includes Retail Banking Customers, Small and Medium Enterprises (SMEs), Large Corporations, and Financial Institutions. Retail Banking Customers dominate this segment, driven by the increasing use of mobile banking applications and the demand for personalized financial services. The growing trend of digital wallets and payment solutions among consumers is further propelling the adoption of open banking services in this category.

The GCC Open Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Qatar National Bank, National Bank of Abu Dhabi, Al Rajhi Bank, Gulf Bank, Abu Dhabi Commercial Bank, Saudi British Bank, Mashreq Bank, Bank of Bahrain and Kuwait, Arab National Bank, First Abu Dhabi Bank, Kuwait Finance House, Qatar Islamic Bank, Bank Al Jazira, Alinma Bank contribute to innovation, geographic expansion, and service delivery in this space.

The GCC open banking market is poised for significant transformation, driven by technological advancements and regulatory support. As banks increasingly adopt API-driven solutions, customer experience will become a focal point, with personalized financial products gaining traction. The integration of artificial intelligence will further enhance service delivery, enabling banks to offer tailored solutions. Additionally, the shift towards sustainable banking practices will resonate with consumers, aligning financial services with broader societal values and expectations, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | API-Based Services Data Aggregation Services Payment Initiation Services Account Information Services Others |

| By End-User | Retail Banking Customers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions |

| By Application | Personal Finance Management Business Financial Management Investment Management Credit Scoring and Risk Assessment |

| By Distribution Channel | Direct Online Platforms Mobile Applications Third-Party Aggregators |

| By Regulatory Framework | Open Banking Regulations Data Protection Regulations Financial Conduct Authority Guidelines |

| By Customer Segment | Individual Consumers Small Businesses Corporates |

| By Geographic Presence | GCC Countries Emerging Markets Developed Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Executives | 100 | CEOs, CTOs, and Heads of Digital Banking |

| Fintech Startups | 80 | Founders, Product Managers, and Compliance Officers |

| Consumer Insights | 150 | Retail Banking Customers, Digital Wallet Users |

| Regulatory Bodies | 50 | Regulators, Policy Makers, and Compliance Analysts |

| Technology Providers | 70 | IT Managers, Software Developers, and System Architects |

The GCC Open Banking Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital banking solutions and consumer demand for personalized financial services, alongside regulatory support for open banking initiatives across the region.