Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7316

Pages:92

Published On:October 2025

By Type:The segmentation by type includes various subsegments such as Mobile Banking Solutions, Digital Payment Platforms, Microfinance Services, Peer-to-Peer Lending, Insurance Technology (InsurTech), Financial Literacy Tools, and Others. Among these, Digital Payment Platforms are currently leading the market due to the rapid shift towards cashless transactions and the increasing reliance on mobile wallets and online payment systems. The convenience and speed offered by these platforms have made them the preferred choice for consumers and businesses alike.

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Non-Governmental Organizations (NGOs), and Government Agencies. Individuals are the dominant segment, driven by the increasing need for personal financial management tools and services. The rise of mobile banking and digital payment solutions has made it easier for individuals to access financial services, leading to a significant increase in user adoption.

The GCC Financial Inclusion Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology, PayFort, Tabby, STC Pay, NymCard, YAP, Zain Cash, Kiva, Souqalmal, Tamweelcom, Fintech Galaxy, Raqamyah, Baitak Invest, MenaPay, Aion Digital contribute to innovation, geographic expansion, and service delivery in this space.

The future of financial inclusion platforms in the GCC appears promising, driven by technological advancements and increasing consumer demand for digital financial services. As governments continue to prioritize financial literacy and regulatory frameworks evolve, platforms will likely expand their offerings. The integration of artificial intelligence and machine learning will enhance user experiences, while partnerships with traditional banks will facilitate broader service delivery. Overall, the market is poised for significant growth, addressing the needs of diverse consumer segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Solutions Digital Payment Platforms Microfinance Services Peer-to-Peer Lending Insurance Technology (InsurTech) Financial Literacy Tools Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Non-Governmental Organizations (NGOs) Government Agencies |

| By Distribution Channel | Online Platforms Mobile Applications Agent Networks Bank Branches |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) |

| By Payment Method | Credit/Debit Cards Bank Transfers E-Wallets Cash |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Customer Segment | Low-Income Households Middle-Income Households High-Income Households Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Wallet Users | 150 | Consumers, Financial Technology Users |

| Microfinance Institutions | 100 | Loan Officers, Branch Managers |

| Insurance Product Users | 80 | Policyholders, Customer Service Representatives |

| Regulatory Bodies | 50 | Policy Makers, Financial Regulators |

| Fintech Startups | 70 | Founders, Product Managers |

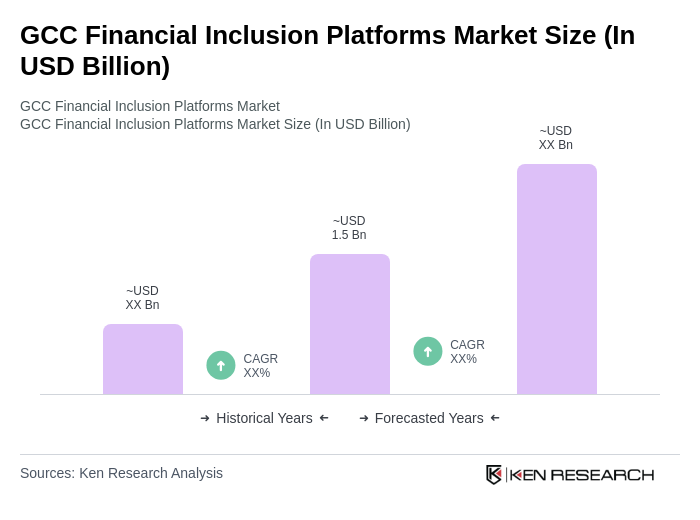

The GCC Financial Inclusion Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the adoption of digital financial services and government initiatives aimed at enhancing financial literacy across the region.